A resilient China market in the face of tariff threats

Colin Ng

Head of Asia Equities

Paul Ho

Head of Investment Technology

Manager Comments

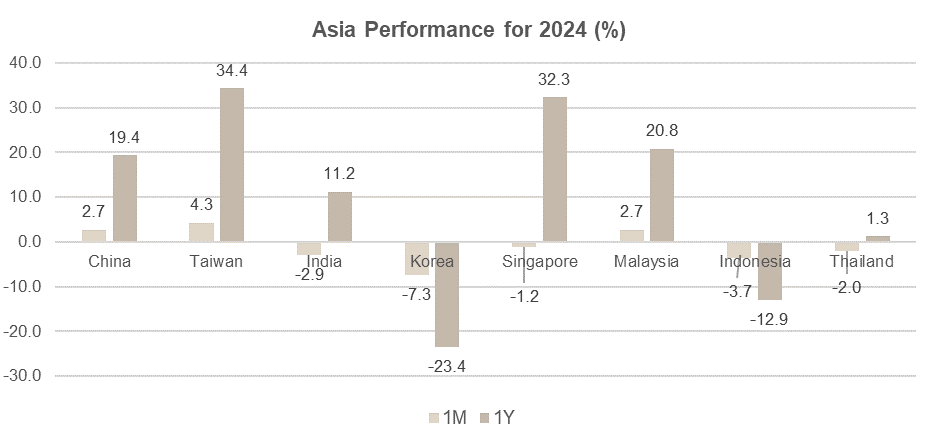

Source: Morningstar, as of 31 December 2024. China: MSCI China Index, Taiwan: MSCI Taiwan Index, India: MSCI India Index, Korea: MSCI Korea Index, Singapore: MSCI Singapore Index, Malaysia: MSCI Malaysia Index, Indonesia: MSCI Indonesia Index, Thailand: MSCI Thailand Index

Asian tech companies continued to outperform

December was a quiet month given the holiday season. However, the US equity markets continued to push ahead with most of the gains narrowly focused on the largest tech stocks including Broadcom, Tesla, Google and Apple.

This strong performance spilled over into the Asian markets, especially in relation to the Taiwanese large cap tech sector, making Taiwan the best performing market in Asia last month.

China overcame tariff fears

China was also amongst the best performing markets in December, benefitting from news of better-than-expected exports and continued stabilisation in the real estate sector.

Also, and somewhat ironically, Trump’s tariff threats are being viewed positively. Investors are hopeful that in response to such threats, China will announce a meaningful stimulus program in early 2025. Over the longer term, tariffs can act as a catalyst for accelerating the localisation of China’s tech supply chain, which would benefit Chinese tech companies.

Korea is still struggling

Korea, on the other hand, has had a bad month. Following a botched attempt at imposing martial law last month, the Korean President is now facing an impeachment charge - the latest in a series of blows to the South Korean economy over the past few months.

Prior to this, the country had been experiencing weak export growth, anemic domestic consumption, and labour unrest. The current political turmoil has further weakened investor confidence in the country.

India corrected, but we remain positive

The market saw meaningful fund outflows in December. This followed a bigger-than-expected slowdown in the fourth quarter of 2024, causing the Reserve Bank of India (RBI) to revise down its GDP forecast for 2024 and 2025. Investors were also concerned about the market’s high valuations, and took some profit in order to reallocate to other markets.

However, we continue to view India positively, given that in our view, the market still offers the best structural growth play in Asia region. Furthermore, we expect policies in the US to be inflationary and underpin a strong US dollar. This leads us to favour India, which is more domestically oriented and less sensitive to US macro conditions.

Regional Asia Solutions

Previous month performance

| 1M | 1Y | 3Y | |

| United Asia Fund | 2.08% | 8.37% | -2.53% |

| Benchmark | 1.91% | 15.79% | -1.20% |

Source: Morningstar. Performance as at 31 December 2024, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Asia Fund – A SGD Acc. Benchmark: April 1992 – December 2011: MSCI AC FE ex-Japan; January 2012 to present: MSCI AC Asia ex-Japan. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

| 1M | 1Y | 3Y | |

| United Greater China Fund | 4.55% | 8.38% | -4.39% |

| Benchmark | 4.84% | 26.69% | -1.56% |

Source: Morningstar. Performance as at 31 December 2024, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Greater China Fund – A SGD Acc. Benchmark: MSCI Golden Dragon Index. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

- We saw further stabilisation in our United Asia Fund performance last month, The Fund outperformed its benchmark by 0.17 percent.

- China was the largest contributor to performance this month due to our overweight in Financials and Industrials (such as ports and construction services companies).

- We also benefitted from our underweight position in Korea but our holdings in Samsung Electronics was a drag on performance this month.

- Performance detraction was due to our underweight in the China and Taiwan tech sector, and overweight position in India.

- The United Greater China Fund underperformed its benchmark by 0.29 percent. Similar to the United Asia Fund, this detraction was due to our underweight in the China and Taiwan tech sector

Current month rebalancing

- Our AI model’s recommendation this month is to underweight the China and Hong Kong markets. Meanwhile, our analysts are neutral on China but see the potential for short term weakness. As a result, we have decided to take a slight underweight position on China and Hong Kong, but less than that proposed by the AI model.

- We remain underweight in Korea. While the market offers a few tactical opportunities, at the moment, both our analysts and AI model do not recommend upgrading the market.

- Both our AI model and analysts recommend a continuation of our Taiwan underweight position. The current seasonally weak sales is unlikely to reverse course until 2026.

- We remain overweight in Malaysia. This is in line with both our AI model and analyst recommendations. Our analysts’ on-the-ground feedback is that there continues to be significant bottom up opportunities in the market.

- We remain overweight in India. Our AI model is positive on this market, and this position is reflected by our analysts who are detecting good bottom up opportunities and long term structural strength.

- January rebalancing for the United Greater China Fund was largely at the stock level. We increased our exposure to Taiwan tech companies, funded by a relative reduction in China financials

Multi-Asset Solution

| 1M | 1Y | 3Y | |

| United SG Dynamic Income Fund | -0.29% | -3.84% | - |

| Benchmark | 0.40% | 5.52% | - |

Source: Morningstar. Performance as at 31 December 2024, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United SG Dynamic Income Fund – A SGD Acc. Benchmark: Singapore Overnight Rate Average (SORA) Index +2%. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

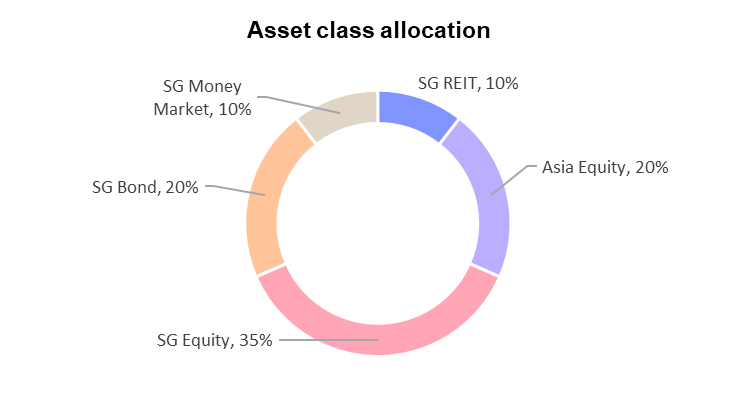

Previous month performance

- The United SG Dynamic Income Fund underperformed by 0.69 percent December vs benchmark (SORA + 2 percent).

- Performance detraction came from our underweight in Asia Equities, and overweights in SG REITs, SG Bonds and Asia Bonds. The latter three asset classes were weighed down by continued strength in US bond yields.

- The Strategy Committee, however, contributed to the Fund’s performance by instituting a higher exposure to SG Equities than recommended by the AI-Model. SG Equities was the second best performer in December.

Current month rebalancing

As of December 2024

- The AI model turned more positive on equities for the month of January and is calling to overweight Asia Equites and SG Equities.

- This is consistent with our more positive view on equities in general. Our Strategy Committee continues to hold a positive view on SREITs but recommended a reduction in the SREITS allocation to allow for a greater allocation to SG Equities.

- The Strategy Committee therefore recommends cutting our allocation to SREITs (-20%) and Money Markets (-20%), The proceed are moved to support a bigger exposure to SG Equities (+20%) and Asia Equities (+20%).

For more details on the funds above, check out the respective Monthly Fund Commentaries

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

United Greater China Fund

United SG Dynamic Income Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

Please visit the following for more details on the funds, important notes and the respective funds’ disclaimers.

United Asia Fund: https://www.uobam.com.sg/our-funds/highlights/united-asia-fund/index.page

United Greater China Fund: https://www.uobam.com.sg/our-funds/highlights/united-greater-china-fund/index.page

United SG Dynamic Income Fund: https://www.uobam.com.sg/our-funds/highlights/united-sg-dynamic-income-fund/index.page

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z