A rebound in oversold stocks

Colin Ng

Head of Asia Equities

Paul Ho

Head of Investment Technology

Manager Comments

Some gains reversed in January

The AI-augmented Asia equity funds largely underperformed in the month of January after outperforming in the prior two months. Most of the detraction came from our underweight position in Korea and China and overweight position in India.

Our underweight in Korea worked well in November and December 2024, but worked against us in January 2025. Key benchmark stocks like Samsung Electronics and SK Hynix rebounded from their oversold levels. The strong performance of AI stocks in the US also helped to boost investor sentiment for Asian tech stocks such as index heavyweight TSMC.

We believe Korea’s rebound is temporary

We retain our negative view of Korea and believe that the country’s current economic struggles go far beyond the political crisis sparked by President Yoon’s attempt at imposing martial law. Many of the problems are structural in nature.

This includes the ability of Korea’s key industries, ranging from shipbuilding and construction to autos and semiconductor manufacturing, to withstand competition for newer players in China and elsewhere. In addition, export-dependent Korean companies have been hurt by the government’s decisions to join the US in its China sanctions.

Tariff uncertainties continue to hold back China

The short-term outlook for China remains uncertain and the market is likely to stay volatile ahead of policy announcements from the US. Markets are braced for US announcements of more negative measures. Nevertheless, DeepSeek’s launch helped to inject some optimism into Chinese tech stocks just ahead of the Lunar New Year holidays.

The development of a Chinese AI large language model which claims to outperform OpenAI’s ChatGPT in key areas, while spending only a fraction of the cost to train and develop, has unnerved global markets. If substantiated or more contenders emerge, this could severely impact future capital expenditure on AI hardware, which in turn would undermine the entire Taiwan AI hardware supply chain.

Regional Asia Solutions

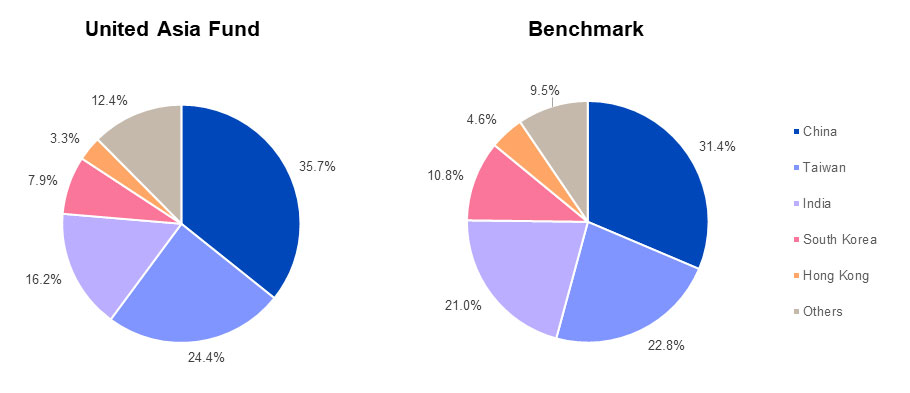

United Asia Fund

Previous month performance

| 1M | 1Y | 3Y | |

| United Asia Fund | -2.67% | 3.11% | -1.17% |

| Benchmark | 0.09% | 20.99% | -0.22% |

Source: Morningstar. Performance as at 31 January 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Asia Fund – A SGD Acc. Benchmark: April 1992 – December 2011: MSCI AC FE ex-Japan; January 2012 to present: MSCI AC Asia ex-Japan. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

- The United Asia Fund underperformed by 2.76 percent in the month of January after outperforming in the prior two months.

- The biggest detraction in performance came from our underweight position in Korea and China, and overweight position in India.

- Our underweight in the tech sector detracted from our performance both in China and Taiwan.

Current month rebalancing

Source: Morningstar, January 2025

- Our AI model’s recommendation this month is to underweight the China and Hong Kong markets. Meanwhile, our analysts are neutral on China but see the potential for short term weakness. As a result, we have decided to take a slight underweight position on China and Hong Kong, but less than that proposed by the AI model.

- We remain underweight in Korea. While the market offers a few tactical opportunities, both our analysts and AI model do not recommend upgrading the market for the time being.

- Both our AI model and analysts recommend a continuation of our Taiwan underweight position. The current seasonally weak sales is unlikely to reverse course until next year.

- We remain overweight in Malaysia, in line with both our AI model and analyst recommendations. Our analysts’ on-the-ground feedback is that there continues to be significant bottom-up opportunities in the market.

- We remain overweight in India. Our AI model is positive on this market, and this position is reflected by our analysts who are detecting good bottom-up opportunities and long-term structural strength.

- January rebalancing for the United Greater China Fund was largely at the stock level. We increased our exposure to Taiwan tech companies, funded by a relative reduction in China financials.

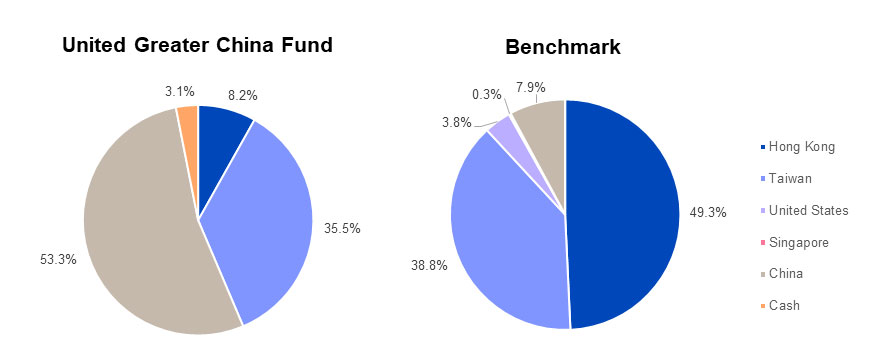

United Greater China Fund

| 1M | 1Y | 3Y | |

| United Greater China Fund | -0.92% | 10.22% | -2.88% |

| Benchmark | 0.91% | 36.18% | -0.62% |

Source: Morningstar. Performance as at 31 January 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Greater China Fund – A SGD Acc. Benchmark: MSCI Golden Dragon Index. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

Previous month performance

- The Fund underperformed by 1.83 percent in the month of January, with most of the detraction coming from our underweight position in many of the large cap index eCommerce and tech stocks that did well this month.

- We have a small tactical overweight in China as we believe that China valuations are very attractive at current levels, with most of the negative sentiment having been priced in. Hence any positive news may trigger more buying at the margin.

Current month rebalancing

Source: Morningstar, January 2025

- There were no substantial adjustments to the country/sector allocations this month.

Multi-Asset Solution

| 1M | 1Y | 3Y | |

| United SG Dynamic Income Fund | 0.24% | -3.84% | - |

| Benchmark | 0.39% | 5.70% | - |

Source: Morningstar. Performance as at 31 January 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United SG Dynamic Income Fund – A SGD Acc. Benchmark: Singapore Overnight Rate Average (SORA) Index +2%. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

Previous month performance

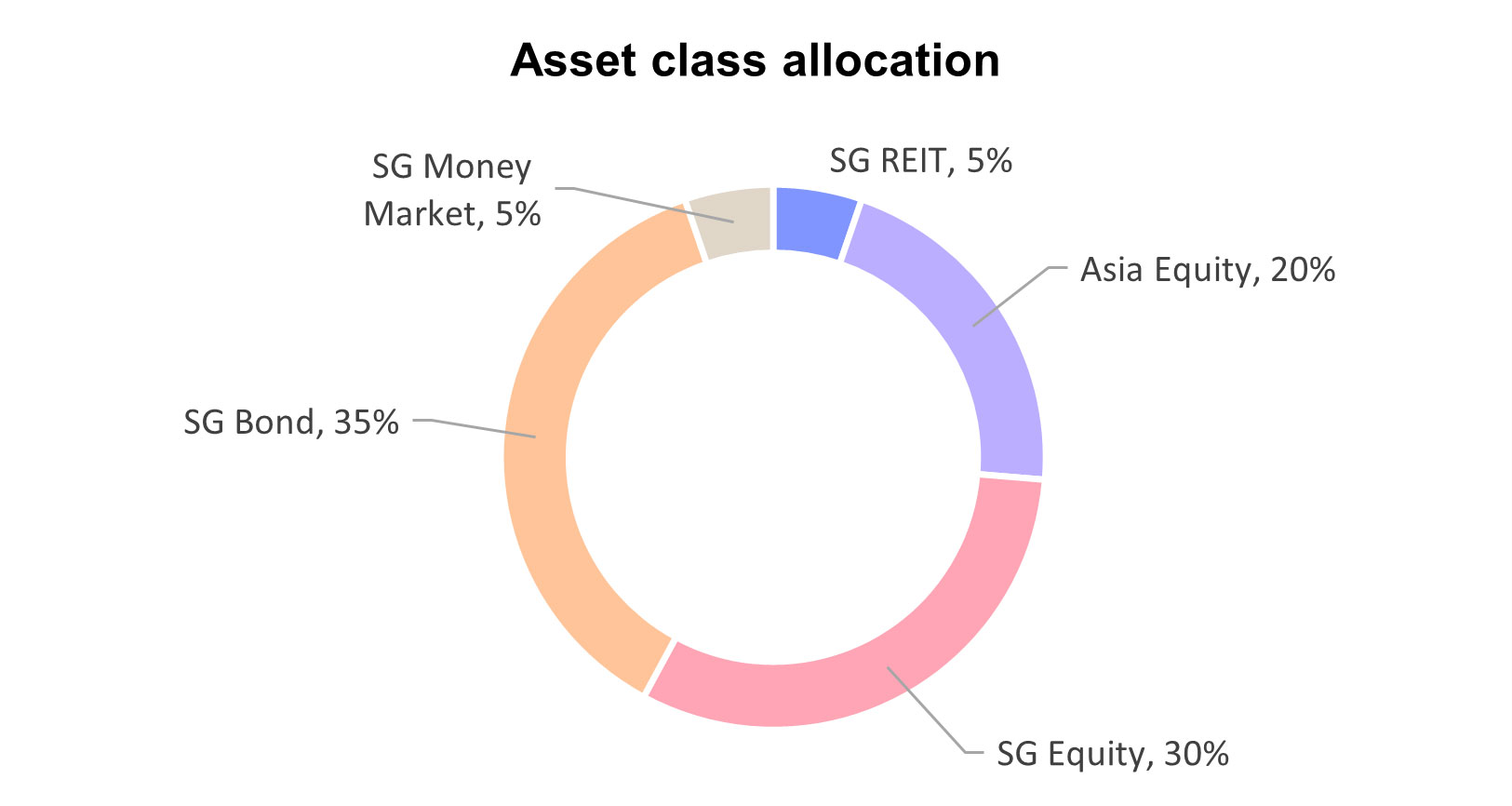

- The Fund underperformed by 0.15 percent in the month of January vs the SORA + 2 benchmark.

- We benefitted from our overweight call in SG Equities and SG Bonds as these were the best performing asset classes in January.

- Performance detraction came from our overweight call in Asia Equities which turned out to be the worst performing asset class last month.

Current month rebalancing

As of January 2025

- The AI model turned more positive on SG Bonds. The Strategy Committee agrees and recommends increasing our allocation from 20 percent to 35 percent.

- This will be partially funded by switching out of money market from 10% to 5%.

- We remain constructive on equities in general hence and will be retaining our allocations to Asia EQ. We are slightly trimming our Singapore equity allocation from 35 to 30 percent.

- Given the recent rising bond yields, we are also trimming our exposure to SG REITs from 10 to 5 percent.

For more details on the funds above, check out the respective Monthly Fund Commentaries

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

United Greater China Fund

United SG Dynamic Income Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

Please visit the following for more details on the funds, important notes and the respective funds’ disclaimers.

United Asia Fund: https://www.uobam.com.sg/our-funds/highlights/united-asia-fund/index.page

United Greater China Fund: https://www.uobam.com.sg/our-funds/highlights/united-greater-china-fund/index.page

United SG Dynamic Income Fund: https://www.uobam.com.sg/our-funds/highlights/united-sg-dynamic-income-fund/index.page

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z