China hit by tariff fears, but still one of the best performing YTD

Colin Ng

Head of Asia Equities

Paul Ho

Head of Investment Technology

Manager Comments

China pulls ahead

February started well for the China market. By 27 February, the CSI 300 index had climbed about 4.6 percent1. However, in the final trading day of the month, the market corrected sharply amid renewed tariff fears, wiping out half of its gains. As a result, the CSI closed February up just 2.5 percent2.

Similarly, our AI stock selection model reflected a positive tilt toward Chinese companies during February. This was reinforced by our analysts, who further refined the model’s stock selection with an increased emphasis on AI, robotics, smart EV, and consumption growth sectors.

This helped our United Greater China Fund to not only keep pace with China’s early rally but to end the month slightly above its index and peers. However, one of the Korean companies in the United Asia Fund portfolio reported a surprisingly weak set of earnings results, causing the stock to drop more than 20 percent in a day3. This weighed on the Fund’s performance, causing it to marginally lag its benchmark.

China remains the best performing Asian market year to date as tech stocks continued to lead gains post DeepSeek. President Xi’s meeting with leading Chinese tech entrepreneurs - notably Jack Ma, founder of Alibaba - sent a positive signal to the market. Investors were encouraged by the prospect of a more constructive policy stance towards the Chinese private sector, and private companies’ greater participation in the drive to turn around the economy. Many are also hoping for more stimulus measures to help offset the impact of tariffs.

Korea and India are struggling

Korea and India, on the other hand, continued to see fund outflows. Recent macroeconomic data from Korea confirmed investor fears that the economy is still weak. The country’s semiconductor exports recorded their first decline in 16 months amid falling DRAM and NAND prices. Meanwhile, 11 out of Korea’s 15 export sectors reported a slowdown compared to the same time last year4.

India has recorded its fifth successive monthly loss, the first time since 1996. Foreign institutional investors have sold more than $23 billion in India stocks since the market peak last October5.

AI stocks take a breather

Taiwan markets have also pulled back, following a similar retreat in the US’s AI stocks. Nvidia results were within expectations but failed to provide further impetus for AI-related sectors. All eyes are now on the launch of Nvidia’s Blackwell chips. A strong sales momentum going into 3Q could signal the bottoming out of the memory sector in Asia and globally.

We remain positive on the semiconductor sector in the medium to long term and will be looking for the best timing to build up our sector positions in the coming months.

AI-Augmented Asia Solutions

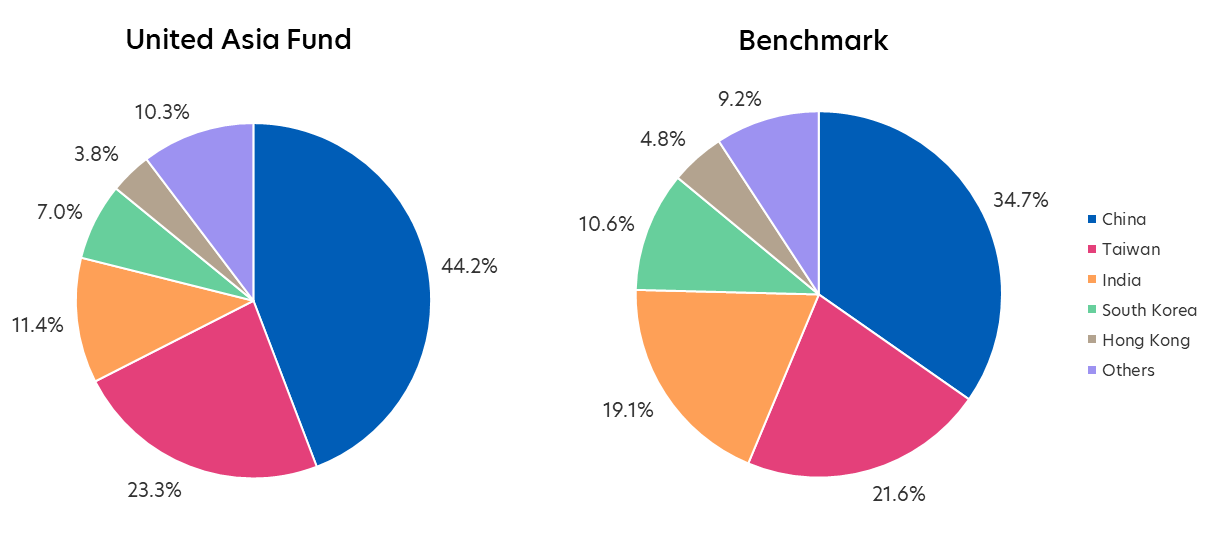

United Asia Fund

Performance: We underperformed by 0.25 percent in February

| 1M | 1Y | 3Y | |

| United Asia Fund | 0.30% | -3.17% | -0.51% |

| Benchmark | 0.55% | 14.50% | 0.62% |

Source: Morningstar. Performance as of 28 February 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Asia Fund – A SGD Acc. Benchmark: April 1992 – December 2011: MSCI AC FE ex-Japan; January 2012 to present: MSCI AC Asia ex-Japan. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

- Our overweight in China stocks contributed the most to our performance last month and in particular our positions in Alibaba, Tencent and Meituan.

- Taiwan was our second largest contributor to performance. With AI stocks taking the backseat this month, our underweight in the Taiwan AI sector proved to be the right call.

- The biggest detraction in performance came from one of our Korean stocks, given its worse-than-expected earnings

- Within ASEAN, our overweight in Malaysia also detracted from performance. However, one of our Philippines stocks was a notable exception, gaining 30 percent in an otherwise lacklustre market.

Rebalancing: Small adjustments towards China

Source: Morningstar. Portfolio rebalancing as of 28 February 2025, Benchmark allocation as of 28 February 2025

- We are adding a little more weight in China, funded by a slight reduction in India and Taiwan.

- We will continue to hold the Chinese tech and consumer stocks introduced into the portfolio following our last rebalancing. They were recommended by our analysts due to their high conviction levels.

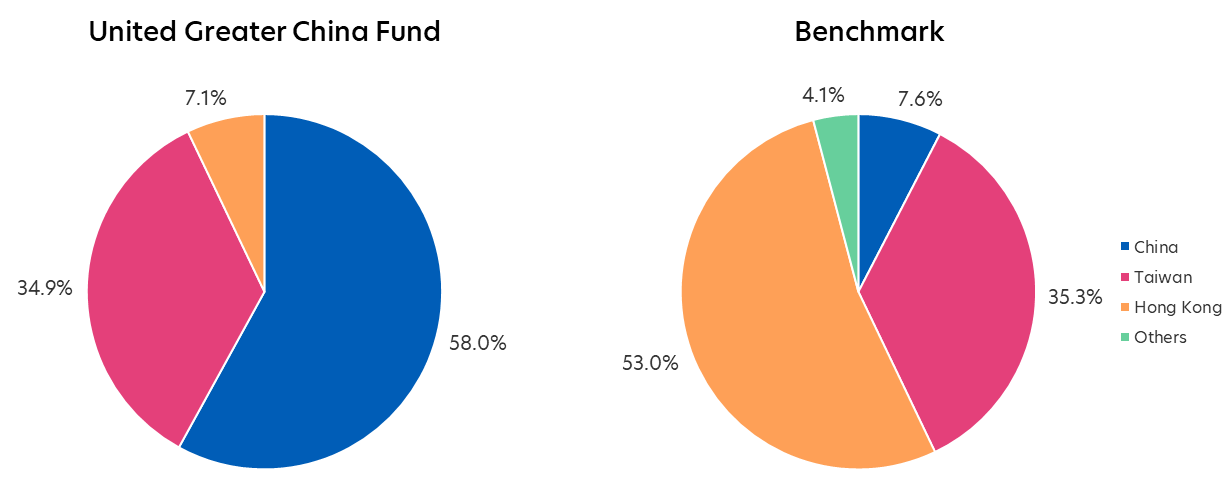

United Greater China Fund

Performance: We outperformed by 0.30 percent in February

| 1M | 1Y | 3Y | |

| United Greater China Fund | 4.91% | 6.65% | -0.38% |

| Benchmark | 4.61% | 32.39% | 1.92% |

Source: Morningstar. Performance as of 28 February 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United Greater China Fund – A SGD Acc. Benchmark: MSCI Golden Dragon Index. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

- There was strong momentum in China markets following news of more aggressive adoption and integration of DeepSeek by many major Chinese tech companies into their products.

- BYD’s announcement of their Smart EV strategy which includes a nationwide rollout of their autonomous driving technology even in their lowest end EVs sparked investor interest in the companies within the EV supply chain.

- China’s breakthrough in humanoid robotic technology also generated some excitement amongst investors

- Similar to the United Asia Fund, our underweight position in Taiwan also contributed to performance this month

Rebalancing: No change

Source: Morningstar. Portfolio rebalancing as of 28 February 2025, Benchmark allocation as of 28 February 2025

- Similar to the United Asia Fund, we will continue to hold the Chinese tech and consumer stocks introduced into the portfolio following our last rebalancing based on our analysts’ high conviction levels.

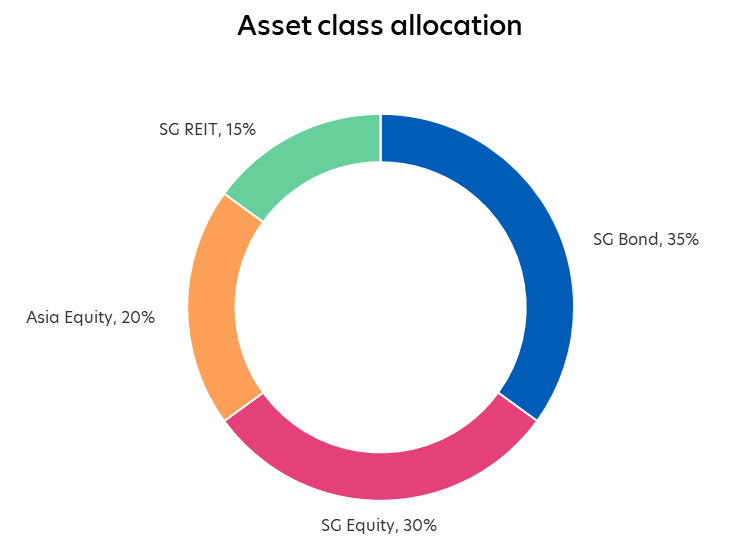

Multi-Asset Solution

United SG Dynamic Income Fund

Performance: We were up 0.25 percent in February, slightly underperforming the SORA + 2 percent benchmark

| 1M | 1Y | 3Y | |

| United SG Dynamic Income Fund | 0.25% | -1.23% | - |

| Benchmark | 0.34% | 5.35% | - |

Source: Morningstar. Performance as of 28 February 2025, SGD basis, with dividends and distributions reinvested, if any. Fund refers to United SG Dynamic Income Fund – A SGD Acc. Benchmark: Singapore Overnight Rate Average (SORA) Index +2%. Performance figures for 1 month till 1 year show the per cent change, while performance figures above 1 year show the average annual compounded returns.

- We benefitted from our overweight call in Singapore equities, Asia equities and Singapore bonds. These were the best performing asset classes in February.

- The Strategy Committee portfolio outperformed the pure AI portfolio this month. The committee recommended a higher allocation to SG equities, the best performing of the portfolio’s five asset classes.

Rebalancing: Higher allocation to SREITS

Source: UOBAM, as of 28 February 2025

-

For March, both our AI model and the Strategy Committee recommended an increase in allocation to Singapore REITs by 10 percent. This asset class has underperformed the others in this portfolio, and is now trading at the lower band of their historical valuations. New drivers are emerging for this asset class, including demand for the attractive yield, currently standing at 6.5 percent.

-

The Strategy Committee also recommended taking some profit from SG equities by shaving 5 percent from the current allocation after the asset class’s stellar performance YTD.

-

The AI model has turned more positive on SG bonds and negative on money market.

For more details on the funds above, check out the respective Monthly Fund Commentaries.

1,2,3Source: Bloomberg, February 2025

4,5Source: UOBAM, February 2025

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: United Asia Fund

United Greater China Fund

United SG Dynamic Income Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

Please visit the following for more details on the funds, important notes and the respective funds’ disclaimers.

United Asia Fund: https://www.uobam.com.sg/our-funds/highlights/united-asia-fund/index.page

United Greater China Fund: https://www.uobam.com.sg/our-funds/highlights/united-greater-china-fund/index.page

United SG Dynamic Income Fund: https://www.uobam.com.sg/our-funds/highlights/united-sg-dynamic-income-fund/index.page

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z