Investors have been flocking to Asian bonds

Rates on Singapore Treasury bills (T-bills) and Singapore Savings Bonds (SSBs) have fallen steadily over the past months. The yield on the latest Singapore six-month T-bill is just 2.73 percent, down from a high of 4.4 percent in December 20221. Meanwhile, March 2025's issue of the SSBs offers an average return of 2.85 percent over 10 years, compared to a return of 3.47 percent in December 20222.

Naturally, investors are looking elsewhere for better yield. One area that has captured significant interest is Asian bonds, which recorded more than $26 billion of net inflows in 2024, a threefold increase from 2023 levels3.

Why Asian bonds?

This strong investor demand is understandable. Asian bonds were of one of the best performing bond segments in 2024, delivering total returns of 7.7 percent, compared to 3.2 percent for global bonds and 5.7 percent for US bonds4.

Looking ahead, Asian bonds are poised to continue their positive momentum in 2025, driven by themes such as the potential for further interest rate cuts by Asian central banks, Asia’s economic resilience, and the demand for higher yields.

How have UOBAM Funds performed?

At UOB Asset Management (UOBAM), we offer a range of Asian bond solutions. With different duration and credit quality features, the Funds currently offer different yields commensurate with the range of differing risk levels.

Here is a quick summary:

|

|

United SGD Money Market Fund |

United SGD Fund |

United Asian Bond Fund |

United Asian High Yield Bond Fund |

|

Weighted average yield to maturity (YTM) |

2.60% |

4.21% |

6.30% |

10.33% |

|

Effective duration |

Very short: 0.10 years |

Short: 1.68 years |

Intermediate: 5.22 years |

Relatively short: 3.03 years |

|

Credit quality of underlying investments |

Investment grade: AAA |

Investment grade: BBB+ |

Investment grade: BBB |

High yield: BB- |

|

Risk (as measured by 3-year standard deviation) |

0.35% |

1.23% |

4.00% |

6.39% |

|

Distributions5 |

- |

Class A: 4% p.a. |

4.5% p.a. |

7% p.a. |

|

Features |

Decent yield with no lock in period |

Stability and regular income |

To lock in attractive yields with investments in underlying investment grade bonds |

Higher yields |

Source: UOBAM, as of 31 March 2025

Solutions in detail

Here’s what to know about each fund and their performance as of end-March 2025.

United SGD Money Market Fund: For liquidity and yield enhancement

High quality holdings

This low-risk Fund holds Singapore Treasury bills (T-bills) and MAS bills, which are very high-quality, short-term instruments that offer investors stable returns and capital preservation.

Decent yield

The Fund currently offers a yield to maturity (YTM) of 2.60 percent with no lock in period. YTM is the annualised return that a bond would generate if held to maturity, assuming interest payments are reinvested.

Highly liquid

Due to its very short duration of about one month, the Fund allows for investment proceeds to be withdrawn and received within one business day. This means the Fund is a useful place to park cash while waiting for investment opportunities or for upcoming spending needs.

Fund performance

The Fund has delivered 0.64 percent returns year to date, slightly underperforming its benchmark (3M Compounded Singapore Overnight Rate Average (SORA)). Since inception, the Fund has generated positive returns every calendar year, a testament to its consistent performance across different market cycles.

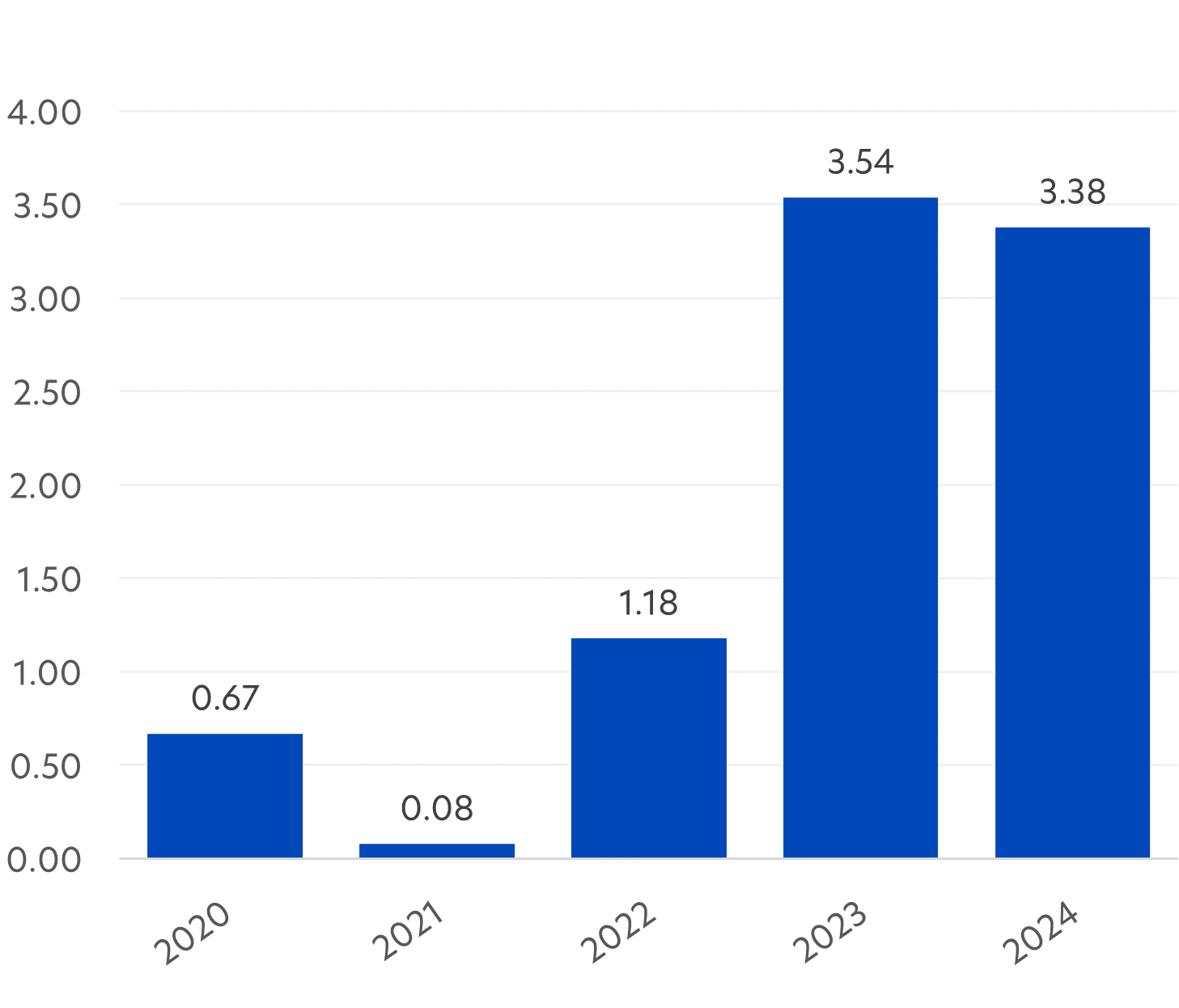

Fig 1: United SGD Money Market Fund calendar year returns (%) since inception

Source: Morningstar, as of 31 March 2025. Past performance is not necessarily indicative of future performance. Performance is net of fees and is based on United SGD Money Market Fund Class A1 SGD share class, in SGD basis, on a Net Asset Value (NAV) basis, with dividends reinvested, if any.

United SGD Fund: For yield enhancement in SGD

High quality bonds

The United SGD Fund invests in short-term, investment grade (IG) corporate, sovereign and non-sovereign bonds across Asia and globally, with an average credit quality of BBB+, making it a relatively low risk option for investors.

Attractive income

With annual distributions of up to 4 to 5 percent6, paid out monthly, the Fund may be a potential option for investors who are seeking higher yields while keeping the risk profile at a lower level.

Laddered strategy

The Fund’s attractive current distribution rate can be attributed to its laddered strategy of investing in bonds with different maturity dates across a three-year timeframe.

In today’s environment of falling interest rates, the Fund’s longer maturity bond holdings ensure that current yields are locked in for longer. This helps the Fund to maintain higher yields even with lower interest rates on the horizon.

Fund performance

The Fund has experienced negative returns in only two calendar years (2008 and 2022) since its inception 27 years ago. This makes it a potentially ideal option for investors seeking stability and income. Year to date, the Fund has returned 1.06 percent, compared to 0.75 percent for its benchmark (6M Compounded SORA).

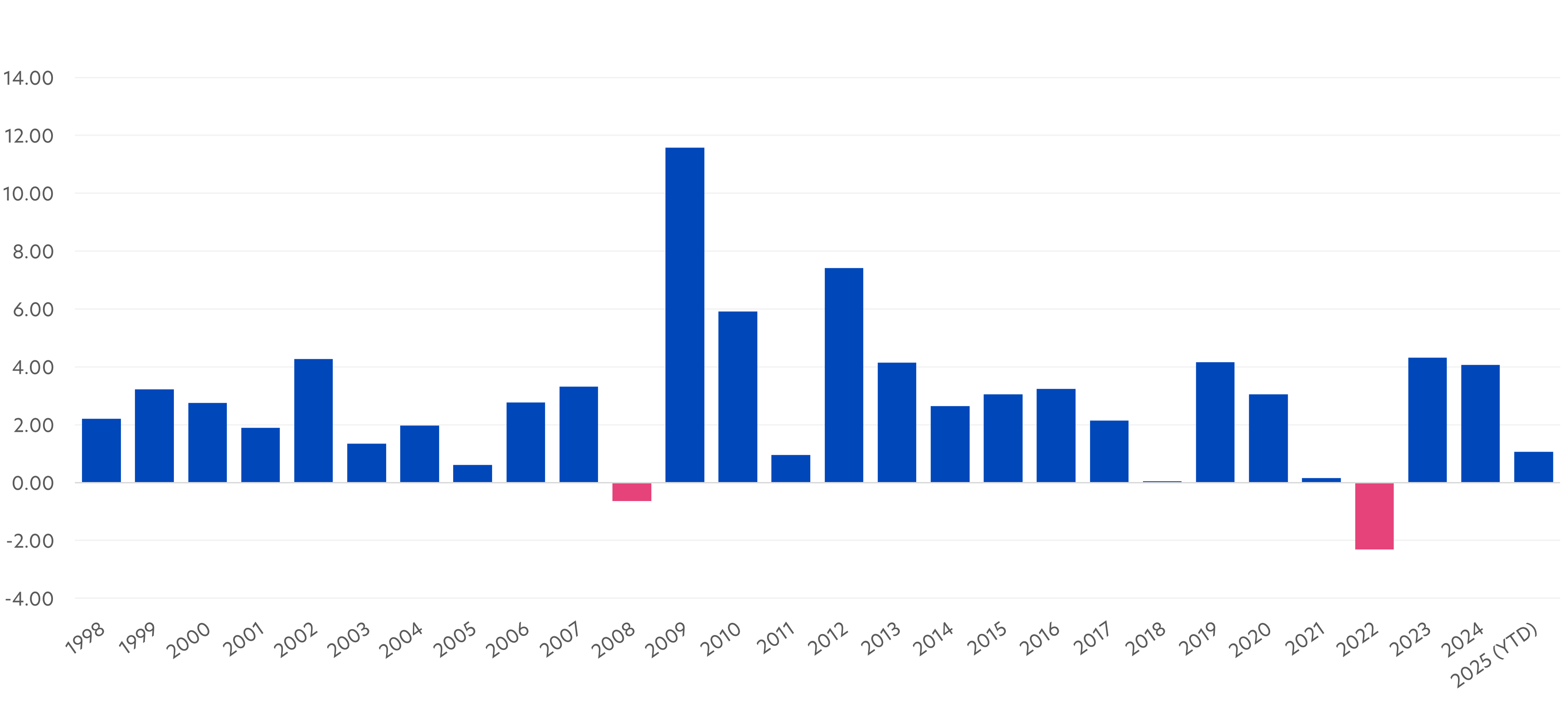

Fig 2: United SGD Fund calendar year returns (%)

Source: Morningstar, as of 31 Mar 2025. | Past performance is not necessarily indicative of future performance. Fund performance is sourced from Morningstar and is based on United SGD Fund Class A SGD Acc, in SGD terms, on a NAV basis, with dividends and distributions reinvested, if any

United Asian Bond Fund: Potential for capital upside

Quality Asian bonds

The Fund invests in IG corporate bonds across Asia, with a focus on bonds from financial companies. The financials sector currently makes up about half the portfolio and top holdings include bonds from HSBC Bank, Deutsche Bank, and KKR Group Finance.

Intermediate duration

The Fund’s intermediate duration, targeted to range around five years, provides several benefits in the current interest rate and inflation environment.

- With rates expected to trend lower over the coming years, bonds with a longer maturity are able to lock in yields for a longer period.

- Such bonds are more sensitive to interest rate changes than their shorter maturity counterparts. So when rates fall, these bonds will tend to see a greater price appreciation.

- In a recession, rates tend to fall quickly. Again, an intermediate duration fund is better positioned to benefit than a short duration fund.

Good income potential

The Fund provides an annualised dividend yield of up to 4.5 percent7, paid out monthly (Class A SGD Dist (Hedged)). Investors seeking to beat inflation may consider the Fund as a potential option.

Fund performance

After a challenging 2023, the Fund saw a recovery in performance. It outpaced its benchmark in 2024 and has generated positive returns in the year to date.

|

|

YTD |

1Y |

2024 |

2023 |

|

United Asian Bond Fund |

0.19% |

4.75% |

8.87% |

-0.26% |

|

Benchmark |

0.67% |

5.46% |

7.78% |

5.65% |

Source: Morningstar, UOBAM. Benchmark: JACI Investment Grade Total Return Index. Performance as of 31 Mar 2025, SGD basis, with dividends and distributions reinvested, if any. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Performance figures for YTD and 1 year show the per cent change since 1 January 2025 and across the past 12 months respectively. Past performance is not necessarily indicative of future performance.

United Asian High Yield Bond Fund: Strong yields, higher volatility

Defensively managed

Although high yield bonds are riskier than investment grade bonds, the Fund seeks to manage the risks by keeping to the higher end of the high yield spectrum. The Fund also seeks to mitigate potential default risks by selecting companies that can demonstrate solid fundamentals.

Higher yield, lower risk than the benchmark

As of 31 March 2025, the Fund’s weighted average yield to maturity is 10.33 percent, above the average yield of the JACI non-IG index. At the same time, its three-year standard deviation of 6.39 percent is lower than the index standard deviation of about 15 percent8, reflecting the Fund’s more cautious stance within the Asian high yield space.

Strong income potential

The Fund aims to offer an attractive monthly income of up to 7.0 percent per annum9.

Fund performance

The Fund delivered 15.7 percent returns in 2024, beating Asian equity returns of 12.0 percent10, but underperforming its high yield benchmark.

The Fund’s more defensive positioning – such as its caution on China high yield real estate bonds - enables it to exceed its benchmark when markets are volatile (such as in 2023) but lag when markets rally (such as in 2024).

|

|

YTD |

1Y |

2024 |

2023 |

|

United Asian High Yield Bond Fund |

0.41% |

8.32% |

15.73% |

12.61% |

|

Benchmark |

1.47% |

10.59% |

19.12% |

3.03% |

Source: Morningstar, UOBAM. Benchmark: JACI Non-Investment Grade Total Return Index. Performance as of 31 Mar 2025, SGD basis, with dividends and distributions reinvested, if any. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Performance figures for YTD and 1 year show the per cent change since 1 January 2025 and across the past 12 months respectively. Past performance is not necessarily indicative of future performance.

Summary

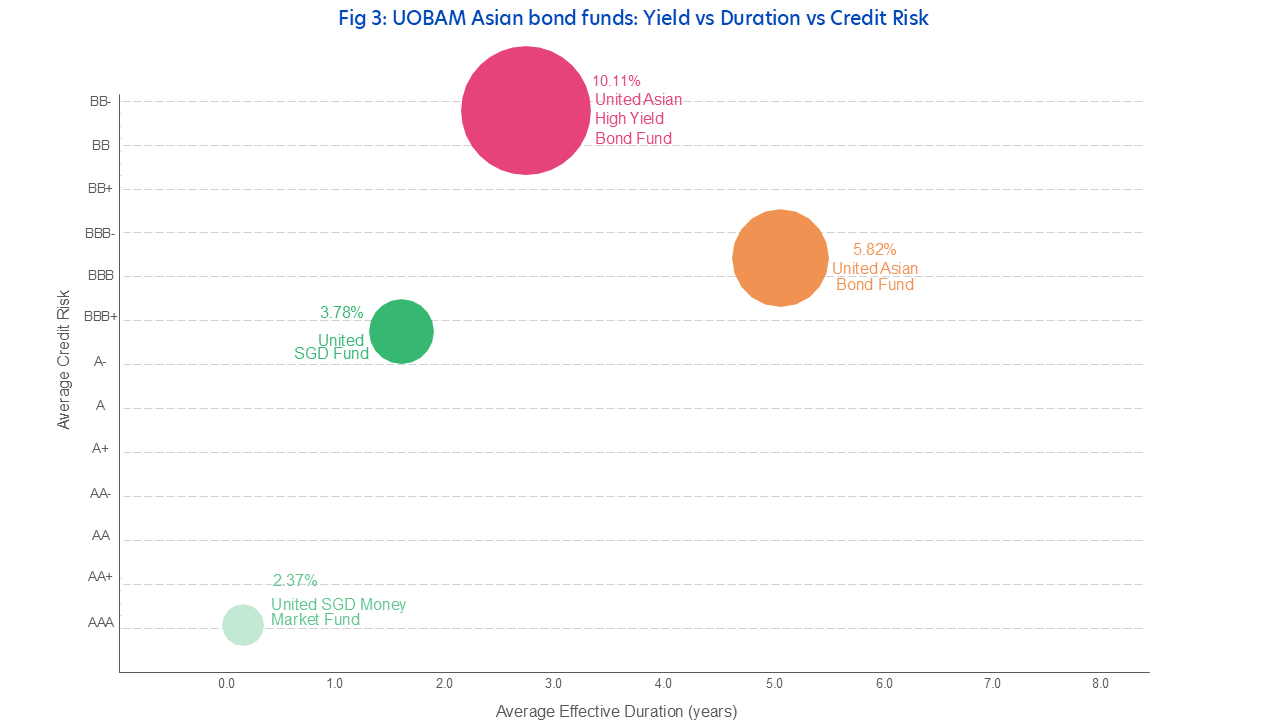

UOBAM’s four most popular Asian bond funds differ in terms of yield, credit quality and average duration. The chart below can help investors easily compare and select the fund that best meets their objectives.

Fig 3: UOBAM Asian bond funds: Yield vs Duration vs Credit Risk

1,2Source: MAS, March 2025

3Source: Calastone, Global Fund Flow Data, data from January to November 2024

4Source: Bloomberg, as of 28 February 2025. Asia bonds: JACI Composite Total Return Index, Global bonds: Bloomberg Global Aggregate Total Return Index, US bonds: Bloomberg US Aggregate Gov/Credit Total Return Index

5,6,7Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund's prospectus

8Source: UOBAM, Bloomberg as of 31 March 2025

9Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund's prospectus

10Based on the MSCI All Country Asia ex Japan index

|

If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider:

United SGD Fund

United Asian Bond Fund

United Asian High Yield Bond Fund

|

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z