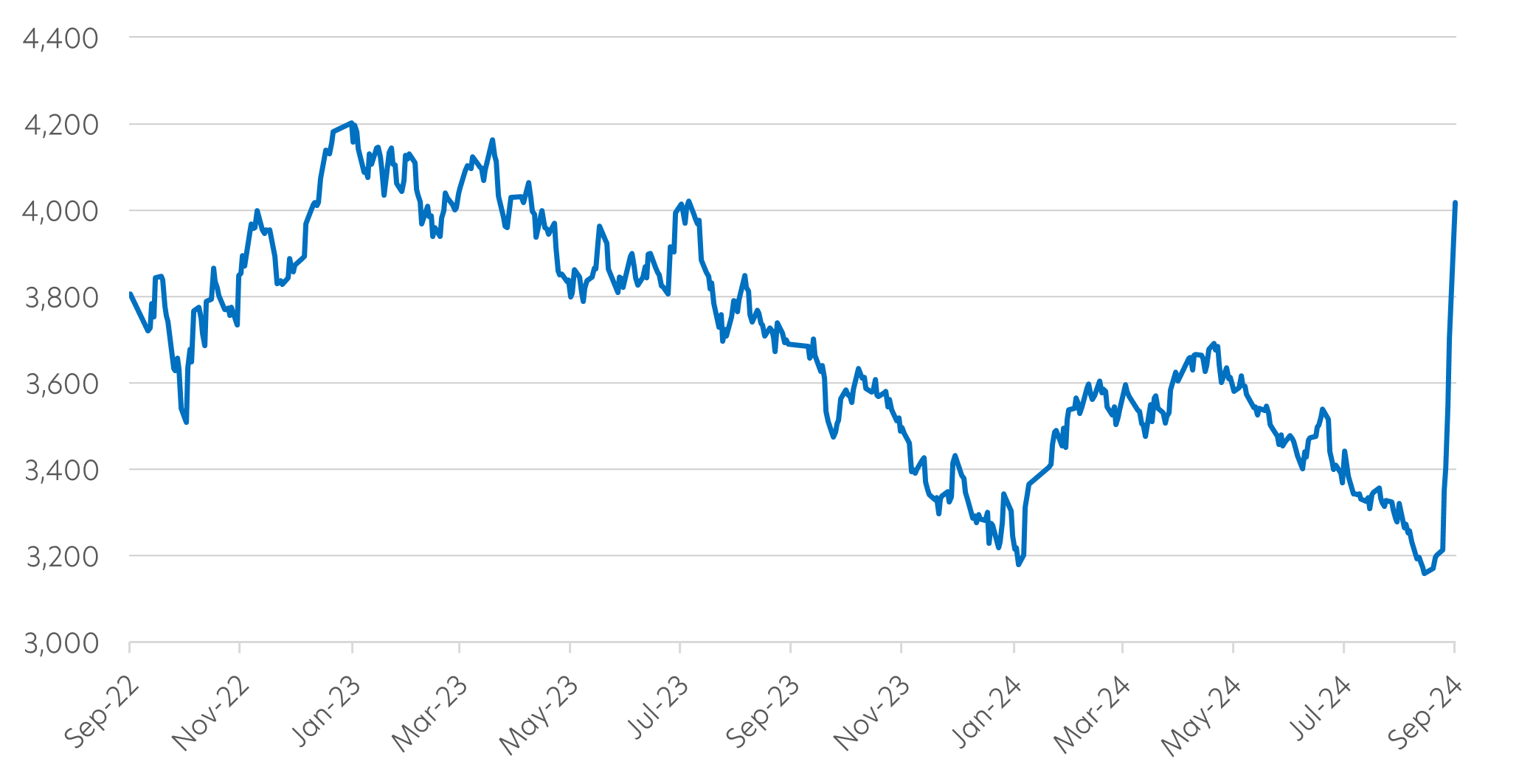

China’s rally over the past week has been nothing short of spectacular. It has only been five days since the country’s central bank announced its latest package of stimulus measures. In that time, the CSI 300 index has risen by 25.0 percent, surpassing the S&P500’s gains of 21.0 percent which took nine months to chalk up.

Fig 1: CSI 300 index (30 Sep 2022 – 30 Sep 2024)

Source: Bloomberg/ UOBAM

We asked Colin Ng, UOBAM’s Head of Asia Equities, to explain this sudden reversal of sentiment, and whether it can last.

China has unveiled many policy measures in the past. What is it about this latest package that is causing markets to rally so strongly?

The most significant difference from previous policy announcements is that this is a comprehensive bundle instead of piecemeal measures.

Firstly, the magnitude of the rumoured fiscal stimulus (between RMB 2 – 3 trillion) is more aggressive than the market had expected.

In addition, the measures focus more on demand than supply, which, in our view, represents a policy pivot. The government has signalled that there is potential for the stimulus package to be further upsized if it is deemed in time to be insufficient. This highlights China’s intention and commitment to turn the economy around at all costs.

Finally, the timing of the announcement, in the wake of the Fed’s recent rate cut, suggests that the Chinese authorities are now less concerned about the potential of these easing measures to spark RMB volatility.

Do you think the current rally is sustainable?

While the above measures are significant, the current rally has been intensified by China’s out-of-favour status over the past two years. Prior to the rally, the market had been attractively valued and under-owned by portfolio managers, who had to scramble to re-build their positions following the announcement.

Looking ahead, we see a number of catalysts that could sustain the rally. These include the following:

- This week is the 75th founding anniversary of the People’s Republic of China (PRC), and President Xi Jinping’s speeches should continue to lift the investor sentiment

- The potential approval of an additional budget to allow for an increased quota of bond issuances, which would reaffirm the commitment to supporting financial markets

- A Politburo meeting scheduled for October will be closely watched for signs of willingness to further enhance economic growth

- Any indications of de-escalation in US-China trade tensions in the lead-up to the US elections could provide another significant boost for the Chinese market

Looking ahead, which sectors and industries do you expect to benefit the most?

It appears that many sectors are already benefiting from the current rally. So far, high-beta growth stocks with strong fundamentals - especially large-cap internet stocks - have seen the strongest gains.

However, in the longer term, we note that brokerage companies will stand to benefit from higher trading volumes. Meanwhile, travel, consumer, and logistic stocks should all enjoy a boost from increased policy-induced spending.

We would also expect stronger government support for innovation, which would be positive for AI-related high-tech firms. We prefer H-shares over A-shares, given strong foreign inflows and the US rate cut cycle. On the other hand, major banks could lag due to concerns over their national service burden.

What about China’s property sector? When can we expect this sector to start turning around?

We believe China’s property sector have the potential to stabilise soon.

Both the central and local governments are putting forward measures to clear housing inventory and stimulate demand. After last week’s announcement from the central government, tier 1 cities such as Shanghai, Guangzhou, and Shenzhen have already stepped up their local housing easing measures. This includes reducing downpayment ratios and easing restrictions on home purchases.

However, we will need to wait for more data releases before determining the actual inflection point.

What are the risks ahead for the China market??

In the short term, we would not be surprised by some profit-taking following the strong rally. However, this should not persist unless we also expect delays in the policy roll-out or signs of weak implementation. These developments could cause markets to lose faith quickly.

Additionally, China’s week-long National Day Holiday starts today. We are keen to analyse the consumption data during and after this event for signs that the recent stimulus is having an effect on consumer sentiment.

Finally, any further instability in China’s property market or economic data could undermine current tailwinds, especially as expectations are now higher than they were.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management fund to consider: United Greater China Fund

Awarded Best Fund over 3 Years and 5 Years (Equity Greater China) at LSEG Lipper Fund Awards LSEG Lipper Fund Awards, ©2024 LSEG. All rights reserved. Used under license. You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the funds are suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z