Asian markets are picking up steam. But riding the momentum is not a long-term strategy. To make sustained gains, the United Asia Fund uses a combination of traditional and innovative techniques

Riding the China rally

After three years in the doldrums, Chinese stocks are staging a comeback fuelled by overseas fund flows. The CSI 300 index is up 8 percent this year, nearly on par with the S&P 500. And there are a few good reasons to hope that the current rally is not just another false start.

- China’s economy is stabilising with a solid first-quarter performance this year of 5.3 percent 1

- Manufacturing activity is expanding, with the Caixin/S&P Global manufacturing PMI registering 51.4 in April2, the fastest pace in over a year

- China has increased support for its property sector to the tune of US$42 billion3, by helping to soak up unsold apartments, lower mortgage rates and reduce down-payment ratios

Good news for rest-of-Asia

Elsewhere in Asia, stock markets in Taiwan, India and South Korea are also in the green this year, buoyed by positive developments on the economic front.

- Taiwan’s economy grew 6.5 percent in the first quarter of 20244, marking the fastest pace of growth in almost three years

- India is poised to be the world’s fastest-growing major economy this year, with the World Bank forecasting growth of 7.5 percent in 20245

- South Korea's exports rose for a seventh straight month in April, raising the prospects for a robust pick-up in economic growth this year

Stock picking is crucial

UOB Asset Management’s (UOBAM) AI-Augmentation framework is designed to select stocks that have the highest return potential across Asia. This form of active management differs from an index-hugging strategy, which relies on buying stocks that feature in Asia indices.

Such stocks are typically large cap and high profile, and will see a rush in demand when macroeconomic factors look positive. This means their upside potential tends to be limited, and their fortunes fall away once macro data starts to disappoint.

The AI-Augmentation framework is less sensitive to such momentum-driven factors. Instead, an AI-powered engine processes vast amounts of data in order to shortlist stocks from across the Asia universe. These stocks are then further assessed by human analysts to arrive at a portfolio of stocks with the highest potential to outperform.

This strategy takes into account, but is not dependent, on prevailing market conditions. Whether or not the China rally continues, the framework searches for alpha opportunities without any specific style or other biases.

The United Asia Fund

The United Asia Fund (the “Fund”) is UOBAM’s flagship AI-Augmented fund. It seeks to achieve long term capital growth mainly through investing in stocks across Asia (excluding Japan). Leveraging our analysts’ deep local knowledge + AI-generated shortlists, the Fund is rated five-stars by Morningstar in the category of EAA Fund Asia ex-Japan Equity6. It is in the top quartile of its peer group in the 3-year category, and has managed to offer high returns for average risk7.

Fig 2: Fund returns (%)

| 2024 YTD | 2023 | 2022 | 2021 | |

| Fund | 12.85 | 10.53 | -22.70 | 10.24 |

| Benchmark | 6.95 | 4.24 | -20.09 | -2.81 |

Benchmark: MSCI AC Asia Ex Japan Index.

Source: Morningstar. 2024 YTD performance as of 30 April 2024, SGD basis, with dividends and distributions reinvested, if any. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Past performance is not necessarily indicative of future performance.

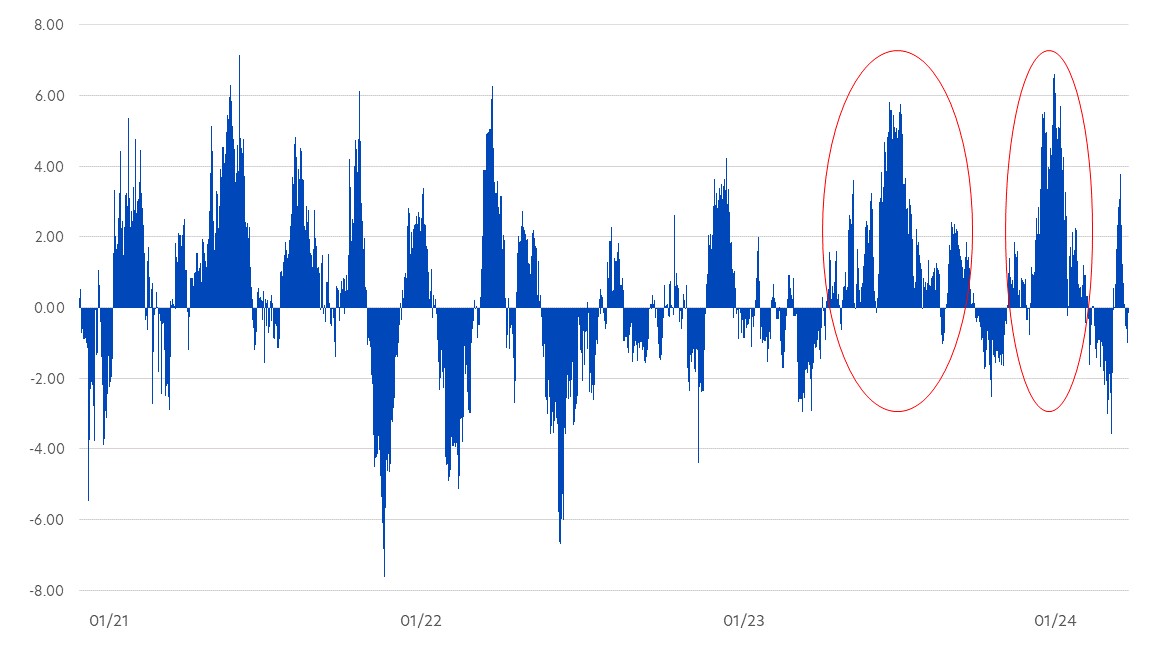

The Fund does not track the market closely, but an analysis of the Fund’s monthly returns relative to the index does reveal some interesting trends. For example, since the introduction of the Fund’s AI-Augmentation framework in October 2020, it has outperformed the index 1.4 times more often than underperformed, and monthly returns on the upside were 1.3 times higher than on the downside8.

Looking at the post-Covid period since January 2023, it is also clear to see that positive months have far outweighed negative months. During these periods, the Fund’s positive monthly returns reached a maximum of around 6 percent9.

Fig 2: Monthly excess returns (daily rolling) Oct 2020 – Apr 2024

Source: Morningstar, as of 30 April 2024

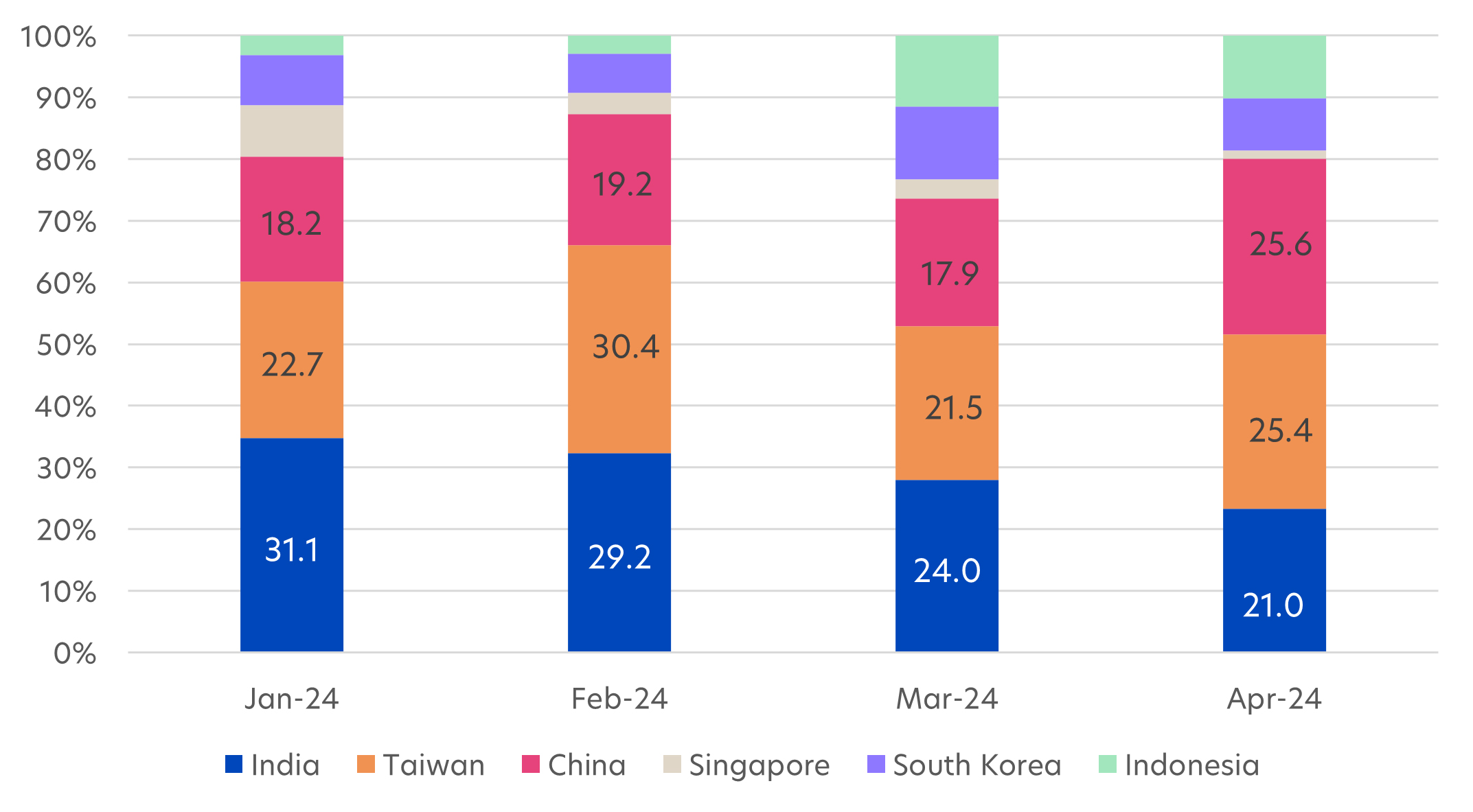

Diversified regional exposure

At the start of the year, the Fund was finding higher return potential in stocks from India and Taiwan, including companies such as Bharat Petroleum, Gail India, Arcadyan Technology and Tung Ho Steel Enterprise. Indian and Taiwanese stocks made up more than half of the Fund’s portfolio in January and February 2024.

Since then, more Chinese stocks with good upside potential have been identified, and the Fund has taken profit from several India stocks. China is now the Fund’s largest country allocation and four of the Fund’s top 10 holdings are now Chinese stocks.

Fig 3: Fund country allocation changes (%), Jan – Apr 2024

Fig 4: Fund top 10 holdings, as of 30 April 2024

| Company name | Weight (%) | Description |

| Asia Vital Components | 3.33 | Taiwanese manufacturer of fan coolers for computers |

| Taiwan Union Tech | 3.05 | Taiwanese manufacturer of copper clad laminates |

| Bharat Petroleum | 3.04 | Indian oil and gas company |

| Radiant Opto-Electronics Corporation | 2.98 | Taiwanese opto-electronic components manufacturer |

| Hisense Home Appliances | 2.74 | Chinese appliance and electronics manufacturer |

| Cofco Sugar Holding | 2.70 | One of the largest sugar traders in China |

| Chicony Electronics | 2.68 | Taiwan-based multinational electronics manufacturer |

| Tian Di Science & Technology | 2.66 | Chinese manufacturer of mining machinery |

| Tongcheng Travel Holdings | 2.64 | China online travel agency |

| SK Telecom | 2.51 | Korea’s largest mobile operator |

1Source: AP News, China GDP grows 5.3% in Q1, beating expectations, 16 Apr 2024

2Source: AP News, China GDP grows 5.3% in Q1, beating expectations, 16 Apr 2024

3 Source: People’s Bank of China, May 2024

4 Source: Bloomberg, Taiwan economy grows at fastest pace since 2021 on chip boom, 30 Apr 2024

5 Source: World Bank, Apr 2024

6,7 Source: Morningstar, as of 30 April 2024

8,9 Source: Morningstar/UOBAM as of 30 April 2024

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

Awarded Outstanding Achiever for Asia Pacific ex-Japan Equity at Benchmark Fund of the Year 2023 awards You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z