Investors like the enhanced income offered by Asian high yield bond funds but worry about the risks. The United Asian High Yield Bond Fund dials down its volatility by avoiding high risk sectors and long duration issues

- Asian high yield bond funds provide attractive income but typically come with elevated risks

- It is important to choose a fund that carefully manages portfolio risk

- The United Asian High Yield Bond Fund offers higher yield, higher returns and lower volatility than its peers

Global investors seeking an enhanced income stream are turning to Asian high yield (HY) bond funds. These funds have also delivered good capital returns this year, driven by interest rate cut expectations, a healthy economic recovery in Asia, and strong corporate earnings.

The Asian HY bond market may look attractive today, but China’s property downturn in 2021 and 2022 caused the market to lose nearly half its value. So it is important to choose your HY bond fund carefully, especially as bond funds can differ greatly in the way they manage risk in the portfolio.

Here are three key ways that Asian HY bond funds can be the same, or different from, their peers.

1. Fund composition

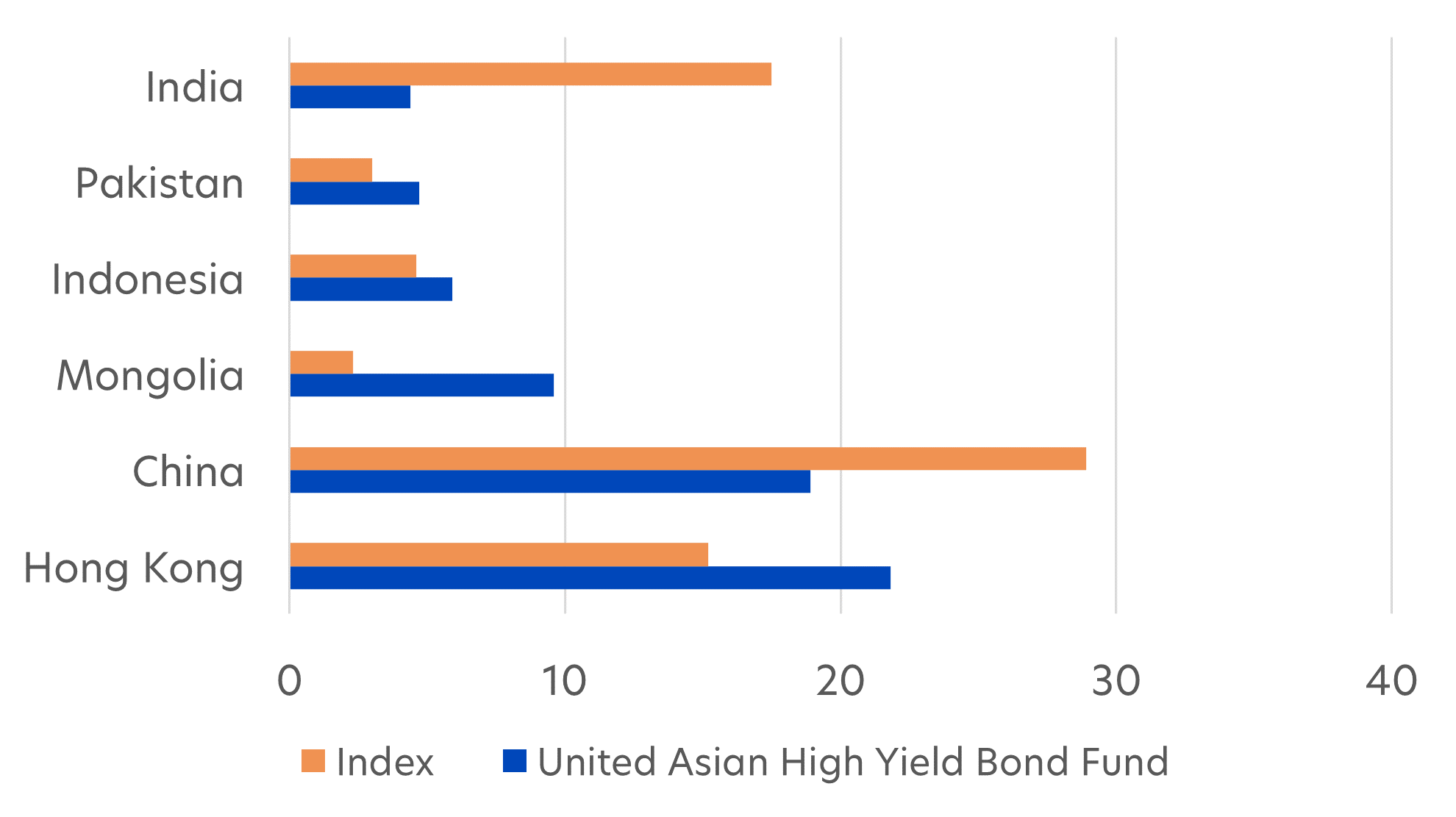

Most Asian HY bond funds have a large exposure to the top three Asian HY bond markets, namely China, India and Hong Kong1. The largest Asian HY bond sectors are real estate, financials and utilities1.

United Asian High Yield Bond Fund: This Fund is actively managed and generally more defensively positioned than the market. In June 2022, the Fund's “benchmark” i.e. the JACI Non-investment Grade Index (the “Index”) was converted to a “reference benchmark” to highlight the Fund's active management.

As a result, geographically, the Fund's allocation to China is significantly smaller than the Index, while its allocation to Hong Kong HY bonds is significantly larger.

Fig 1: Geographic allocation: United Asian High Yield Bond Fund vs Index

Source: Bloomberg, UOBAM, based on the JACI Non-Investment Grade Index, as of 30 June 2024

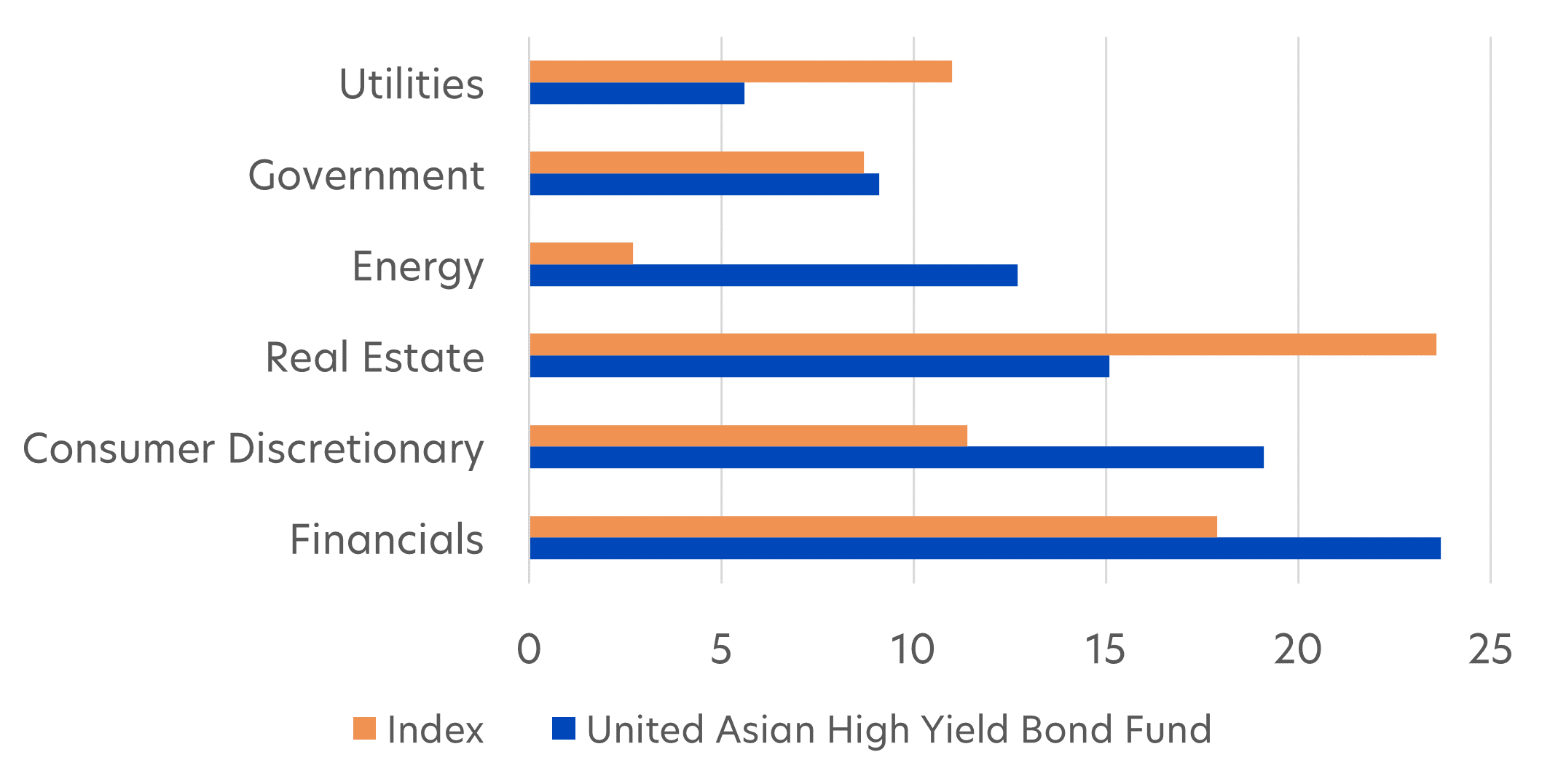

Similarly, sector-wise, the Fund has a significantly lower exposure to real estate and utilities, and significantly higher exposure in the financial, consumer discretionary and energy sectors. Financial sector companies are generally more defensive because they better credit fundamentals and in many cases, are owned or supported by their respective governments.

Fig 2: Sector allocation: United Asian High Yield Bond Fund vs index

Source: Bloomberg, UOBAM, based on the JACI Non-Investment Grade Index, as of 30 June 2024

Notably, the Fund's portfolio manager remains very cautious on China's HY property sector and believes that stimulus measures announced so far have failed to generate a sustained recovery. This sector makes up just 5 percent of the Fund's portfolio, about three times less than the market (as reflected by the JACI Non-Investment Grade Index).

2. Credit quality

HY bonds can have credit ratings ranging from BB+ to D. Depending on their investment strategy, some funds may hold more lower-rated HY bonds to generate a better yield, but this also exposes them to greater levels of default risk.

United Asian High Yield Bond Fund: The Fund has maintained an average credit rating of BB- over the past 12 months. This is marginally higher than the BB average of its peers, according to Morningstar. About a tenth of the Fund’s holdings are investment grade bonds and about half are in better-rated BB bonds.

3. Average maturity

The average weighted maturity of Asian HY bond funds can range from around 2 to 10 years. Funds with a lower average weighted maturity tend to be better insulated against interest rate fluctuations. According to Morningstar, the average maturity for the Asian HY bond fund category is 4.1 years, as of 30 June 2024.

United Asian High Yield Bond Fund: In contrast, the Fund’s average weighted maturity is 2.5 years. While the Fund does not specifically target a short maturity strategy, the Fund’s portfolio manager has a preference for HY bonds that have a higher certainty of repayment and therefore has a higher concentration of shorter maturity issues.

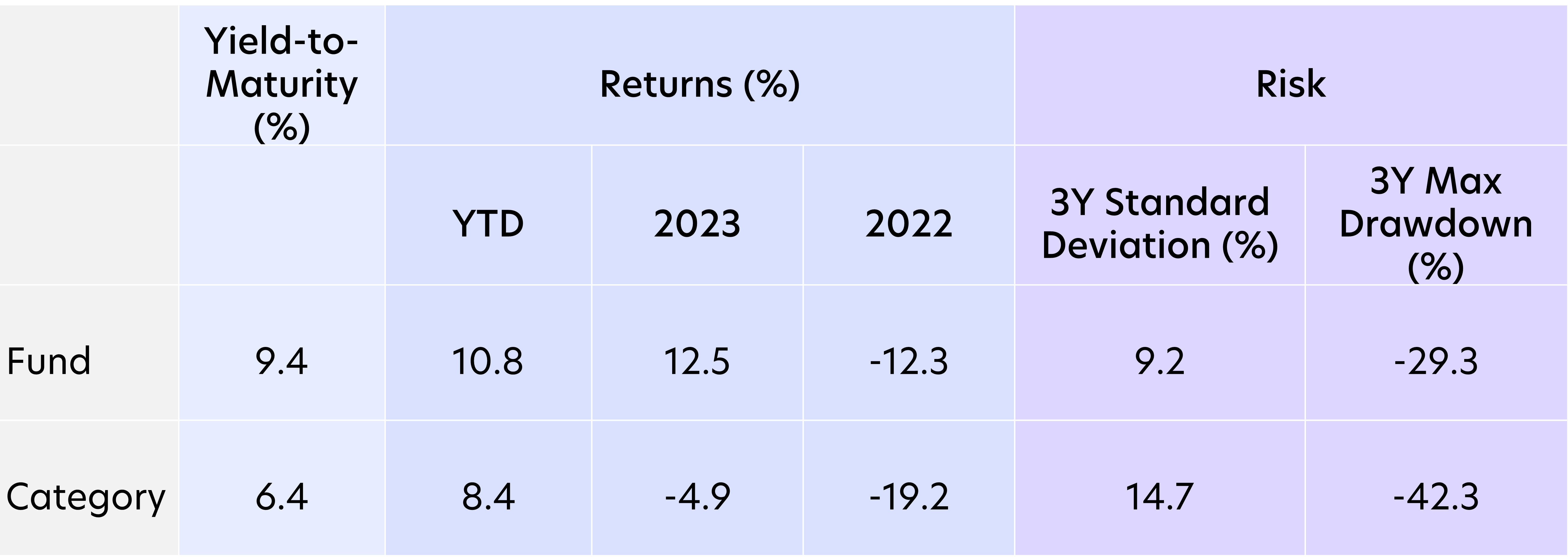

United Asian High Yield Bond Fund: Higher yield, higher returns and lower volatility than its peers

As a result of its more defensive positioning, the Fund has a lower risk profile than its peers. Its three-year standard deviation of 9.2 is considerably lower than the 14.7 average across its peers. In 2021 and 2022, despite default rates of 13.3 percent and 16.8 percent respectively within the Asian HY market2, none of the Fund's holdings defaulted during this period. The Fund's maximum loss over the past three years was 29 percent, compared to the average 42 percent for its peers.

Despite this, the Fund's yield is 9.4 percent, far higher than its peers. Also, its YTD, 2023 and 2022 returns have exceeded those of its peers.

Fig 3: United Asian High Yield Bond Fund: Yield, returns & risk vs peers,

as of 30 June 2024

Source: Morningstar, UOBAM, as of 30 June 2024. Category refers to the Morningstar Asian High Yield Bond category.

Performance as of 30 June 2024 on a SGD basis, based on the SGD Dist share class. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Past performance is not necessarily indicative of future performance.

Fund details

| Fund Name | United Asian High Yield Bond Fund |

| Investment Objective | To achieve a total return consisting of high income and capital appreciation by investing primarily in high yield fixed income or debt securities (including money market instruments) issued by Asian corporations, financial institutions, governments and their agencies. |

| Fund Classes Available3 | Class A SGD Acc (Hedged) Class A SGD Dist (Hedged) Class SGD Acc Class SGD Dist Class USD Acc Class USD Dist |

| Subscription Mode | Class SGD: Cash & SRS Class USD: Cash |

| Minimum Subscription | Class SGD, Class A SGD and Class USD: S$1,000/US$1,000 (initial); S$500/US$500 (subsequent) |

| Subscription Fee | Currently up to 3%, maximum 5% |

| Management Fee | Currently 1.25% p.a., maximum 2% p.a. |

| Dealing Frequency & Deadline4 | Generally every business day, on a forward pricing basis till 3pm (Singapore time). |

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian High Yield Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

1Source: Bloomberg, UOBAM, based on the JACI Non-Investment Grade Index, as of 30 June 2024

2Source: UOBAM, JP Morgan, May 2024

3Investors should refer to the Fund's prospectus for more details on the different classes available. Please check with our distributors on the availability of the Fund classes

4Please check with the distributor(s) or refer to the Fund’s prospectus for more details.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z