The United Asian Bond Fund is focused on active credit selection as the market gets ever broader and deeper

- Asia’s corporate bond market is growing rapidly

- Asian investment grade corporate bonds now offer higher yields than their US peers

- The United Asian Bond Fund invests in bonds that are undervalued and therefore have good spread tightening potential.

Asian investment grade (IG) corporate bonds are seeing a strong surge in interest from both locals and foreigners. Over the past year, the market has risen about 10 percent in USD terms, boosted by a few key factors:

Top of the list is the opportunity for investors to lock in higher yields as the US Fed prepares to cut interest rates in September. Asian IG corporate bonds are offering yields averaging around 5.4 percent1, compared to around 3.6 percent2 offered by its US peers. In addition, export-led growth in Asia is expected to strongly exceed that of the US or Europe, which in turn should continue to lift corporate earnings.

In response to this demand, Asian G3 (USD, EUR and JPY-denominated) bond issuances have grown by 18 percent to US$122.9 billion3 so far this year. China and Korea dominated in the IG corporate space, while India has become one of this year’s primary high bond issuers.

The United Asian Bond Fund

An active, bottom-up approach

The objective of the United Asian Bond Fund (the “Fund”) is to provide stable current income and capital appreciation by investing primarily in debt securities issued by Asian corporations, financial institutions, governments and their agencies (including money market instruments).

The Fund is actively managed with a focus on USD-denominated, investment grade (IG) corporate bonds that have improving fundamentals and good demand. This means that through a rigorous bottom-up selection process, the Fund buys and holds bonds that are undervalued given the corporate’s fundamentals and credit worthiness.

Such corporates have relatively higher yields but the potential for credit spread tightening. As the market starts to recognise their worth, their spreads gradually compress and the bonds eventually revert to their fair value, enabling the Fund to capitalise on the corresponding price gains.

Higher yield, lower volatility

This has allowed the Fund to achieve an average yield to maturity in July of 5.9 percent. Despite this, its focus on investment grade bonds with an average credit quality of BBB, and relatively low duration of 4.8 years, makes it a less volatile solution within the Asian Bond space.

Solid performance in 2024

The Fund’s bottom-up selection in corporate bonds with a potentially meaningful credit improvement story has contributed to the outperformance over its benchmark (the JACI IG Total Return Index) this year. After lagging its benchmark in 2023, the Fund has seen a recovery in performance, returning 5.6 percent so far this year and outpacing its benchmark by 1.28 percent.

Fig 1: Fund performance vs benchmark, as of 31 July 2024

| Cumulative returns (%) | Calendar year returns (%) | |||

| 1M | YTD | 2023 | 2022 | |

| Fund | 0.29 | 5.63 | -0.26 | -13.20 |

| Benchmark | -0.02 | 4.35 | 5.65 | -11.27 |

Benchmark: JACI Investment Grade Total Return Index

Source: Morningstar, UOBAM. Performance as of 31 July 2024, SGD basis, with dividends and distributions reinvested, if any. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Past performance is not necessarily indicative of future performance.

Attractive income potential

The Fund provides an annualised dividend yield of 4.5 percent, paid out monthly4 (Class A SGD Dist (Hedged)). With SGD one-year fixed deposit rates and Singapore inflation likely to range from 2.0 – 3.0 percent over the next few years, this Fund may be a viable option for investors looking to step up their passive income.

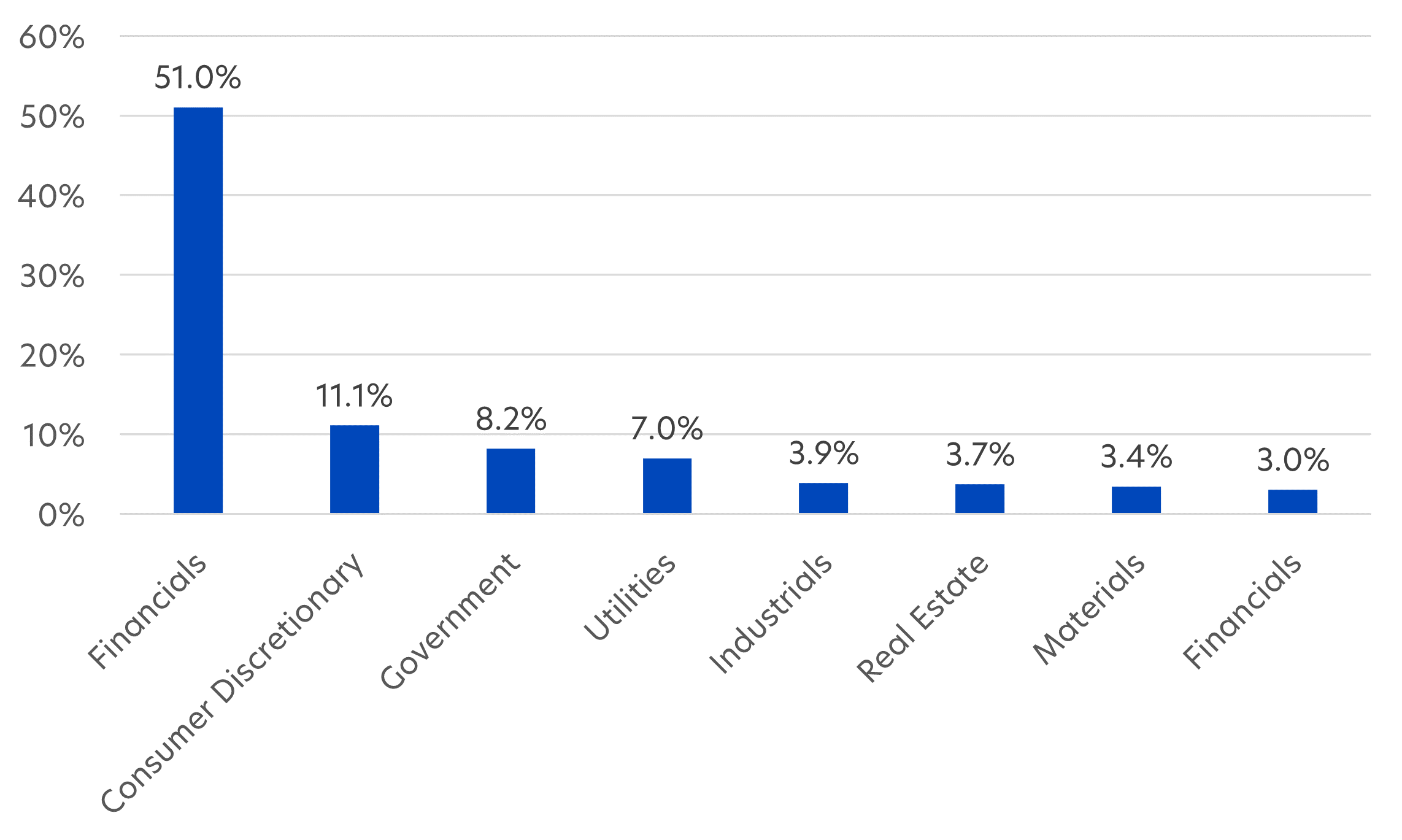

Focus on Financials

At present, the Fund manager sees significant potential in financial company bonds, resulting in the financials sector making up 51 percent of the portfolio. This emphasis on financial companies has helped improve returns with the sector accounting for between 40 to 50 percent of the Fund’s positive returns over the past two months. Other sectors include consumer discretionary, government and industrials.

Fig 2: Fund sector allocation, as of 31 July 2024

Source: UOBAM

Not surprisingly, the Fund’s current top holdings are mainly financial sector companies, with the exception of mining company, Freeport Indonesia and Zhongsheng Group, one of China’s largest car dealerships.

Fig 3: Fund top 10 holdings, as of 31 July 2024

| Bond issuing company | Weight (%) | Description |

| Huarong Finance | 1.89 | Chinese company offering financial and investment management services |

| Barclays | 1.82 | Global financial services provider offering retail banking, credit cards, and wealth management services |

| Deutsche Bank | 1.82 | Global financial services provider offering commercial, investment, private, and retail banking |

| Freeport Indonesia | 1.68 | Indonesian mining company |

| ROP Sukuk Trust | 1.67 | Special purpose trust formed under Philippine law and administered by Land Bank of the Philippines |

| Zhongyuan Dayu International | 1.67 | Chinese financial company |

| Chang Development | 1.66 | Chinese economic development agency |

| Mirae Asset Securities | 1.66 | Korea’s largest investment banking and stock brokerage company |

| Zhongsheng Group | 1.64 | China’s leading national automobile dealership groups |

| Societe Generale | 1.63 | French multinational financial services company |

Interested to invest? Here are some useful fund details.

Fund details, as of 31 July 2024

| Fund class available | SGD, A SGD Acc (Hedged), A SGD Dist (Hedged) |

| Management fee | Currently 1.10% p.a. |

| Subscription fee | Currently up to 3%, Maximum 5% |

| Minimum subscription / trading size | S$1000 (initial); S$500 (subsequent) |

1JACI Investment Grade Total Return Index, as of 31 July 2024

2ICE BofA US Corporate Index, as of 31 July 2024

3Source: LSEG, August 2024

4Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

Investors should note that the making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. If distributions are made, such distributions are not in any way a forecast, indication or projection of the future or likely performance of the relevant fund. UOBAM reserves the right to vary the frequency and/or amount of distributions. The making of any distribution shall not be taken to imply that further distributions will be made. Investors should also note that the declaration and/or paying of dividends may have the effect of lowering the net asset value of the relevant fund.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z