China and Hong Kong were among the top performing stock markets last month. How can investors seize alpha opportunities in the current rally?

The China and Hong Kong stock markets have been advancing since mid-April. Investor sentiment turned positive following China’s April Politburo meeting, which hinted at possible interest rate cuts to support the economy. Officials also pledged to cut housing inventory, prompting speculation that more property stimulus measures could be on the way.

As a result in April, Hong Kong’s Hang Seng Index gained 7.4 percent, the top performer globally. Meanwhile China’s CSI 300 rose about 2 percent and Taiwan’s TAIEX index declined by 1 percent having rallied strongly since the start of the year.

Seizing alpha opportunities

Whether China’s rally can be sustained is still uncertain. But what is clear is that the Greater China region, comprising China, Hong Kong, and Taiwan, provides investors with vast and diverse opportunities. Going forward, the Taiwan market is set to continue booming due to the artificial intelligence (AI) craze, China market valuations have become very attractive, and Hong Kong stocks will remain in demand as a more liquid China play.

That said, this region is home to over 5,000 listed companies1. While the region is once again being seen as a rich hunting ground for alpha opportunities, identifying potential winners is a daunting task.

The United Greater China Fund

Using AI techniques is one way to overcome the problem of stock-picking within a vast universe. UOB Asset Management’s AI-Augmented framework such as that applied by the United Greater China Fund (the “Fund”) offers an unbiased, data-driven and high-coverage approach to investing.

The Fund seeks to capture alpha opportunities across Greater China and deliver long-term capital growth through its unique strategy:

|

How AI-Augmentation works:

|

Traditional fund managers are typically constrained by certain style or factor philosophies, or simply by the impossible task of researching all 5,000+ Greater China stocks on a regular basis. This means they are at risk of potentially missing out on the region’s best alpha opportunities.

In contrast, AI and machine learning helps to evaluate the entire range of stocks listed within the Greater China region and identify a shortlist of stocks with the highest potential to outperform the index. Human managers then help to ensure that these stocks satisfy quality and risk criteria, and that the portfolio is well-balanced.

Award-winning performance

Powered by its AI-Augmentation strategy, the Fund has managed to deliver good returns despite the struggles faced by China’s stock market in recent years. The Fund has generated positive performance in 4 out of the past 5 calendar years, unlike the broader market which experienced losses in 2021, 2022 and 2023.

In April, the Fund also benefitted from the rally in China and Hong Kong stocks, registering positive gains of 2.36 percent. This takes its performance over the past one year to 15.01 percent.

Thanks to its consistently strong performance, the Fund was recently awarded the following at the LSEG Lipper Fund Awards*:

- Best Fund over 3 Years (Equity Greater China) [the Fund’s second consecutive win]

- Best Fund over 5 Years (Equity Greater China)

Fig 1: Fund returns (%)

| 1 Month | 1 Year | 2024 YTD | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Fund | 2.36 | 15.01 | 10.74 | 5.89 | -23.85 | 5.32 | 39.15 | 16.11 |

| Benchmark | 4.21 | 4.32 | 8.51 | -2.53 | -22.74 | -7.66 | 25.98 | 22.11 |

Benchmark: MSCI Golden Dragon Index.

Source: Morningstar. 1 month, 1 year, and 2024 YTD performance as of 30 April 2024, SGD basis, with dividends and distributions reinvested, if any. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Past performance is not necessarily indicative of future performance.

*Please refer to uobam.com.sg/awards for the latest list of UOBAM awards.

A unique Greater China portfolio

With its AI-driven stock picks, the Fund’s portfolio is naturally very different from traditional Greater China funds and indices. For instance, the top 10 constituents of the MSCI Golden Dragon index do not feature in the Fund’s top 10 holdings. Instead, the Fund invests in lesser-known names that nonetheless hold high return potential.

Fig 2: Fund top 10 holdings, as of 30 April 2024

| Company name | Weight (%) | Description |

| CNOOC Energy | 3.89 | Chinese oil and gas company |

| Hexing Electric | 3.83 | Chinese utilities company |

| PetroChina | 3.48 | Chinese oil and gas company |

| Radiant Opto-Electronics Corporation | 3.47 | Taiwanese opto-electronic components manufacturer |

| China Construction Bank | 3.45 | One of the "big four" banks in China |

| Taiwan Hon Chuan | 3.36 | Taiwanese plastic and metal packaging product manufacturer |

| Yuanta Financial Holdings | 3.31 | Taiwanese financial services firm |

| Shandong Hi-Speed Group | 3.29 | Chinese state-owned transport infrastructure operating company |

| Chicony Electronics | 3.21 | Taiwan-based multinational electronics manufacturer |

| CTBC Financial | 3.2 | Taiwanese banking, insurance and brokerages services firm |

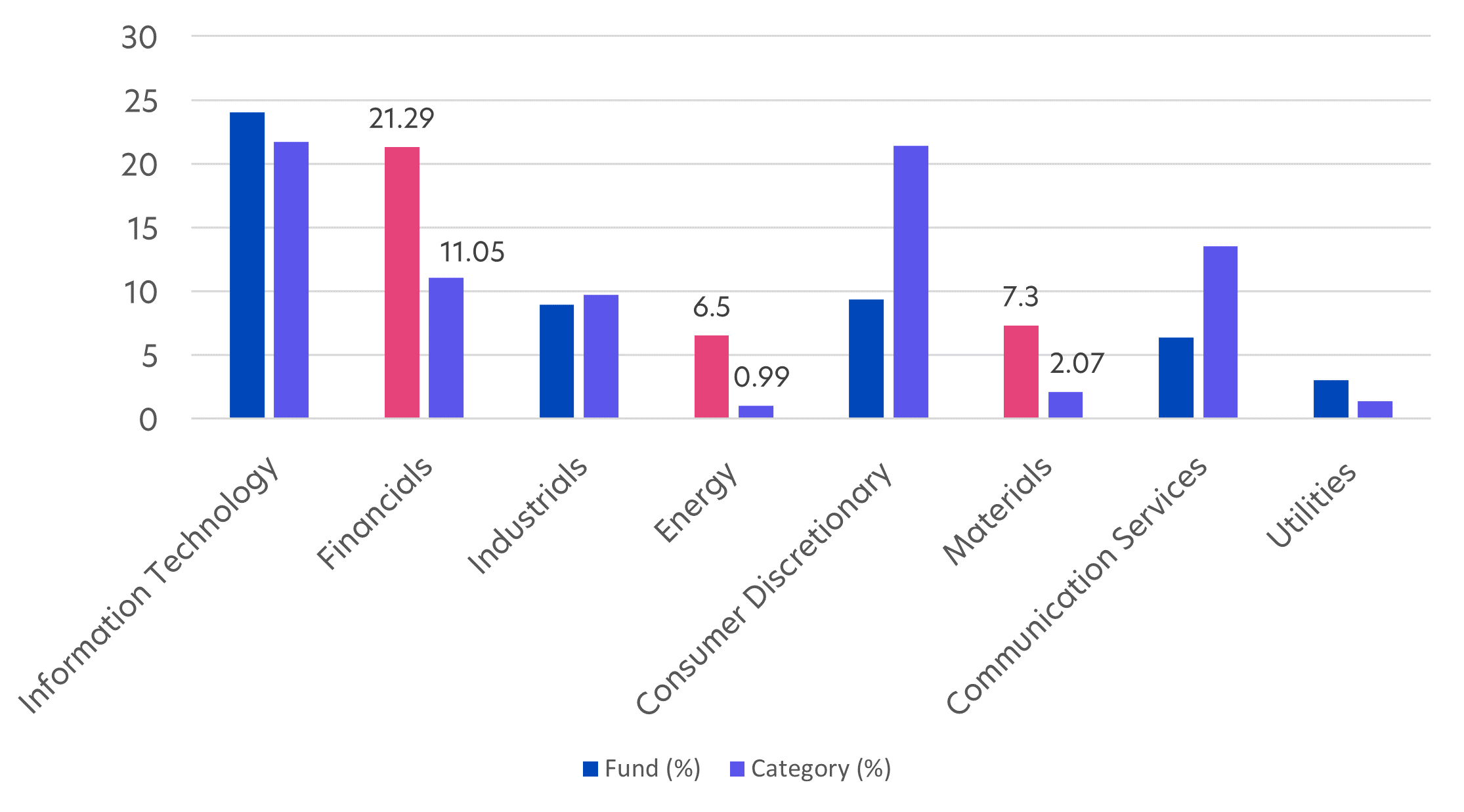

In terms of sector exposure, the Fund also differs from other Greater China Equity funds. Its AI-Augmentation model has generally found companies in the Financials, Energy and Materials sectors to show higher return potential relative to other sectors. This accounts for the Fund’s higher allocation to these sectors compared to peer funds.

Fig 3: Fund sector allocation vs peers (%)

Source: Morningstar, as of 31 March 2024. Fund: United Greater China Fund; Category: Morningstar Greater China Equity. Pink shading highlights notable differences in sector allocation between the Fund and its peer funds.

The Fund also has higher exposure to Taiwanese stocks (40.57 percent) compared to peer funds (19.84 percent) after signals from its AI-Augmentation model indicated higher return potential there2. As it stands, Taiwan’s TAIEX is up 16 percent in the year to date, compared to 7 percent for China’s CSI 300 and 9 percent for Hong Kong’s Hang Seng Index.

Alpha generation from active stock selection

Investors may also be surprised to learn that the Fund currently has a very high turnover ratio of 201 percent, compared to 71 percent for peer funds3. The higher the turnover ratio, the more actively traded a fund is.

Indeed, the Fund leverages its AI-Augmentation strategy to dynamically adjust its portfolio allocation to capture alpha opportunities. This means on a monthly basis, the Fund’s portfolio manager – guided by AI indicators and their own experience – may take profit from certain segments to fund purchases or additional investments in other more promising sectors.

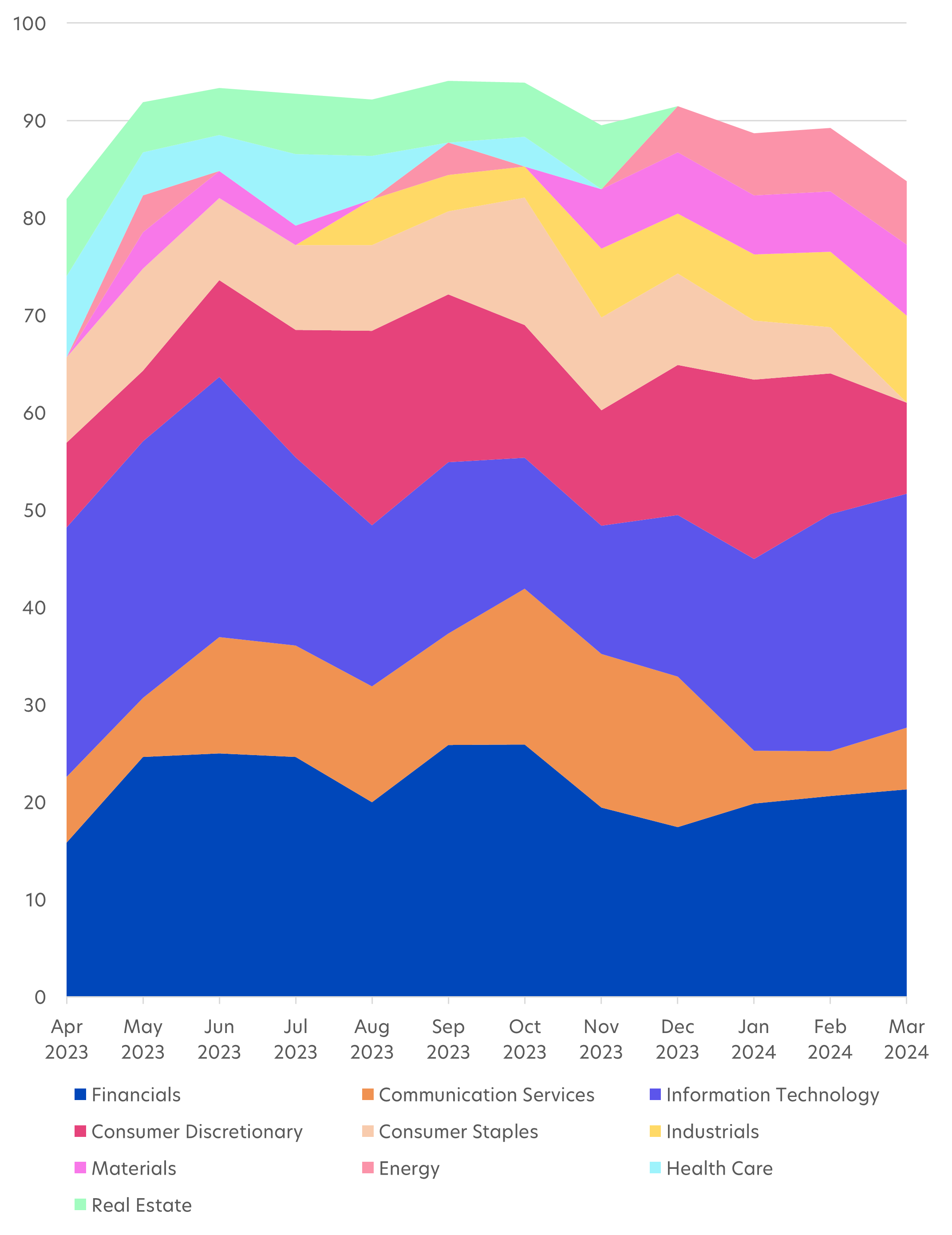

We can see this reflected in the Fund’s changing sector allocations over the past year (see Fig 4).

- From June to December 2023, the Fund steadily increased exposure to stocks from the Communication Services and Consumer Discretionary sectors after the AI model found higher return potential there.

- In January 2024, the Fund manager took profit from Communication Services stocks and redeployed funds to Financials and Information Technology stocks.

- Healthcare and Real Estate were part of the Fund’s sector allocation in 2023, but this was replaced by Materials and Energy from December 2023.

Fig 4: Fund sector allocation changes (%), Apr 2023 – Apr 2024

Source: Morningstar, as of 31 March 2024. Weights shown represent the top 8 sector allocations each month and do not add up to 100%

As a result of this AI-driven active stock selection, the Fund’s portfolio manager has been able to unearth opportunities that other traditional fund managers may have missed. Such a differentiated approach has so far delivered desirable investment outcomes for the Fund, allowing them to capitalise on the abundant alpha opportunities across Greater China.

1Source: China Association for Public Companies, Feb 2024

2Source: Morningstar, as of 31 March 2024

3Source: Morningstar, as of 8 May 2024

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Greater China Fund

Awarded Best Fund over 3 Years and 5 Years (Equity Greater China) at LSEG Lipper Fund Awards You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z