The reawakening of the China stock market has everyone asking: is China now on a different path? The United Greater China Fund is focused on managing the region’s potential long-term rewards… and risks.

The end of September 2024 saw the China stock market rocket up 25 percent, making it one of the most exciting weeks in China's history. Since then, the mood has turned from excitement to contemplation. While it is not unusual for the China market to gain by more than 50 percent gains over short periods, more often than not these gains have fizzled out. As a result the CSI 300 index has gained only about 5 percent per annum over the past decade, compared to 11 percent for the S&P500.

China is a slow burn

So aside from the good tactical opportunities that China is able to offer nimble-footed investors, many uncertainties remain for those who want to reap sustainable rewards from China’s long term economic prospects.

On the plus side, China is already said to be leading the world in terms of its research and adoption of “critical” technologies. Going forward, the Chinese authorities appear to have a steely determination to boost consumer demand, the stock market and the property sector. Furthermore. positive earnings and poor sentiment has led to attractive valuations, even despite the recent rally.

However, China is a big ship and it remains unclear what it will take to turn it around. The policy measures announced at the end of September, while more aggressive than many had expected, are really only the beginning rather than the end of the story.

The United Greater China Fund (the “Fund”)

With China's many opportunities but also many challenges in mind, this Fund takes a novel approach to investing in Greater China markets:

1. Unique AI-Augmentation strategy

The Fund seeks to capture alpha opportunities across Greater China in order to deliver long-term capital growth. It does this by applying a unique strategy that combines AI techniques and analyst research. An AI-driven model enables the Fund to cover all 5,000+ stocks listed in China, Hong Kong and Taiwan. At the same time, portfolio managers help to ensure that the Fund is aligned to firm-wide asset allocation views, and selected stocks satisfy quality and risk criteria.

2. Long term returns at lower risk

The Fund has delivered positive returns so far this year but underperformed its benchmark, due to the unexpectedly strong market reaction to the Chinese government’s recent policy announcements.

Fig 1: Calendar year Fund returns (%) as of 30 September 2024

|

|

Sept 2024 |

YTD 2024 |

2023 |

2022 |

2021 |

2020 |

2019 |

|

Fund |

6.35 |

8.92 |

5.89 |

-23.85 |

5.32 |

39.15 |

16.11 |

|

Benchmark |

12.44 |

24.09 |

-2.53 |

-22.74 |

-7.66 |

25.98 |

22.11 |

Benchmark: MSCI Golden Dragon Index. Performance does not include the effect of charges such as sales or subscription fees, which an investor might or might not pay. Past performance is not necessarily indicative of future performance.

Source: Morningstar. Performance as of 30 September 2024, SGD basis, with dividends and distributions reinvested, if any.

This is perhaps not surprising given that the Fund is positioned to leverage positive fundamentals but also to minimize the downside arising from market crises and dislocations. As a result, the Fund has generated positive performances in four out of the past five calendar years. These returns were achieved with less volatility than many of its peers as shown in the chart below.

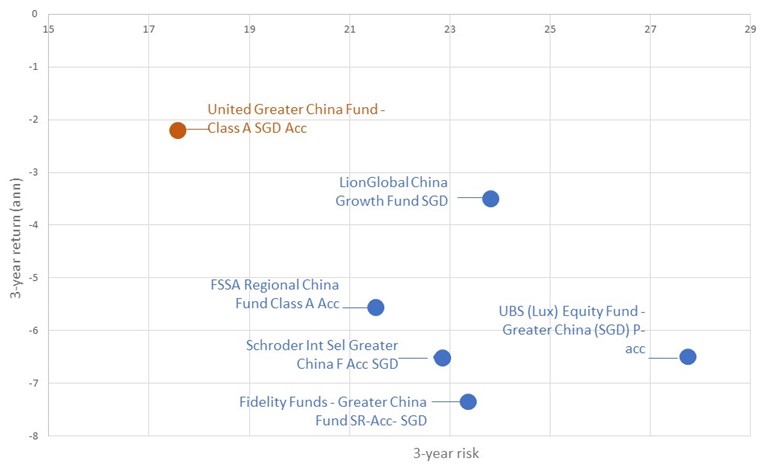

Fig 2: 3-year return (ann) & 3-year standard deviation for selected Greater China funds

Source: Morningstar/UOBAM as of 30 September 2024. Past performance is not necessarily indicative of future performance.

3. Reasonably active stock selection

The Fund's AI-Augmentation strategy ensures that its stock selection is active without sacrificing the returns provided by large cap stock holdings during market rallies. For example, during the recent rally, the Fund’s AI model continued to recommend a more defensive position on China.

However, portfolio adjustments have been made to reflect the UOBAM Strategy Committee’s more neutral stance. As a result, the Fund increased its exposure to e-commerce, consumption and stock-trading sectors such as Tencent, Alibaba, Hisense Home Appliance and Guangfa Securities, and reduced its exposure to banks.

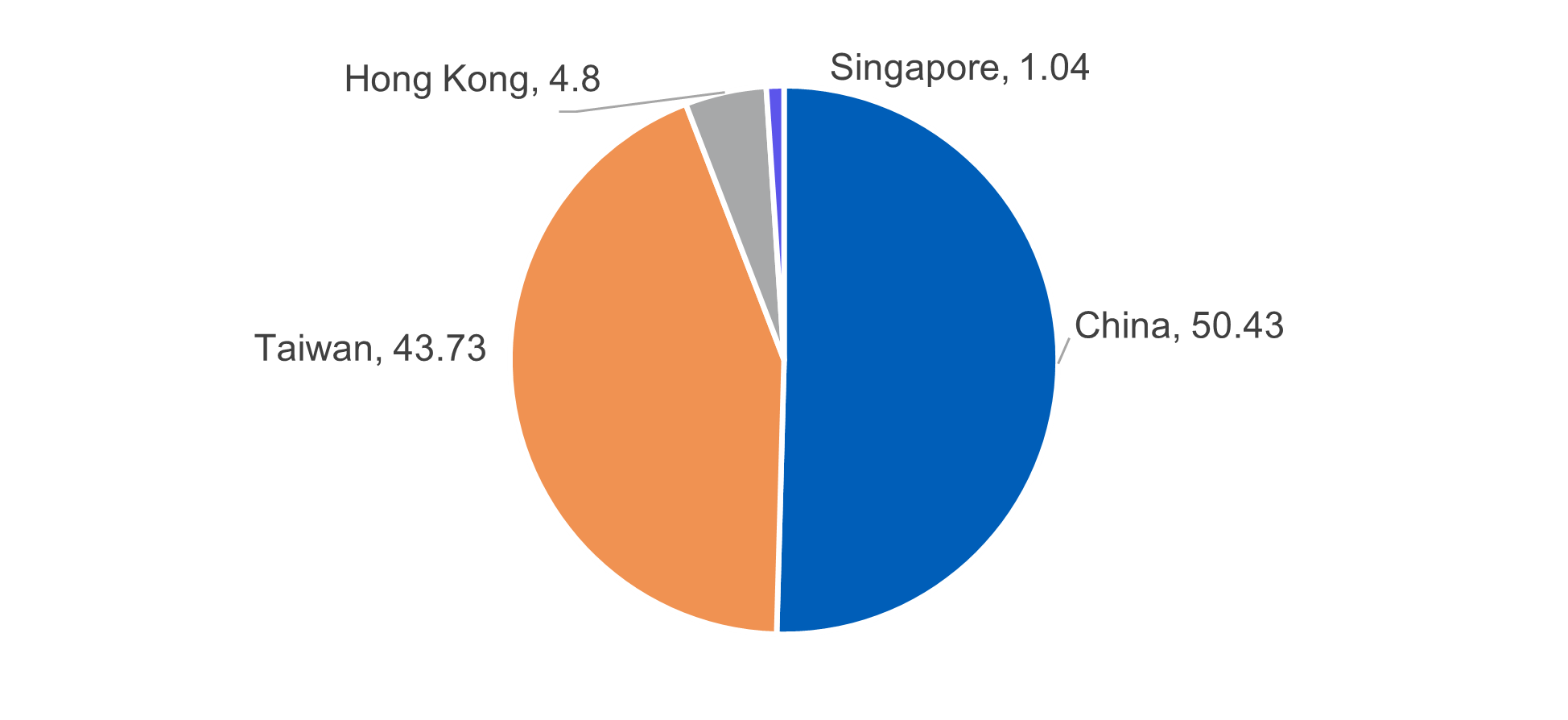

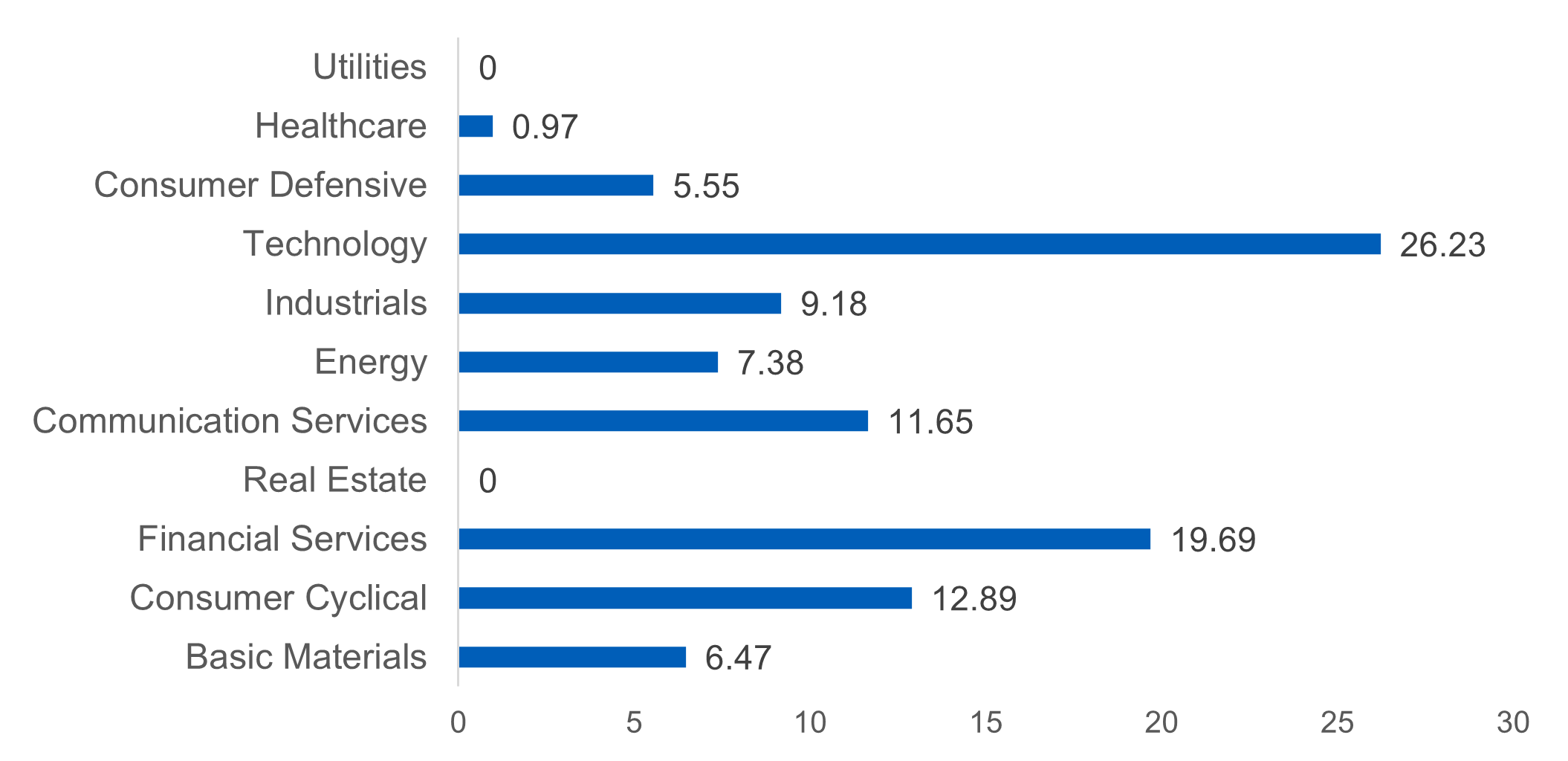

4. Country and sector diversification

The Fund is diversified across the Greater China market. This allows the Fund to capture China opportunities, but also to hedge against China risks but investing in Taiwan's AI-related industries, and Hong Kong's financial and property companies.

Looking ahead, the risks are high of a short term China market correction after such a steep rally. Over the longer term however, we believe that the government will top up on whatever is judged to be insufficient, and that the government will be reluctant to let the market slide back to where it was previously.

That said, the Fund will continue to be managed in a way that captures returns in a stable, risk-conscious way.

Fig 3: Fund top 10 holdings, of 31 August 2024

|

Company name |

Weight (%) |

sector |

|

Taiwan Semiconductor Manufacturing Co Ltd |

13.01 |

Technology |

|

Tencent Holdings Ltd |

8.73 |

Communication Services |

|

China Construction Bank Corp Class A |

3.32 |

Financial Services |

|

Sinopec Kantons Holdings Ltd |

3.19 |

Energy |

|

Cheng Shin Rubber Industry Co Ltd |

3.00 |

Consumer Cyclical |

Fig 4: Country allocation %, as of 31 August 2024

Source: Morningstar, Fund: United Greater China Fund

Fig 5: Sector allocation % as of 31 August 2024

Source: Morningstar, Fund: United Greater China Fund

As of end-September 2024, the United Greater China Fund is rated 5-stars by Morningstar. The Morningstar RatingTM is a quantitative assessment of a fund's past performance–both return and risk–as measured from one to five stars

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management fund to consider: United Greater China Fund

Awarded Best Fund over 3 Years and 5 Years (Equity Greater China) at LSEG Lipper Fund Awards LSEG Lipper Fund Awards, ©2024 LSEG. All rights reserved. Used under license. You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the funds are suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z