Stay ahead of inflation

Inflation may be stabilising after two difficult years, but its potential to squeeze household budgets has not gone away. The United SGD Fund helps to ensure you remain one step ahead.

Inflation can erode lifestyles

In a small and export-dependent economy like Singapore’s, inflation can rise quickly and have painful consequences. In 2023, Singapore’s all-item inflation reached 4.8 percent1. While Fixed Deposit rates also increased, this was not enough to counter the effects of such high inflation.

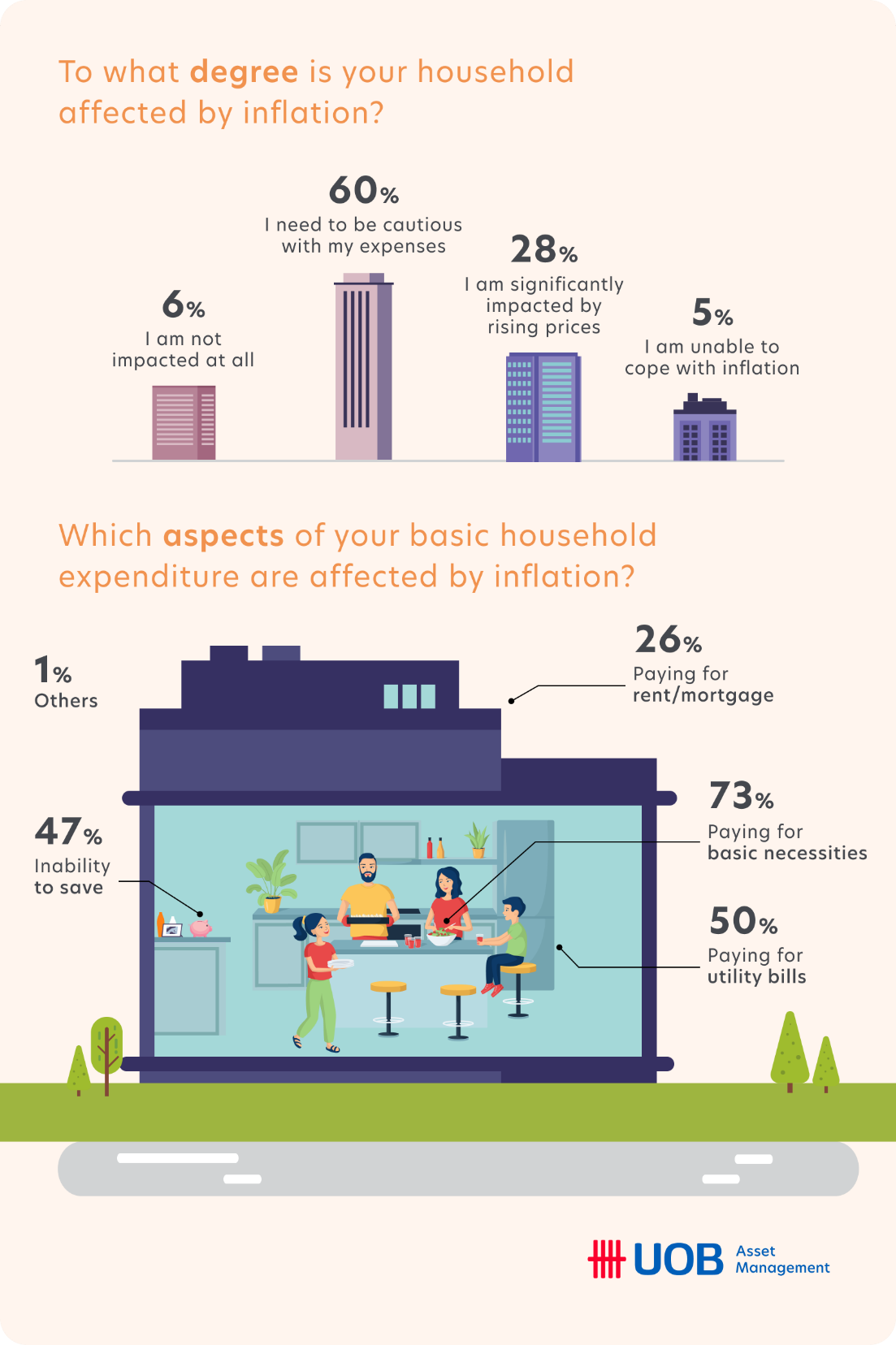

A survey2 of the impact on Singaporean households conducted at the time tells a cautionary tale:

Source: Rakuten Insight

It would appear that over a third of Singapore households were hit hard by the 2023 inflation, with many feeling the pinch with regards everyday necessities such as food, clothing and healthcare.

Beware, inflation risks remain

Today, inflation appears to have peaked and is on its way down. The most recent Monetary Authority of Singapore (MAS) report tells us that all-item inflation will likely average 2.5 percent in 2024, and is forecast to fall to around 2.0 percent in 20253.

But this does not tell the full story. Here’s why:

#1. Official inflation numbers are only broad averages. On the ground, inflation is not felt equally across all households. For example, compared to September last year, food prices are up by 2.6 percent, housing and utilities up 3.2 percent and healthcare up 4.1 percent4. So a household’s actual inflation rate can be very different depending on spending patterns.

#2 A household’s wage growth, and therefore its ability to cope with inflation, can also vary widely. According to the Ministry of Manpower, average wages in 2023 grew by 5.2 before taking inflation into account, and 0.4 percent after accounting for inflation5. However, they noted differences across employee types. For example on average, Junior Management employee wages grew by 6.3 percent, whereas Senior Management employee wages only increased 4.6 percent5, that is, below the inflation rate at the time. Depending on your specific role and company, your wage growth may not be keeping pace with inflation.

#3 There are many factors that could derail next year’s inflation forecasts. We believe that there is potential for upward pressure on inflation arising from deeper geo-political uncertainties, the effects of climate change, and Trump’s promised tariffs. As such, Singaporeans should remain cautious of the potential for inflation to stay higher for longer.

The United SGD Fund helps investors achieve real returns

The United SGD Fund, launched 26 years ago, offers a way for investors to navigate inflation by providing both steady income and a potential for capital appreciation.

The Fund focuses on high-quality corporate bonds with staggered maturities of around 1 – 3 years. This allows the fund to lock in yields as interest rates start to ease.

Furthermore, in today’s environment of positive growth, moderating inflation and falling interest rates, the Fund benefits because corporate bonds tend to perform better than government bonds. As a result, over the last year, the Fund returned 5.03 percent6, well ahead of inflation and fixed deposit rates.

The above conditions are expected to last into 2025 as Singapore interest rates continue to decline, growth stays resilient but inflation remains relatively sticky.

Find out more about the United SGD Fund here.

Fund details

|

|

United SGD Fund, as of 31 October 2024 |

|

Investment objective |

Invest substantially all its assets in money market and short term interest bearing debt instruments and bank deposits with the objective of achieving a yield enhancement over Singapore dollar deposits. |

|

Average portfolio duration7 |

1.36 years |

|

Average credit rating7 |

BBB+ |

|

Distribution policy |

Class A SGD (Dist): Dividend rate of 4.0% per annum, paid out monthly* |

|

Top 5 country allocation (%)7 |

Singapore: 22.13% |

|

Top 5 sector allocation (%)7 |

Financials: 36.40% |

|

Fund classes available8 |

Class A SGD Acc; Class A SGD Dist |

|

Management fee9 |

Class B SGD Acc and Class D SGD Acc: 0.33% p.a. |

|

Subscription fee9 |

Up to 2% p.a. |

|

Minimum subscription / trading size9 |

Class A/S: S$1000/US$1000 (initial); S$500/US$500 (subsequent) |

1 Macrotrends, Singapore Inflation Rate 1961-2024, November 2024

2 Rakuten Insight, May 2023

3 Monetary Authority of Singapore, MAS Monetary Policy Statement – October 2024, October 2024

4 Trading Economics, Singapore Inflation Rate, October 2024

5 Ministry of Manpower, June 2024

6 Morningstar, United SGD Fund – Class A SGD Dist as of 31 October 2024

7 Morningstar, October 2024

8 Investors should refer to the Fund's prospectus for more details on the different classes available.

9 Please check with the distributor or refer to the Fund's prospectus for more details.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United SGD Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z