Not all short maturity bond funds are created the same. Relative to its peers, the United SGD Fund is able to achieve similar yields with lower risk

- It is important to consider the credit quality, average maturity and risk level of a short maturity bond fund before investing in it

- Some funds may take higher risk to generate a higher yield

- The United SGD Fund offers similar yields as the average of its peer group, but at half the volatility

Short maturity bond funds have seen strong demand in recent months. Investors see such funds as a way to achieve higher-than-cash yields, while limiting the risk of negative returns. However, given that there are many funds in this category, it is useful to understand their similarities and differences.

Looking under the hood

There are three key aspects of a short maturity bond fund that investors should note:

-

Credit quality

Similarities: Most funds in the short maturity bond fund category are rated investment grade (IG), i.e. their credit quality is no lower than BBB-.

Differences: However, that is not the end of the story. Even within IG funds, some take higher risk by holding more bonds from the lower end of the IG universe in order to obtain a higher yield. As of early 2024, BBB rated securities (i.e. bonds close to the border between investment grade and high yield bonds) made up over 20 percent of IG bond funds’ total portfolio1.

United SGD Fund: The Fund has tended to maintain a stable credit rating that is several steps higher than BBB-. Over the past 12 months, the Fund’s average credit rating has generally hovered around BBB+ and A-.

Fig 1: United SGD Fund average credit rating, July 2023 – July 2024

| Month | Average credit rating |

| July 2023 | BBB+ |

| August 2023 | BBB+ |

| September 2023 | BBB+ |

| October 2023 | BBB+ |

| November 2023 | A- |

| December 2023 | A- |

| January 2024 | A- |

| February 2024 | BBB+ |

| March 2024 | BBB+ |

| April 2024 | A- |

| May 2024 | A- |

| June 2024 | BBB+ |

Source: UOBAM, as of 30 June 2024

-

Average maturity

Similarities: The standard definition of a short maturity bond portfolio is one where the average weighted maturity of its bond holdings is between 1 to 3 years. The shorter a bond’s maturity, the less its price will fluctuate as interest rates change.

Differences: Again, some short maturity bond funds have a weighted average maturity of around three years, that is, close to the maximum maturity for its category. This allows the fund to see bigger price gains when rates fall, but also causes fund returns to be more volatile.

United SGD Fund: As of end-June, the Fund's average weighted maturity was 1.33 years. This compares with the average of 3.65 years across the entire category2. Over the past 12 months, the Fund has displayed a shorter maturity than the average of its peers.

Fig 2: United SGD Fund average weighted maturity, July 2023 – June 2024

| Month | Average weighted maturity (years) |

| July 2023 | 1.29 |

| August 2023 | 1.25 |

| September 2023 | 1.21 |

| October 2023 | 1.19 |

| November 2023 | 1.12 |

| December 2023 | 1.04 |

| January 2024 | 1.11 |

| February 2024 | 1.16 |

| March 2024 | 1.20 |

| April 2024 | 1.24 |

| May 2024 | 1.29 |

| June 2024 | 1.33 |

Source: UOBAM, as of 30 June 2024

-

Fund volatility

Similarities: Short maturity bond funds tend to have low volatility and are generally considered to be low risk.

Differences: However, given the factors mentioned above, plus the option to use other risk controls, funds within this category can differ substantially in terms of their volatility. The average three-year standard deviation for short maturity bond funds is around 33. This means that if the mean return for the category is 2, then returns will range between -1 percent and 5 percent.

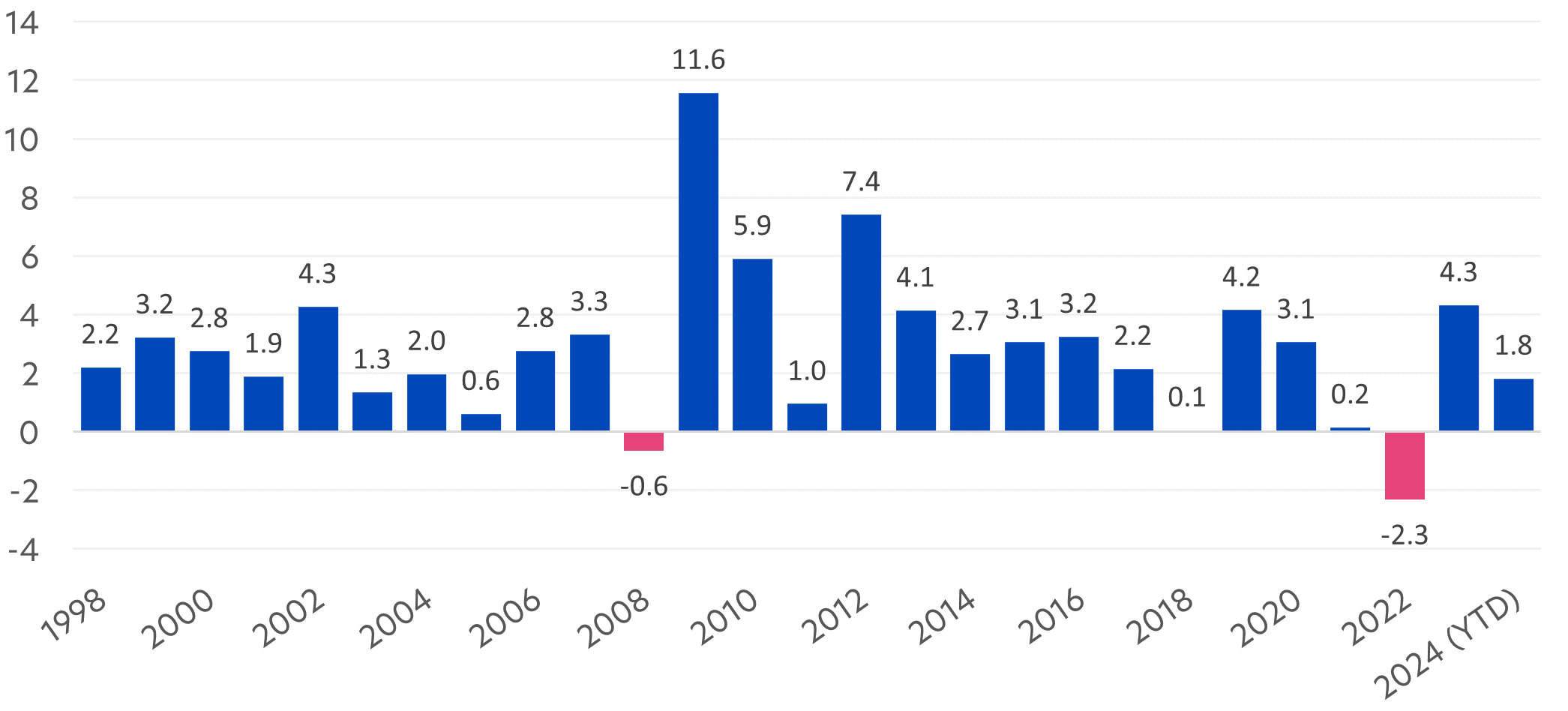

United SGD Fund: In comparison, the Fund's three-year standard deviation is around 1.5, that is, half of that displayed by its peers. It is this low relative volatility that has enabled the fund to suffer only two negative years in the 26 years since its inception. The two years – 2008 and 2022 – were due to the global financial crisis and the Covid pandemic and the fund recovered strongly thereafter.

Fig 3: United SGD Fund calendar year returns (%)

Source: Morningstar, as of 30 June 2024. | Past performance is not necessarily indicative of future performance. Fund performance is sourced from Morningstar and is based on United SGD Fund Class A SGD Acc, in SGD terms, on a NAV basis, with dividends and distributions reinvested, if any

Lower risk, similar yield

It is notable that despite its lower risk profile, the United SGD Fund’s yield is comparable to the average yield of its peer group. It is important therefore that investors do not regard all short maturity bond funds to be the same. While some funds manage to offer higher yields by taking more (albeit still limited) risk, the United SGD Fund shows that it is able achieve its yields without dialing up its risk.

Fig 4: Summary of United SGD Fund metrics vs peers, as of 30 June 2024

| Average maturity (years) | Average credit rating | Risk (3Y standard deviation) | Max drawdown (%) (3 years) | Yield (%) | |

| United SGD Fund | 1.33 | BBB+ | 1.47 | -3.85 | 4.69 |

| Morningstar Short-term Bond Category | 3.65 | A | 3.08 | -7.25 | 4.23 |

Source: Morningstar, UOBAM, as of 30 June 2024

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United SGD Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

1Source: CEPR, Changes in global corporate bond markets and dynamics around the investment grade threshold, 28 Jun 2024

2,3Source: Morningstar, as of 30 June 2024. Category: Morningstar Short-term Bond Category

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z