Interest rates are high but on their way down. The United SGD Fund is a short-maturity bond fund that lets you hang on to higher yields

Bank deposit yields are on average five times higher than they were three years ago. But these are already falling, and will get even lower once the US starts cutting its interest rates, likely later this year.

Not surprisingly, everyone is looking for a way to lock in current yields. The usual way is to put money away in a long-tenor fixed deposit, but many banks are now only offering 12-month tenors, after which your fixed deposit has to be renewed at a lower rate. The other option is a short maturity bond fund. These funds have the potential to provide cash-plus yields and capital appreciation in exactly this kind of environment.

|

Key takeaways

|

Here’s how short maturity bond fund returns are able to beat cash:

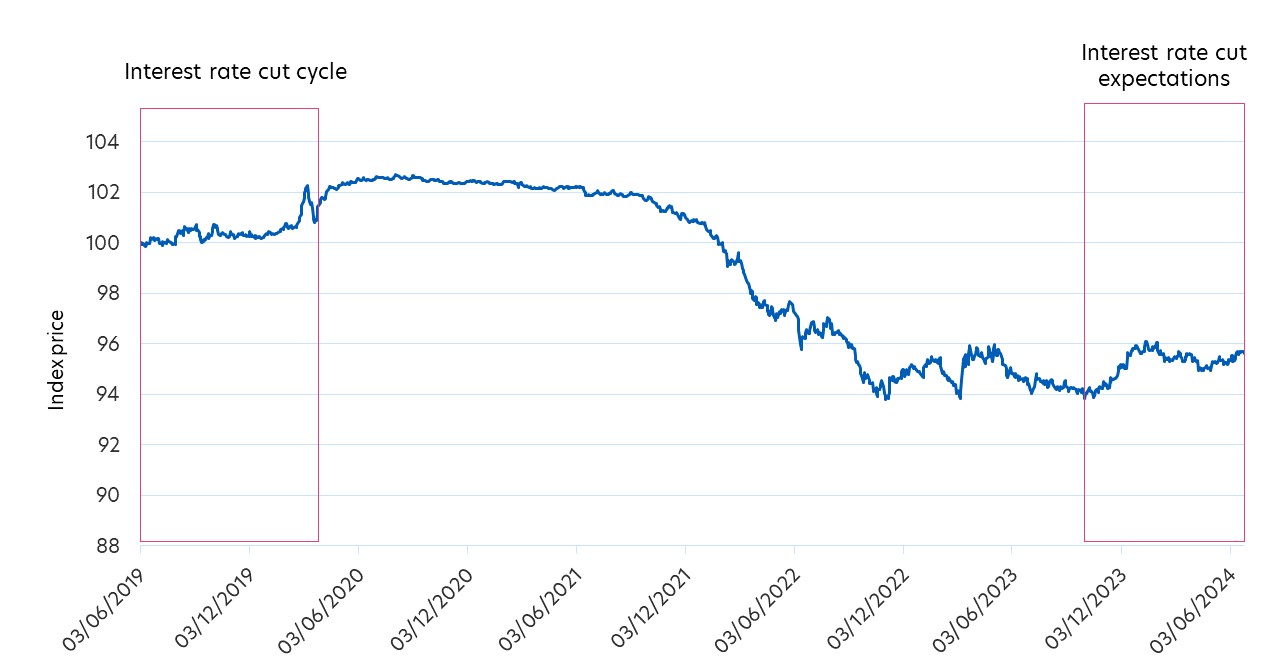

Bond prices move up when rates move down

The returns from bonds are different from cash. When interest rates fall (or threaten to fall), bond prices tend to rise because bonds yields become more attractive than cash yields. As in 2019, we would expect any interest rate cuts to result in higher bond prices, and therefore higher capital appreciation for bond investors.

Fig 1: Bond prices: Jun 2019 – Jun 2024

Source: Bloomberg, as of 27 June 2024. Index: Bloomberg 1 -3 Yr Gov/Credit Total Return Index

The yield curve is currently inverted

In addition to the potential rise in bond prices, short maturity bonds are offering higher yields than long maturity bonds. In today’s topsy-turvy interest rate environment, bonds that have shorter (0 – 3 years) maturity are paying higher yields than those that have longer maturity (4 – 30 years), as shown in the chart below.

Fig 2: US Treasury yield curve rates: 25 June 2024

Source: US Treasury

Short maturity bonds are less volatile

Short maturity bonds are also less volatile than long-maturity bonds. This is because bonds that mature sooner are less exposed to the possibility of unforeseen interest rate changes. This results in short maturity bonds showing greater price stability, as evident below

Fig 3: 1-year bond risk as of 27 June 2024

| Risk (as measured by 1Y standard deviation) | |

| Short maturity bonds | 5.9% |

| Intermediate maturity bonds | 13.1% |

Source: Bloomberg. Short maturity: Bloomberg 1 -3 Year Gov/Credit Total Return Index. Intermediate maturity: Bloomberg U.S. Aggregate Bond Index

A portfolio of short maturity bonds offers diversification

Finally, short maturity bond funds tend to invest in a large number of bonds that are of different credit qualities and maturities. Many funds hold 100 or more bonds. By doing so, such funds are able to diversify their risks and sources of return.

The United SGD Fund

The United SGD Fund (the “Fund”) is one of the most popular short-maturity bond solutions in Singapore.

There are three reasons why the Fund is well suited for those wanting to lock in high yields while limiting their risk:

-

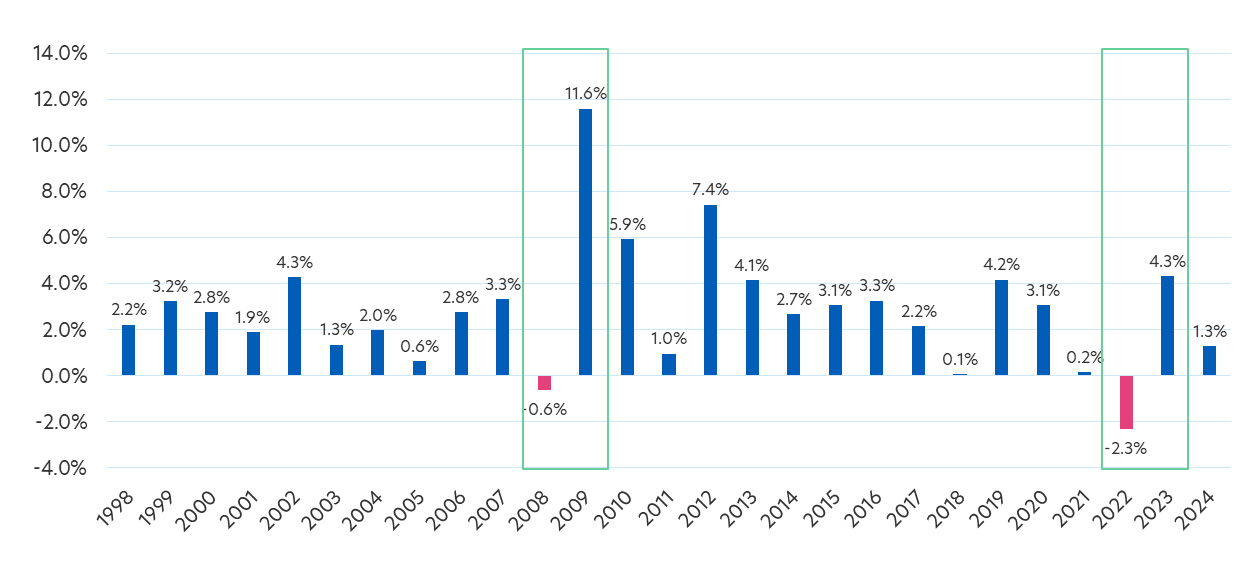

Consistent track record

Since its inception in 1998, there has only been two calendar years (2008 and 2022) where the Fund experienced negative returns. Even so, the Fund bounced back strongly in the following year, more than erasing the loss from the preceding year.

Fig 4: United SGD Fund calendar year returns

Source: Morningstar, as of 31 May 2024. | Past performance is not necessarily indicative of future performance. Fund performance is sourced from Morningstar and is based on United SGD Fund Class A SGD Acc, in SGD terms, on a NAV basis, with dividends and distributions reinvested, if any

-

Attractive yield pick-up

By investing in high-quality, short-term investment grade (IG) bonds, the Fund is offering 4 – 5 percent annual income, distributed monthly. This is almost double the Singapore fixed deposit rates, currently averaging 2.5 percent1 . This Fund is also expected to benefit from capital appreciation when interest rates start to fall.

-

Laddered strategy

The Fund uses a laddered strategy to lock in yields in a falling-interest rate environment. This strategy involves buying bonds that mature at staggered future dates. Lower interest rates in coming years means the Fund’s newer bonds will tend to carry a lower yield. However, its existing bond holdings will continue to provide elevated yields.

As such the strategy ensures:

-

current high bond yields are locked in for longer

-

the Fund is not only invested in low-yielding bonds

-

average portfolio yields are always higher than the prevailing bond yields.

Fund details

| United SGD Fund, as of 31 May 2024 | |

| Investment objective | Invest substantially all its assets in money market and short term interest bearing debt instruments and bank deposits with the objective of achieving a yield enhancement over Singapore dollar deposits. |

| Average portfolio duration | 1.23 years |

| Average credit rating | A- |

| No. of issues | 97 |

| Distribution policy | Class A SGD (Dist): Dividend rate of 4.0% per annum, paid out monthly* Class S SGD (Dist): Dividend rate of 5.0% per annum, paid out monthly* *Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund's prospectus |

| Top 5 country allocation (%) | Singapore: 25.02 Hong Kong: 13.82 South Korea: 13.28 China: 11.16 Australia: 10.15 |

| Top 5 sector allocation (%) | Financials: 37.42 Government: 12.51 Real Estate: 8.20 Consumer Discretionary: 8.03 Industrials: 6.99 |

| Fund classes available3 | Class A SGD Acc; Class A SGD Dist Class A USD Acc (Hedged); Class A USD Dist (Hedged) Class B SGD Acc Class D SGD Acc Class S SGD Dist Class S USD Dist (Hedged) |

| Management fee | Class B SGD Acc and Class D SGD Acc: 0.33% p.a. All other Classes: 0.63% p.a. |

| Subscription fee | Up to 2% p.a. |

| Minimum subscription / trading size | Class A/S: S$1000/US$1000 (initial); S$500/US$500 (subsequent) Class B: S$500,000 (initial); S$100,000 (subsequent) Class D: S$1,000 (initial); S$500 (subsequent) |

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United SGD Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

1Fixed deposit yield based on the average rate offered by Singapore’s local banks for a 12-month placement (DBS: 3.2%, OCBC: 2.8%, UOB: 1.5%), as of 20 June 2024

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z