The market had been tarnished by Chinese developer defaults. But a lower reliance on the China real estate sector has brought Asian high yields back into favour

- The Asian high yield market was rocked by Chinese property defaults in 2021 and 2022

- The sector has since recovered and is up 11% this year

- Investors are returning now that China real estate bonds no longer dominate Asian high yields

There was a time when you could not escape news of yet another Chinese property giant facing severe financial difficulties. Defaults by such high-profile property developers as Evergrande and Country Garden added to the highly negative sentiment. As a result, from the start of the crisis in May 2021 to its low in November 2022, the Asian high yield sector lost nearly half its value.

However, the market has since bottomed and this year, its popularity appears to be on the mend. Returns are up by 11 percent year-to-date, far exceeding the 2 percent returns for global high yields and 4 percent returns for Asian investment grade bonds.

China’s fading dominance

There are many reasons for the Asian high yield market’s recovery, including its very attractive yield, (currently around 8 percent, i.e. more than double that offered by MAS 6-month T-bills). But perhaps most reassuring for investors is the fact that the market is no longer dominated by Mainland China and Chinese property developers.

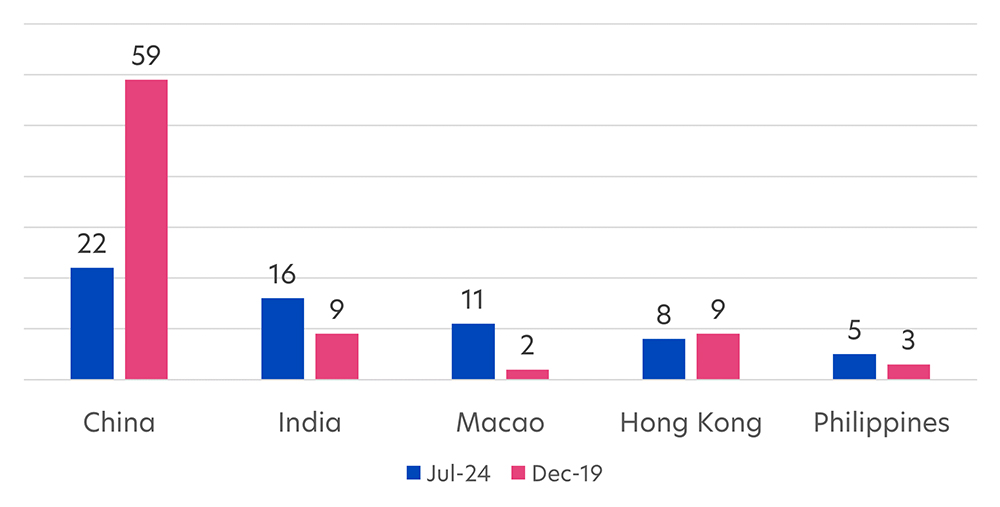

Today, the proportion of Mainland China-based issues is around a fifth of the Asian high yield market. This is in stark contrast to 2019, when Chinese property high yields comprised a third of the market, and China overall made up over half the market.

With this drop, the geographic spread has widened considerably with markets like Hong Kong, Macao, India and Philippines featuring more prominently among the Top 10 largest Asian issuers of high yield bonds.

Figure 1: Top 5 high yield bond market exposure by country weight (%),

July 2024 (vs Dec 2019)

Source: Bloomberg/UOBAM, based on the Bloomberg Asia USD High Yield Diversified Credit Index (USD)

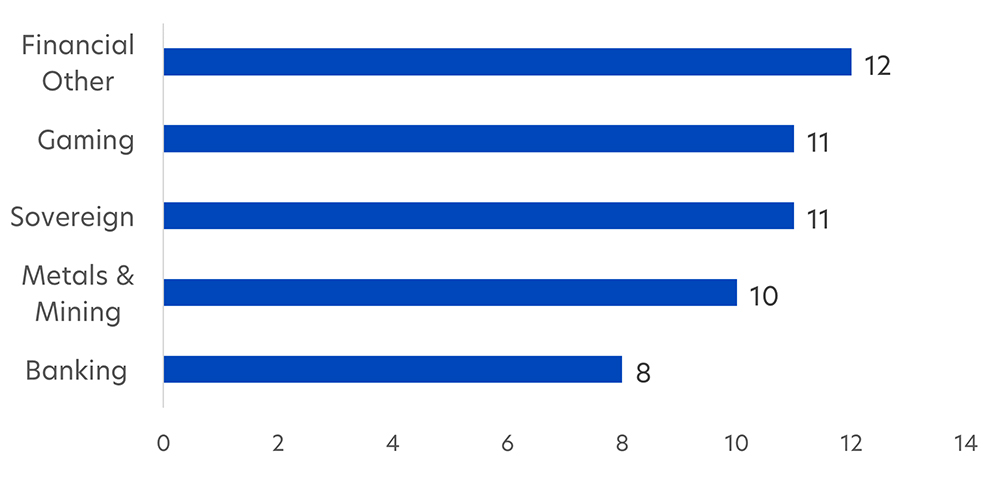

More diversity across industries

As a result, the industry mix is also looking healthier, with financial, retail, metals and mining, and gaming companies among the biggest issuers, while Chinese property issuers now account for less than 5 percent of the market.

In particular, the bigger role being played by the financial industry is a positive for the market. Asian banks and financial firms tend to have better credit fundamentals, and many are wholly or partially owned by their respective governments.

Bond issues from Asian corporates and sovereigns also tend to be shorter duration than their broader emerging market counterparts, and even their US counterparts. As of May 2024, the average duration of the Asian high yield bond market was just 2.5 years, compared to 3.2 years for US issues and 6.5 years for emerging markets, making it less vulnerable to price volatility.

Figure 2: Top 5 high yield bond sector exposure (%), July 2024

Source: Bloomberg/UOBAM, based on the Bloomberg Asia USD High Yield Diversified Credit Index (USD)

Asia’s growth is becoming more balanced

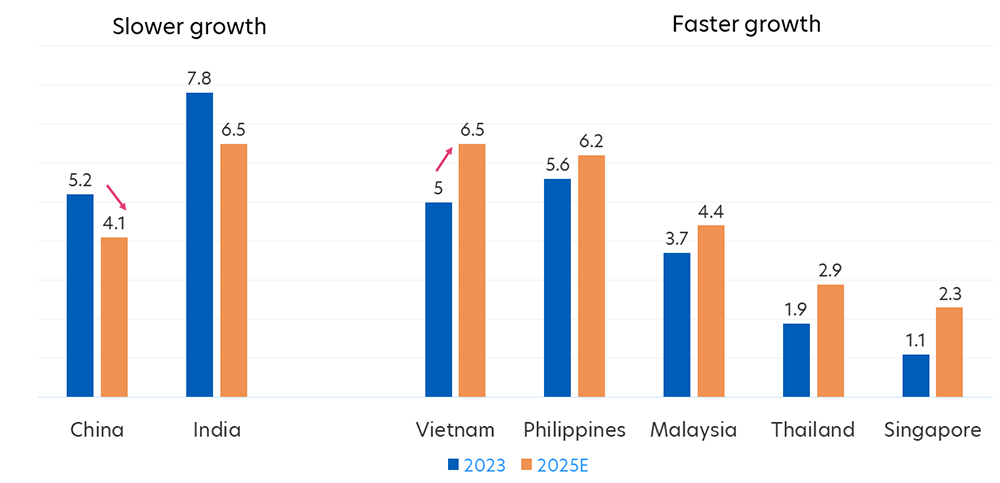

This mix of greographies and sectors reflects Asia’s future. Once powered by the economic expansion in a single country - China – the region looks set for a larger number of growth engines. The International Monetary Fund (IMF) estimates that Asia will see 4.3 percent GDP growth for 2025.

This is more than double that of the US’s 1.9 percent. But as importantly, country contributions to this growth are set to change. Compared to 2023, China and India’s growth are expected to slow, whereas ASEAN countries will see faster growth.

Figure 3: Real GDP growth (year-over-year % change), 2025E vs 2023

Source: IMF/UOBAM, April 2024

Going forward, this more evenly distributed growth profile suggests that the Asian high yield bond market will diversify further. The clearout of defaulted or distressed China property issues has brought down the default rate for Asian high yields from a high of 16.8 percent in 2022 to an estimated 4.5 percent in 2024.

In coming years, given Asia’s potentially strong economic and corporate earnings growth, the default rate should return to long term averages, especially given the reduced dominance of China real estate bonds. For example, Asian high yield default rates in the 2010 – 2019 decade prior to Covid, ranged from 0.6 to 3.1 percent.

Good entry point

These positive factors have not gone unnoticed by investors. As a result the spreads (ie the difference in yield between Asian high yield bonds and Asian investment grade bonds) have been tightening steadily since the end of 2023.

Nevertheless, compared to the US and European high yield markets, Asian spreads are still higher. Excluding China, Asian corporates are achieving better yields on their high yield bonds than similarly-rated bonds issued by US or European corporates.

This suggests that the Asian market is over the worst but remains relatively cheap and offers a good entry point for investors who do not want to take on Asian equity risk but are looking for substantially higher income than fixed deposits or T-bills. Furthermore, after this week’s Fed meeting, a September rate cut is looking even more likely, so locking in current yields has become even more urgent.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian High Yield Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z