In China’s recent stock market rally, ChiNext proved to be a standout performer. Why?

The ChiNext market, which celebrates its 15th year on 23 October 2024, received a stunning anniversary present last month. The index spiked up 67 percent over the two weeks from 23 Sept to 8 Oct 2024, double that of the more broad-based CSI 300 index.

So what lay behind this outperformance? There would appear to be several key reasons why ChiNext overshadowed the gains posted by other broad based China indices.

1. A play on China’s global strengths

Intended to be China’s answer to the Nasdaq, Shenzhen’s ChiNext market was established to attract companies engaged in the country’s “new economy” and is becoming a barometer for China’s strengths on the global stage.

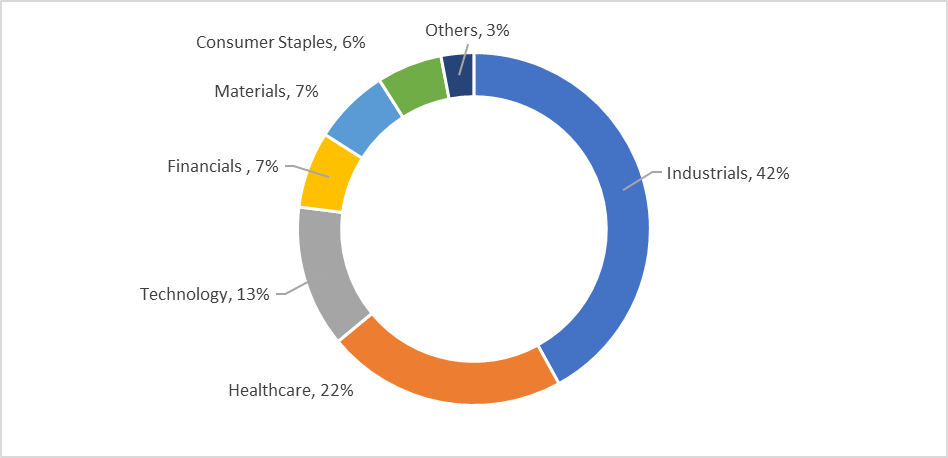

Compared to Shanghai’s STAR market, ChiNext is less focused on “hard technology” companies, and includes a large number of new-age industrial, healthcare and financial services companies. In recent years, there has been a greater tilt towards world-leading, clean energy companies, particularly in sectors such as electric vehicles (EVs), solar energy, and battery technology.

Fig 1: ChiNext sector weights as of 30 Sept 2024

Source: Shenzhen Securities Information Company Limited (“SSI”).

Not surprisingly, such companies saw some of the strongest price rises during the recent rally. Contemporary Amperex Technology (CATL) is the world’s biggest EV and energy storage battery manufacturer and rose 59 percent over the two-week rally period. It currently comprises nearly 20 percent of the index. Another company in the top-5 of the ChiNext index is Sungrow Power Supply, one of the world’s largest exporters of solar photovoltaic (PV) inverters. The stock rose 55 percent during the same two-week period.

2. A benefactor of China’s policy push

The ChiNext market also reflects many of the sectors that are the strategic importance to China and therefore likely to benefit from the policy initiatives being introduced.

For example, one such policy initiative is support for mergers and acquisitions among companies within emerging industries. This will help companies listed on secondary boards such as ChiNext and STAR to acquire more innovative assets. As a result, acquirees can convert their R&D efforts into commercial ventures, while acquirers can become more profitable. At the same time, industry segments facing over-capacity can be optimised.

Similarly, the government has promised to support bio-pharmaceutical companies by providing “end-to-end” policy support for the development of innovative drugs. This includes, for example, a five-year price stability period for newly-launched drugs to help fund R&D costs and boost company earnings. Measures to boost stock trading will also benefit many of the ChiNext-listed financial services companies.

3. A focus for passive foreign investors

Over the past few years, Developed Markets have been battling inflationary pressures and moderating growth. By investing in China, foreign investors are able to diversify their portfolios and leverage structural opportunities not available in their home markets. And yet, many were dissuaded from doing so because of the country’s ongoing property woes.

China’s announcement of large-scale stimulus measures was an impetus for foreign investors to increase their China exposure, but many opted for more targeted, passive channels. As a result, EPFR estimates that between September 19 and 25 2024, foreign investors contributed a net inflow of US$1.8 billion into Chinese equities via passive instruments like ETFs (exchange traded funds).

ChiNext and STAR 50 ETFs gained disproportionately because they offer an easy and transparent way to invest in China’s future-ready industries, while avoiding problematic sectors such as property.

4. A way to buy China at reasonable valuations

Despite the recent run-up, ChiNext remains attractively valued relative to its history, and is still less than 20 percent of its 10-year high. It is also considerably less expensive than the STAR 50 index. This is because the latter consists of the 50 largest-cap securities listed on the Shanghai Stock Exchange’s (SSE) Science and Technology Innovation Board.

Fig 2: Valuation of select China indices

|

Index |

Price Earning ratio* |

10-Year Historical Percentile |

|

STAR 50 |

69.44 |

71.19% |

|

ChiNext |

34.60 |

18.59% |

|

CSI 300 |

12.97 |

59.88% |

|

SSE 50 |

11.06 |

75.15% |

*based on trailing twelve months price-earnings ratio as of 9 Oct 2024. Source: Ping An Asset Management

As such, technology companies make up about two thirds of the STAR 50 index, compared to only one quarter of the ChiNext index. Tech stocks usually have a higher PE because they are expected to show strong earnings growth, but this can also mean high price volatility. ChiNext’s PE sits in between the STAR 50 and more broad-based indices such as the CSI 300 and SSE 50. All three are relatively closer to their 10-year highs.

What next for ChiNext?

ChiNext ETFs have shown their ability to outperform in an environment of positive-China sentiment. However, analysts are still waiting to see the impact of the recent stimulus on China’s real economy, and in particular, whether the property downturn can be sustainably addressed.

Other near-term headwinds include an escalation of US-China trade tensions and lower-than-expected full-year GDP growth. Should these risks materialise, the ChiNext index could experience more downside than the broader China indices. However, the availability of ChiNext ETFs and their recent gains suggest growing interest from institutional investors, which should help to dampen down future price volatilities.

UOBAM Ping An ChiNext ETF

Why Invest?

Accessibility

Gain access to the ChiNext Market, which is less accessible to foreign retail investors

Currency options

Trades are available in both Singapore Dollar (SGD) and United States Dollar (USD)

Supplementary Retirement

Supplementary Retirement Scheme (SRS) compatible

Invest using cash and/or your SRS account

No minimum board lot size

Tradeable on the Singapore Stock Exchange (SGX) from 1 unit per trade order

Excluded Investment Product (EIP)

Does not require the fulfilment of the Customer Account Review (CAR) criteria to trade

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management fund to consider: UOBAM Ping An ChiNext ETF

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z