The world is waiting for the Fed to kick off its rate-cut cycle, expected later this month. In the second of our series looking at the impact on Asian assets, we look at the bond sectors that stand to benefit the most

- We favour Asian credits over government bonds given the potential for further spread compression.

- Asian high yield spreads still have room to compress compared to the segment’s long term average.

- Easing of US interest rates is expected to be especially beneficial for Asian frontier markets.

Having raised interest rates eleven times since March 2022 in order to curb soaring inflation, the Fed looks set to change gears and start cutting rates at its September meeting.

Asian central banks are closely watching the Fed and many are likely to follow suit. So what can Asian bond-holders expect from a lower rate environment? And which Asian bond sectors are expected to excel?

We ask Asia fixed income portfolio manager Melvin Chan to share his outlook for Asian bonds in the coming months.

1. What is the likely impact on Asian credits (corporate bonds) of a rate-cutting cycle in the US and Asia over the next 2 years?

A rate cutting cycle benefits Asian credits for various reasons. Firstly, a rate cut benefits bond prices directly, especially longer duration investment grade bonds. This is because bond prices move inversely to interest rates.

Secondly, as rates taper off, corporate fundamentals – especially for bonds in the riskier segment of the investment grade and high yield universe – are also likely to improve. As refinancing costs decline, cash flows will tend to improve and balance sheets become stronger. This eventually leads to spread compression, which is positive for bond prices.

2. What are the average Asian corporate bond spreads that you are expecting?

The JP Morgan Asia Credit Index (JACI) tells us that the Asia high yield credit spread is around 793 basis points (bps), still higher than the long-term average of 600 bps. Although the current spread has come down from its high of over 1400 bps at the height of China’s property crisis in 2022, we think that high yield bonds offer room for further spread compression as Asian economies continue to improve.

On the other hand, the JACI investment grade credit spread is around 153 bps, which is below the long-term average of 171bps. Investment grade credit spreads are at the tightest they have been historically, and we do not expect spreads to tighten much further at this level. Thus, the catalyst for any further investment grade upside will likely come from the movement in interest rates.

3. Should investors be seeking to lengthen duration?

In general, lengthening duration amid rate cut expectations can benefit an investor’s portfolio. However, timing is key. At this time, the market expects eight rate cuts through to end-2025. Reflecting the high probability of rate cuts, US 10-Year Treasuries have fallen from 4.3 percent in July to 3.9 percent currently. But should rate cuts not materialise as expected, yields could climb and bond prices could come off in the near term.

As a result, we think that it is important for investors to look at their investment time horizon. Given that interest rates are expected to fall and stay relatively low for several years, investors with a longer investment timeframe can opt to lengthen duration and ignore short term volatility. However, investors with a shorter investment timeframe may want to match their bond duration to their investment horizon.

Investors can also choose to invest in bond funds. Short maturity bond funds invest in shorter duration bonds and can provide good price stability. But investors may want to consider some exposure to longer maturity funds as these provide greater returns potential especially in a falling rate environment.

4. Which specific sectors do you expect to benefit the most/least from the fall in interest rates?

We expect sectors such as Consumers, Industrials, Technology and Real Estate to benefit the most from rate cuts. Financials including banks, insurance, brokerage and money managers are likely to benefit the least as their margins may be negatively affected.

That said, these are just generalisations because a lower interest rate will also reduce the price of non-performing assets. The key is to watch how individual companies navigate this impending period of lower rates.

5. Which geographic markets do you expect to benefit the most/least from the fall in interest rates?

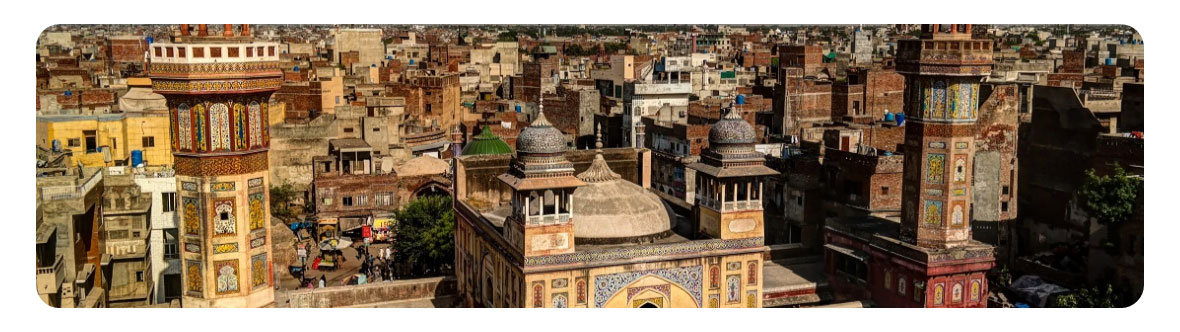

We expect the frontier markets to benefit the most from a fall in interest rates. These include Pakistan, Sri Lanka and Mongolia. Countries such as China, India and Indonesia are also set to benefit as they will likely to follow in the US Fed’s footsteps and cut their rates to support growth.

Conversely, some countries notably Malaysia and Taiwan did not increase rates aggressively during their tightening cycles. As such, they may keep their local rates at current levels rather than ease in line with the US. There are also countries such as Japan and Vietnam which are expected to hike rather than lower rates in the near future. These markets may also not benefit from the fall in global interest rates.

Finally, it is also important to consider the currency impact. In general, while a US rate cut can help Emerging Market countries to repay their USD debt, it can also cause their local currencies to appreciate. This would in turn mean losing some of their competitive advantage in the export market.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United SGD Fund

United Asian High Yield Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z