The Singapore equities market is enjoying a strong start to 2025, helped by easing inflation, a stable SGD and promises to review current IPO rules

Low Soo Fang

Portfolio Manager, Asia equities

- The market reached a new high in the wake of the Singapore budget

- An improved inflation outlook is helping to stabilise the SGD and encourage fund inflows

- Several prevailing themes favour the telecommunication, utility, industrial and real estate sectors

Record market high amid growth-friendly budget

Singapore’s budget announcement this week resulted in the Straits Times Index (STI) closing the day at an all-time high of 3,924. The budget announcement included vouchers and rebates that are likely to benefit the retail consumer sector, as well as longer term investments in key industries such as semiconductors, aviation and energy security. There were also policy initiatives aimed at boosting the domestic equities market and enhancing the Singapore real estate investment trusts (SREITs) sector via extension of tax concessions.

All in all, this was a growth, consumer and market-friendly budget amid Prime Minister Lawrence Wong’s warnings about pressures that could reshape the world economy and potentially dampen Singapore’s growth.

That said, the Singapore market’s good performance this year is not just due to budget expectations. It has been powering ahead since 2H 2024, although this had largely gone unnoticed, with the US and China tending to dominate headlines last year. Without much fanfare, the STI closed the year up by 23.5 percent, compared to 19.6 percent for China’s CSI 300 index and 14 percent for the US’s Dow Jones Industrial Average (DJIA).

Better inflation outlook, attractive valuations

So what has been driving this investor optimism? Arguably, a turning point came following the announcement that 3Q 2024 gross domestic product (GDP) had accelerated to 4.1% year-on-year, considerably higher than 2Q’s 2.9 percent. At the same time, it appeared that Singapore’s inflation had peaked. In December, the Monetary Authority of Singapore (MAS) revised down its core inflation forecast for 2025 to 1.5 – 2.5 percent, from its previous prediction of 2.5 – 3.0 percent.

The positive inflation outlook helped reassure investors that the MAS is unlikely to tighten its monetary policies any further, leading to a more stable SGD. This in turn increases the potential for more foreign direct investments (FDIs) and fund inflows in 2025, especially following a period of net outflows from September to November last year. Investors are also hoping that if the inflation numbers improve further, the MAS will have room to start easing should growth indeed start to weaken.

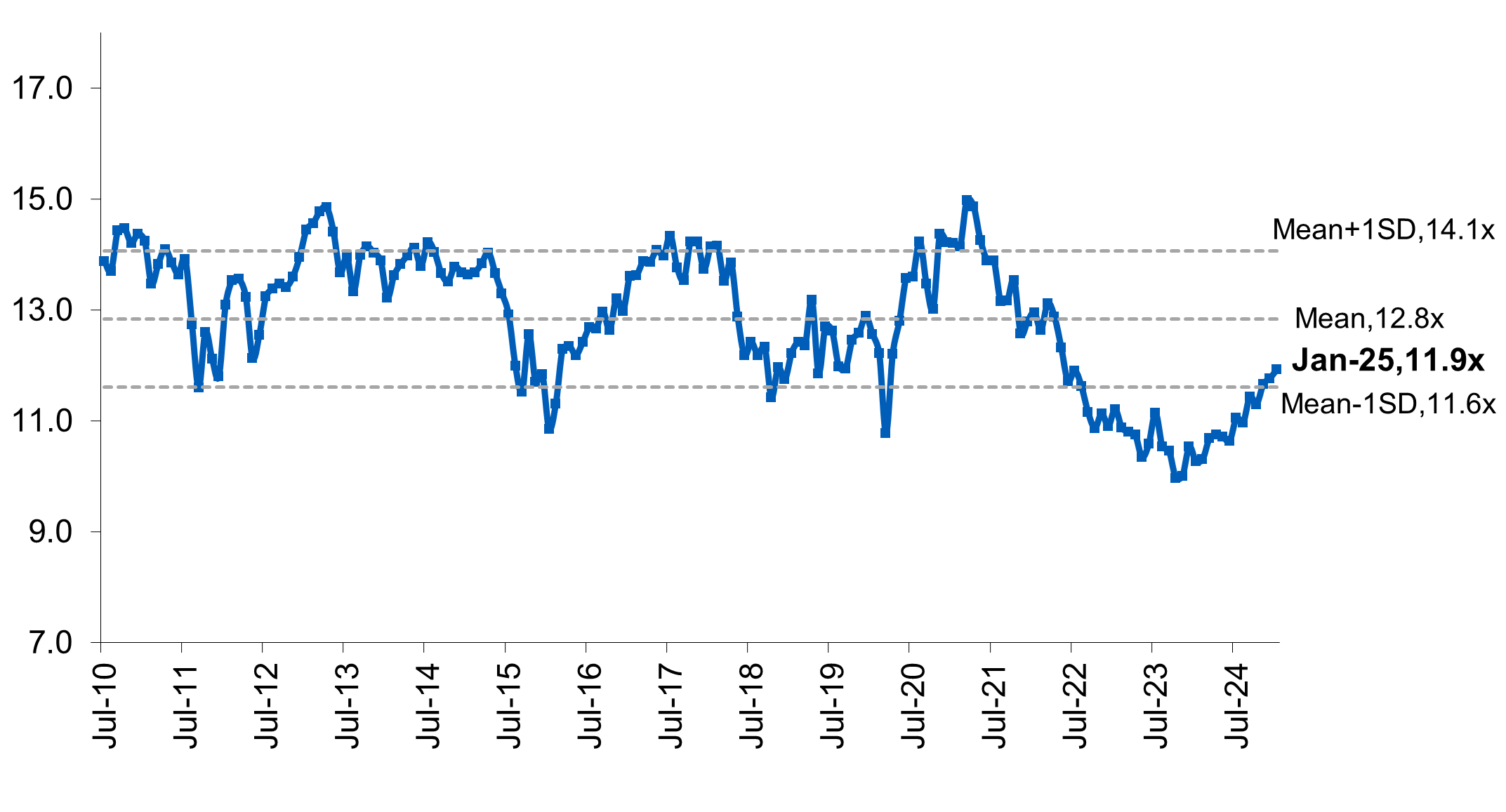

In addition, like many Asian markets, the Singapore market has underperformed over the past few years. Based on its Forward PE Ratio, the STI was more than one standard deviation below its long term mean in 2023. Although this is slowly recovering, STI valuations remain attractive, and has prompted foreign investors to reassess the market’s upside potential. The government has also responded to calls to rejuvenate the stock market given its diminished market capitalisation and trading volumes. Potential enhancements include measures to incentivise IPO issuers and lower listing costs.

Fig 1: Straits Times Index (STI) 12-month forward PE Ratio

Source: Factset Market Aggregate, January 2025

Upcoming themes

Over the next few years, we see a few key themes taking root in the Singapore market.

China + 1

Multinationals look set to deepen their trade diversification strategies as US-China trade tariff threats escalate. Given Singapore’s efficient supply chain and proximity to China and other Asian/ASEAN markets, plus its limited foreign investment restrictions, and political stability, it could become a prime destination for companies seeking China alternatives. Potential beneficiaries include the tech/semiconductor, industrial, real estate, and financial sectors.

Johor – Singapore Special Economic Zone (J-S SEZ)

Loosely modelled after the Shenzhen-HK SEZ, the J-S SEZ agreement signed on 7 January 2025 is expected to enable both countries to undertake up to 100 new business and investment projects over the next decade. The 4km-long RTS (Rapid Transit System), expected to be completed by end-2026, should also help improve connectivity between Singapore and Malaysia, Sectors targeted include the electronics, financial services, business-related services, and healthcare sectors.

Renewable Energy

Singapore targets to grow its total renewable energy (RE) capacity from around 1GW in 2023 to 4GW by 2035. This is in line with its long-term target to achieve net zero emissions by 2050. Under the Singapore Green Plan, solar capacity is expected to increase from 1,170 MWp to 2GW by end-2030, with ASEAN set to be the primary supplier of RE resources such as hydro and wind power. Potential beneficiaries include the utilities, industrial and communication services sectors.

Singapore Equity – Value-up

The MAS Equity Market Review, targeted to be completed by August 2025, aims to address the low trading valuations and low total market capitalisation of companies listed on the Singapore Exchange (SGX). Three areas of focus have been identified, that is, initiatives to encourage quality listings, improve liquidity and re-evaluate regulatory structures, and the government says it is prepared to make “bold changes” once the tradeoffs have been assessed. Potential beneficiaries include the real estate and mid-cap REITs, financial, industrial and communication services sectors.

|

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management fund to consider:

|

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z