- ASEAN markets face near term headwinds from a strong USD and Trump’s trade tariffs

- However, ASEAN markets are likely to be more resilient relative to Emerging Markets given valuation support and low foreign investor participation

- Over the medium to long term, ‘China-plus-one’ strategies and rising domestic consumption can help offset tariff fears

On 20 January, Trump will enter the White House as the US’s 47th president, based on a campaign promise to impose tariffs on all imports by 10 – 20 percent. Since his election, he has double-downed on these promises, saying that he would immediately put in place 25 percent tariffs on Canada and Mexico, and increase already stringent tariffs on China.

While the potential impact of these actions on China is now being widely examined, there is far less discussion about the rest of Asia, and specifically ASEAN. Yet, as Francis Eng, UOBAM’s Head of ASEAN Equities explains, ASEAN markets could be more resilient to US tariffs under Trump 2.0 than during Trump 1.0.

What happened to ASEAN stock markets under Trump 1.0?

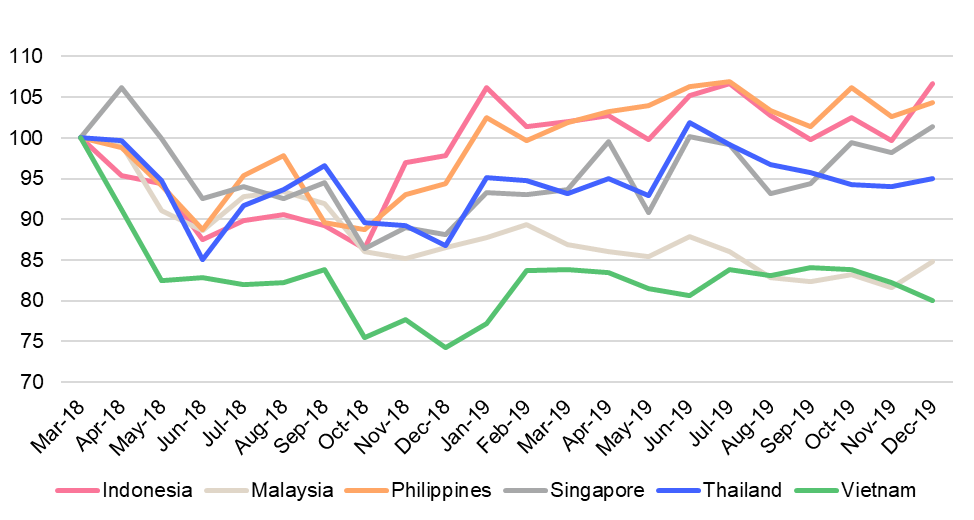

Francis: Donald Trump’s first term as president lasted from 2017 to 2021. Starting in 2018, he introduced tariffs, which covered over half of all Chinese exports to the US. Within ASEAN, Vietnam was worst hit, with 8 percent of its exports covered. Following the tariffs, ASEAN markets weakened and the laggard was Vietnam, which fell by about 20 percent from March 2018 to December 2019.

Fig 1: ASEAN equity market performance by country: Mar 2018 – Dec 2019

Source: Bloomberg/UOBAM. Chart shows MSCI countries performance in USD.

However, the tariffs from US-China trade war resulted in supply chain shifts that benefited ASEAN, including Vietnam. Eventually, the Vietnam equity market recovered as these investments helped to lift the economy.

What is the likely impact on ASEAN stock markets under Trump 2.0?

Trump’s policies on tariffs and immigration have the potential to be inflationary for the US economy. Market expectations for rate cuts in the US for 2025 have been dialed down and this has resulted in strength for the USD relative to other currencies. The near-term strength in the USD is a headwind to the performance of Emerging Market equities and ASEAN.

However, over the medium to long term, ASEAN remains a beneficiary of multinationals’ China Plus One strategies. Multinationals are locating their manufacturing bases beyond China both as a way to diversify their production, and to deal with tariffs on China.

These supply chain shifts have already greatly increased foreign direct investments (FDIs) into ASEAN, with the growth rate from 2015 – 2023 reaching 10.7 percent (compared to just 6.9 percent in the previous decade). Based on forecasts by the ASEAN Secretariat and UNCTAD, ASEAN FDI is set to grow from US$230 billion in 2023 to US$300 billion by 2030. In the long term, increased US tariffs on China exports could reinforce this secular trend.

What is your outlook for ASEAN equity markets?

The strong USD that we are seeing currently is set to dampen ASEAN market sentiment over the next few months. However, I see some mitigating factors for ASEAN markets including comparatively lower positioning by foreign investors than during Trump 1.0, and investors are better prepared. I think some investors see the tariff announcements as a bargaining chip rather than an immovable directive.

Additionally, foreign investors currently have considerably smaller positions in ASEAN capital markets than during Trump’s first term. According to some estimates, foreign portfolios have as much as US$30 billion less in ASEAN equities than at the start of 2017. This suggests that in the coming period, the region is less susceptible to selling pressure by foreign portfolio investors when fears are elevated.

Despite lower foreign investor participation, ASEAN markets fared well in 2024 with the MSCI ASEAN index gaining 11.6 percent in SGD terms, in line with the earnings growth for ASEAN corporates. However, ASEAN markets are still trading below mean valuations. With corporate earnings forecasts in the high single digits for 2025, we see support for ASEAN markets despite headwinds from tariff uncertainties.

Where are the most promising investment opportunities in ASEAN markets?

It is useful to note that ASEAN-listed companies tend to have only a very small direct exposure to China. Collectively, this exposure is estimated to be less than 5 percent.

Nevertheless, my preference is for ASEAN sectors that are more domestically focused, including banks, consumer and telecommunication companies. This coincides with the fact that domestic-centric sectors tend to dominate in ASEAN markets. For example, the financial sector alone comprises around 40 percent of the MSCI ASEAN index.

Going forward, some of the investment opportunities that we favour within ASEAN include:

- Telecoms – consolidation within the Indonesia wireless market is potentially positive for profitability.

- Healthcare – hospitals are set to benefit from the region’s rising affluence and the ageing population in countries such as Singapore and Thailand.

- Manufacturing – ASEAN manufacturers especially tech-related entities and those directly competing with China. Malaysian glovemakers, for example, are expected to benefit from increased US tariffs on Chinese competitors

- Consumer – ecommerce platforms are seeing strong profit momentum and are proxies for ASEAN’s growing consumption trends

Where are the risks?

Investors need to monitor portfolio outflows from the region due to USD strength and the impact of potential tariffs on Asia, particularly China. It is hard at this point to predict what trade barriers the Trump administration is prepared to impose, and how this could be adjusted down the line.

Nevertheless, we believe that any market shocks could be milder than during Trump 1.0. Within ASEAN, only Vietnam has a significant trade surplus with the US.

Francis has more than 27 years of investment experience, encompassing fund management and equities research. He joined UOB Asset Management (Malaysia) in 2007 as a portfolio manager and has assumed the role of Chief Investment Officer since 2010. Under his leadership, the investment team has achieved numerous accolades, including awards from Lipper, Morningstar, AsianInvestor, International Finance, and Asia Asset Management. Francis has been instrumental in developing the institutional business franchise for UOB Asset Management (Malaysia). In 2023, he expanded his responsibilities to serve as Head of ASEAN Equities.

Before UOBAM(M), Francis was a senior analyst at a foreign securities firm, where he contributed to equity research teams consistently ranked among the best by Greenwich Associates and Asiamoney.

He holds a Bachelor of Economics from Macquarie University, with a double major in actuarial studies and finance.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asia Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z