- The China market is weathering the US tariff storm, with YTD returns down just 1.6 percent

- There are several economic and market silver linings for China arising from the tariffs

- Select investment opportunities remain, especially within the A-shares market

Chong Jiun Yeh

Group Chief Investment Officer

China market is staying the course

In yet another policy turnaround, late last week President Trump announced a retroactive exemption for select electronic imports entering the US.

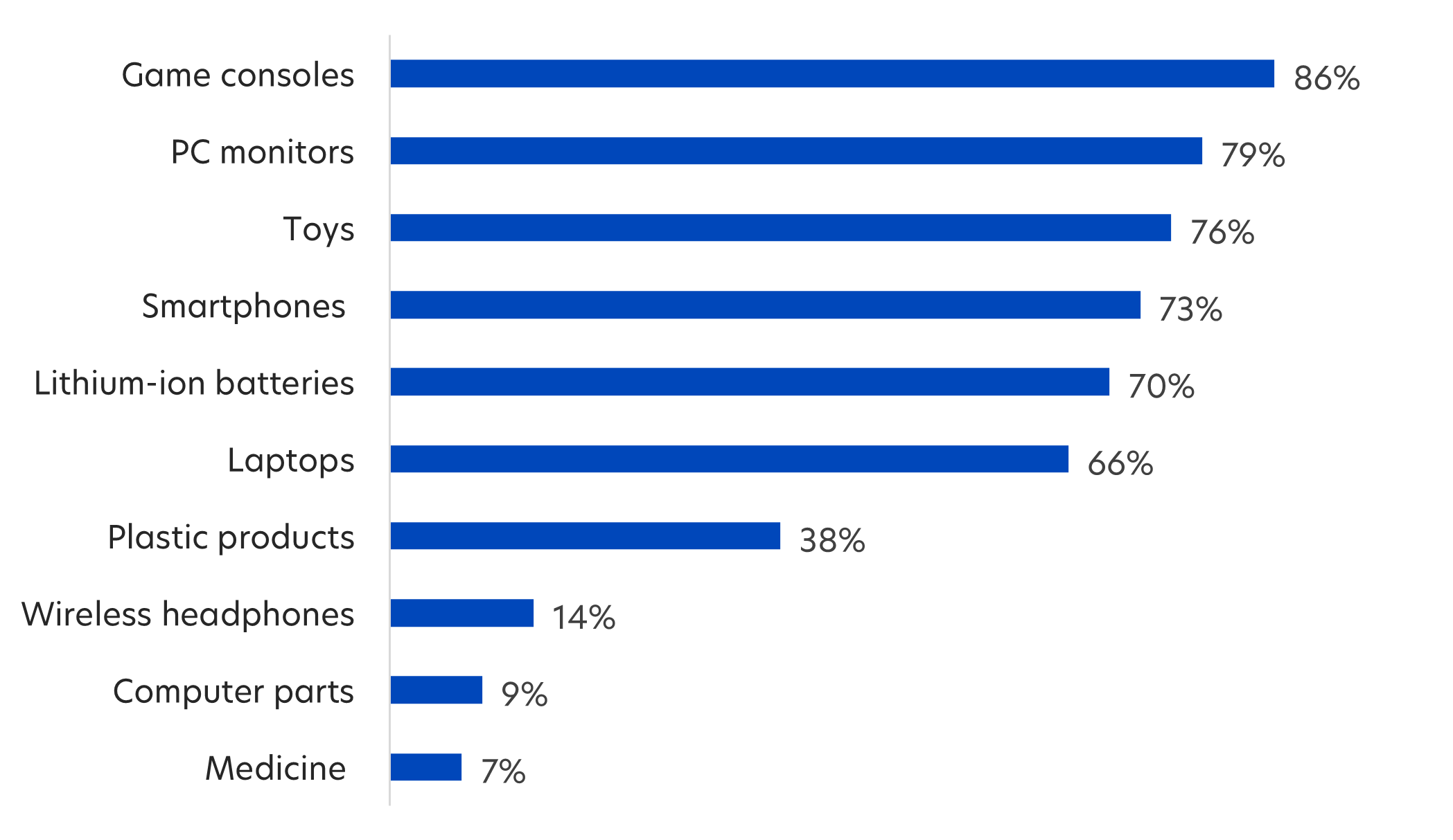

China investors cheered this as a partial cooling of the US-China trade war, but it also perhaps represents an acknowledgement of the US’s dependence on China imports. China’s share of US imports when it comes to such key electronic goods as PC monitors, smartphones and laptops is overwhelming, and finding alternative suppliers for these goods in the short term would have proven very difficult.

Fig 1: China’s share of select US imports (by value) in 2024

Source: US International Trade Commission, UOBAM

This relaxation is also a win for China. It is estimated that the exemptions cover somewhere between 15 - 25 percent of China’s exports to the US.

To date, and despite the many remaining tariff uncertainties, China’s equity market continues to display surprising resilience. The CSI300 index is up by around 4 percent for the week and is down just 1.6 percent year-to-date.

Analysts are detecting some weariness among investors to the US’s on-again, off-again tariffs. Warnings this week by the Trump team that new semiconductor and smartphone tariffs are due to be announced “in a month or two” seem not to have provoked much of a reaction.

In addition, a group of state-backed “National Team” investors, including Central Huijin Investment and China Securities Finance Corp, have been tasked to stabilise the China market during periods of market turbulence. This may have further helped to limit the market’s downside.

Tariff-induced opportunities

Looking ahead, China cannot escape unscathed from its trade war with the US. However, there are some silver linings emerging:

1. Intense focus on the domestic sector

As a result of tariffs imposed by Trump during his first term in office, China has learnt to grow its economy while reducing its exports to the US.

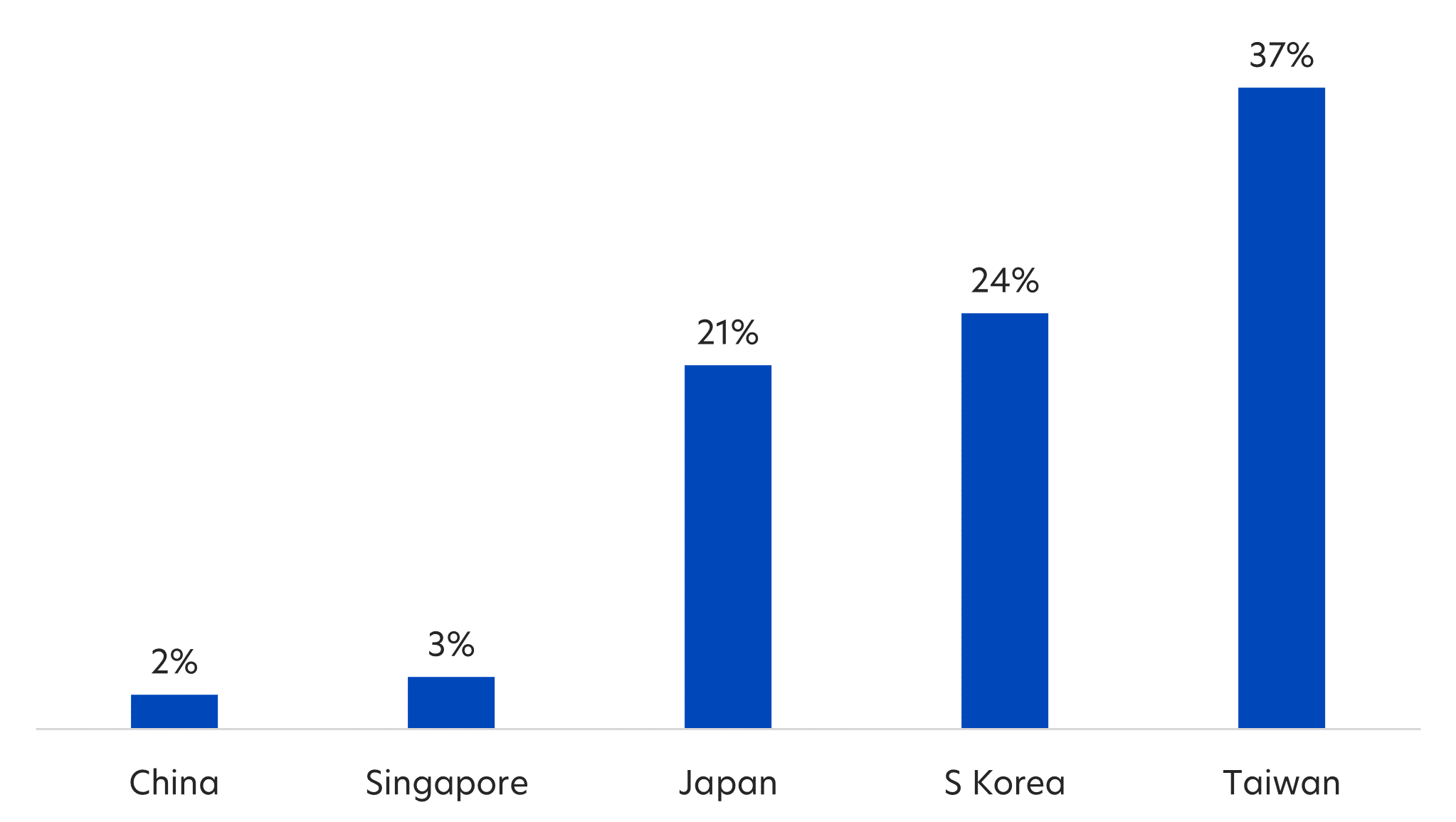

In 2024, the US accounted for less than 15 percent of China’s exports and only 2 percent of MSCI China companies’ revenue exposure. This is in stark contrast to other Asian countries. Over a third of Taiwanese companies’ revenues are derived from the US.

Fig 2: US revenue exposure (MSCI markets)

Source: Factset, MSCI, Goldman Sachs Global Investment Research, UOBAM

In fact, of the total revenues generated by MSCI China companies, only 13 percent are from overseas. The vast majority of revenues come from sales to the local population and amid current trade restrictions, such trends are expected to deepen considerably.

While China’s economy has been slowly turning towards domestic consumption as a primary growth driver, Trump’s policies appear to be greatly accelerating this structural shift.

2. Reshaping of trading relationships

It has been suggested, whatever the tariff policy that is eventually imposed by the US, that the genie is now out of the bottle. Going forward, countries and companies will be keen to end any over-reliance on the US within their manufacturing supply chain.

For example, back in October 2024, the EU imposed additional tariffs ranging from 17 – 35 percent on China-made electric vehicles (EVs). Designed to last five years, the EU has had a quick rethink in response to Trump tariffs, and are seeking a minimum price agreement with China instead. Analysts believe this is a big step towards greater EU-China collaboration and greater China manufacturing investment in the EU.

It is not just economics but also geo-politics that could drive countries into China’s arms. Asia and Latin America are key geo-political battlegrounds for the US and China. With Trump having ceased much of its foreign aid and set to withdraw from multilateral organisations, China is expected to increasingly fill the vacuum, especially given its long history of belt and road initiatives.

A more vibrant capital market

While not a new threat, the current trade disputes between China and the US could solidify US plans to delist Chinese companies from US exchanges. As a result, American Depository Receipts (ADRs) of Chinese firms have seen significant sell-downs this year.

However, many analysts do not see the potential de-listings as a negative development. Most of these firms have already relisted or dual-listed in Hong Kong, Shanghai or Shenzhen, or have plans to do so.

Going back to the 1990s, many innovative Chinese start-ups preferred to list in the US as means of quicker global recognition and growth. Local Chinese/Hong Kong listing rules were also more prohibitive. This has changed significantly in the last decade, both within the mainboards and newly-created Nasdaq-lookalikes such as Shanghai’s Star Board and Shenzhen’s ChiNext Board.

China has long sought to open its capital markets to foreign investors and the migration of Chinese companies back to Hong Kong or China exchanges could help boost their attractiveness. There are currently over 100 Chinese companies that are not dual listed. These ADRs have a total market cap of US$130 billion, including a few big names such as Pinduoduo and Futu. Their potential US de-listings and China re-listings are yet another unintended consequence of the current US-China trade war.

What does this mean for investors?

- In the short term, China faces challenges not just from the direct imposition of US tariffs, but also from the indirect impact on global trading volumes, growth and company earnings. As a result, we have shifted from an overweight to a neutral position on Chinese equities within our global portfolios.

- That said, we remain positive on selective China tech and consumer related stocks in the medium to long term. We believe that these sectors will benefit from China’s structural growth trends and remain profitable, even in the midst of a US-China trade war.

- As such, we favour China A-shares rather than H-shares, supported by the National Team’s statement that it is “firmly optimistic about the development prospects of China's capital market and fully recognises the current investment value of A-shares."

As Group Chief Investment Officer of UOB Asset Management (UOBAM), Jiun Yeh leads the investment team in developing UOBAM's long-term investment strategy and in managing asset allocation with the objective to maximise the value of investments in assets for our investors. He has oversight for the teams managing Equities, Fixed Income, Multi-Asset, including spearheading the firm’s strategic thrusts in sustainable investing and investment technology.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: UOBAM FTSE China A50 Index ETF

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120