- The China market has seen some profit taking since its recent rally

- However, China’s economic fundamentals have stabilised

- As a result, investor sentiment on China may have bottomed

China market up but still volatile

China’s stock market rallied in April and early May. The CSI 300 index is up by about 12 percent since its February low, and about 5 percent since the start of the year. However, it remains almost 40 percent below its 2021 high amid concerns about its property sector and US anti-China policies.

Investors are wondering whether this latest upturn is just another flash in the pan, but it seems likely that the China market has troughed. Despite ongoing volatility, here are three reasons to think that the market is on course to trend higher in coming months.

Deep discounts on China stocks

One of the most important factors driving foreign interest in Chinese stocks is their low valuations relative to peers. The China market’s price to earnings ratio (PER) is currently the lowest in the region, despite its relatively strong earnings growth potential and many Chinese companies’ global status. Looking ahead, it is hard to justify why the market would continue to trade at a 25 percent discount to the regional average, and more than 50 percent discount to India. Such deep discounts appear unsustainable over the longer term.

Figure 1: MSCI Asia ex Japan country valuation estimates as of 24 May 2024

| Market | 2024E PER (x) | 2024E Earnings growth (%) |

| China | 10.7 | 14.1 |

| Singapore | 12.4 | 10.8 |

| Taiwan | 19.8 | 21.1 |

| India | 24.3 | 18.0 |

| Asia ex Japan | 14.1 | 21.5 |

Source: Bloomberg/UOBAM

Trade and manufacturing recovery

China’s 1Q GDP, at 5.3 percent year-on-year and 1.6 percent quarter-on-quarter, suggests a gradual and steady improvement. While this is below growth rates seen in the pre-Covid years, it is substantially higher than that experienced by developed economies - 1.3 percent for the US and 0.4 percent for the Euro Area over the same period. China’s GDP growth has been driven by exports, higher industrial profits and new energy-related manufacturing activities. Consumer spending is yet to recover fully and when it does so, should help to further boost growth.

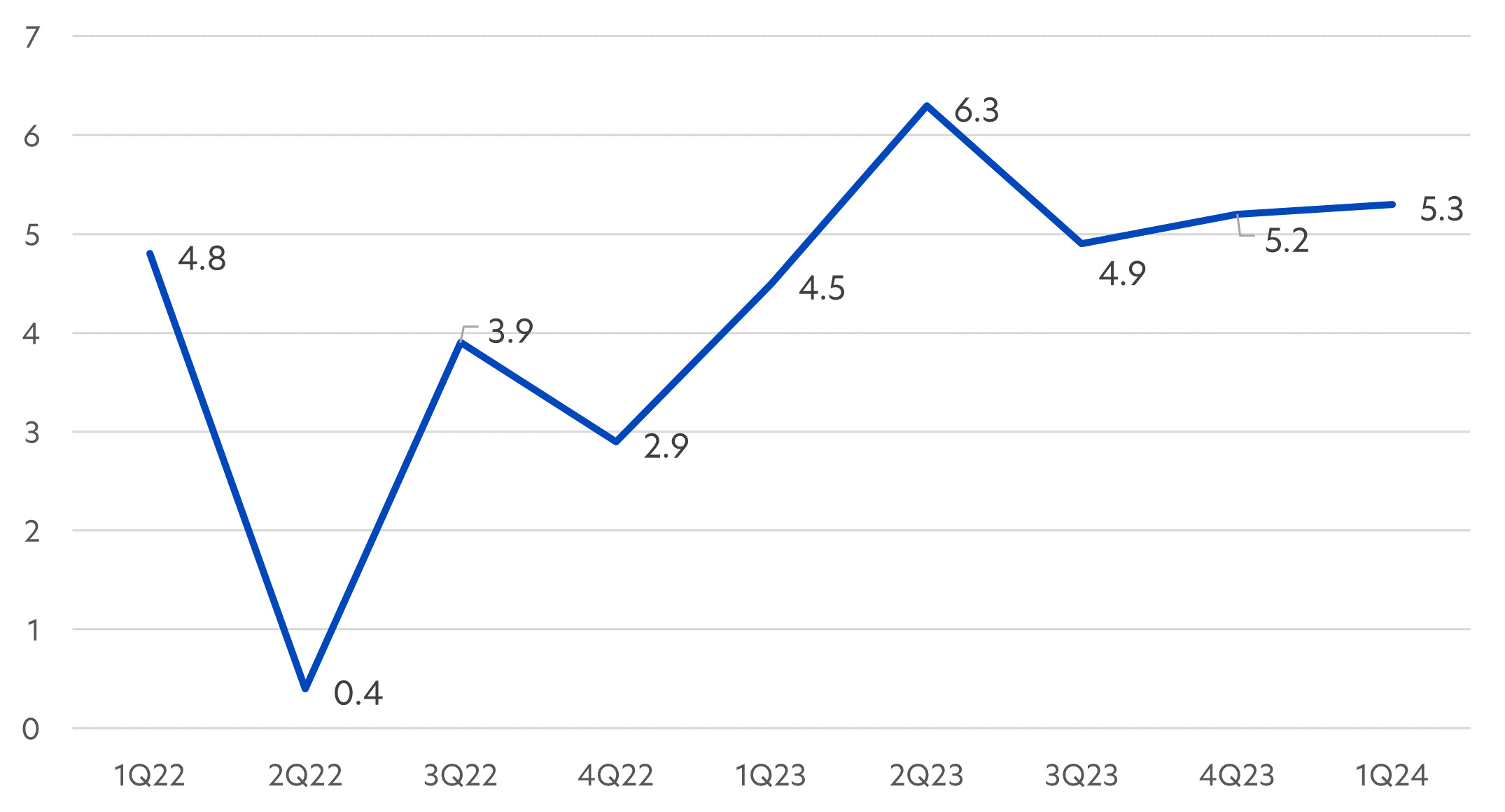

Figure 2: China GDP year-on-year growth (%)

Source: National Bureau of Statistics of China

Policies to limit stock price weakness

In February, the Chinese government took steps to reduce market drawdowns via the injection of funds from state-backed institutions referred to as the “National Team”. These institutions, including China’s sovereign wealth fund, have purchased exchange traded funds (ETFs) to the tune of US$57 billion, according to UBS estimates. These actions are not expected to directly boost the stock market over the long term, but seem to be helping put a floor under stock prices. They also indicate to investors that the Chinese authorities are committed to stabilising the market and restoring confidence.

Housing crisis still unresolved

On the other hand, as we have stressed previously, China’s market volatility looks set to continue for as long as its property sector remains under pressure. Last month, a number of “historic” new policies were launched to address the property market. These included a lowering of minimum downpayment ratios, abolition of mortgage rate floors for first and second homes, and more support for local state-owned enterprises (SOE) purchases of commercial homes.

However, analysts suggest that these measures still do not go far enough. Crucial for ending the crisis, say the IMF, is the deployment of resources to help those who have purchased unfinished homes, thereby facilitating the exit of debt-ridden developers from the property market. This is already ongoing under the 保交楼 initiative, but many are hoping for further acceleration. We believe there is potential for select China stocks to rise further, but investors should not expect a smooth ride.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Greater China Fund

Awarded Best Fund over 3 Years and 5 Years (Equity Greater China) at LSEG Lipper Fund Awards You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z