- Firmer odds of two rate cuts this year, the first likely to be in September

- To lock in higher yields, investors are flocking to corporate bonds

- The outlook remains positive for this sector, despite tight spreads

Not too hot, not too cold

US Treasury yields have fallen as expectations of a US rate cut in September grow ever stronger. Last week, 10-year Treasury bond yields closed at 4.3 percent, down from the post-Covid high of 4.9 percent reached in October 2023.

This fall seems to be the result of a slew of “good” economic news - from the Fed’s point of view. For the Fed, “good” is not what you might think. Rather, it means somewhere between a “too hot” economy, which risks higher inflation, and a “too cool” economy, which risks a recession.

At present, all signs point to the US economy slowing but not too much. The rate of consumer spending has halved from a year ago, wages have fallen and the labour market is softening at the edges. Despite this, GDP growth forecasts remain positive. This is what the Fed had hoped to see, and last week’s comments from Fed Chairman Jerome Powell suggest that the US interest rate cycle is back on track, with two 0.25 percent cuts this year starting in September.

Rate environment favours bonds

The impact on bond returns is two-fold. Firstly, as seen this week, bond yields are already softening in anticipation of lower interest rates. However, the floor remains relatively high as ongoing inflation worries will likely prevent the Fed from cutting rates too quickly or too drastically. If, as assumed by US policymakers, interest rates fall to 4.1 percent by end-2025, this would still be much higher than the 0.25 – 2.5 percent range seen in the five years preceding Covid.

Secondly, bond prices move up when interest rates fall. This is because in such environments, existing bonds have locked in higher yields compared to newly-issued bonds so they attract higher demand. As such, investors can expect to see rising bond prices and higher returns for corporate bond funds in the lead up to rate cuts.

Corporate bonds see strong investor interest

The bond story is compelling for government bonds, but even more so for corporate bonds. This is due to a third factor – corporate earnings. Corporate earnings globally are forecast to see healthy growth in 2024 and 2025. US earnings growth is forecast to hit double digits and the numbers are even more impressive in Asia.

Fig 1: Earnings (EPS) annual growth (%) by country/region

| Region/Country | 2024E | 2025E |

| US | 11.1 | 14.1 |

| Europe | 3.9 | 10.3 |

| Japan | 11.4 | 7.9 |

| Asia ex Japan | 20.6 | 15.5 |

| China | 12.3 | 12.8 |

Source: Factset/UOBAM, 15 May, 2024

This strong earnings potential means corporations are less likely to default on their debt, and Investment Grade (IG) corporate bonds are less likely to fall into the High Yield (HY) bond category. The combination of potentially good earnings, rising bond prices and attractive yields has awakened investor interest in the corporate bond sector.

US bond fund flows turned positive in December 2022 and the first three months of 2024 saw US$23 billion flowing into bond funds. However, anticipation of interest rate cuts have stoked the fervour. In May alone, bond funds saw inflows of US$29 billion, the majority into IG corporate bond funds. This was up strongly from April’s US$19 billion1. Similarly in Singapore, the first quarter of the year saw inflows of S$3.0 billion to fixed income funds, a 58 percent increase over the previous quarter2.

Tight spreads, but still attractive yields

Part of corporate bonds’ appeal is their ability to pay a step up in yields compared to government bonds (commonly known as corporate bond spreads) due to their higher risk premium. For example, in March 2022, IG corporate bond yields were 1.9 percent above Treasuries.

Given the strong demand, spreads have narrowed substantially over the past two years. Nevertheless, IG corporate bond yields remain about 1.0 percent higher than Treasuries, an attractive proposition at a time when Treasury yields are on their way down.

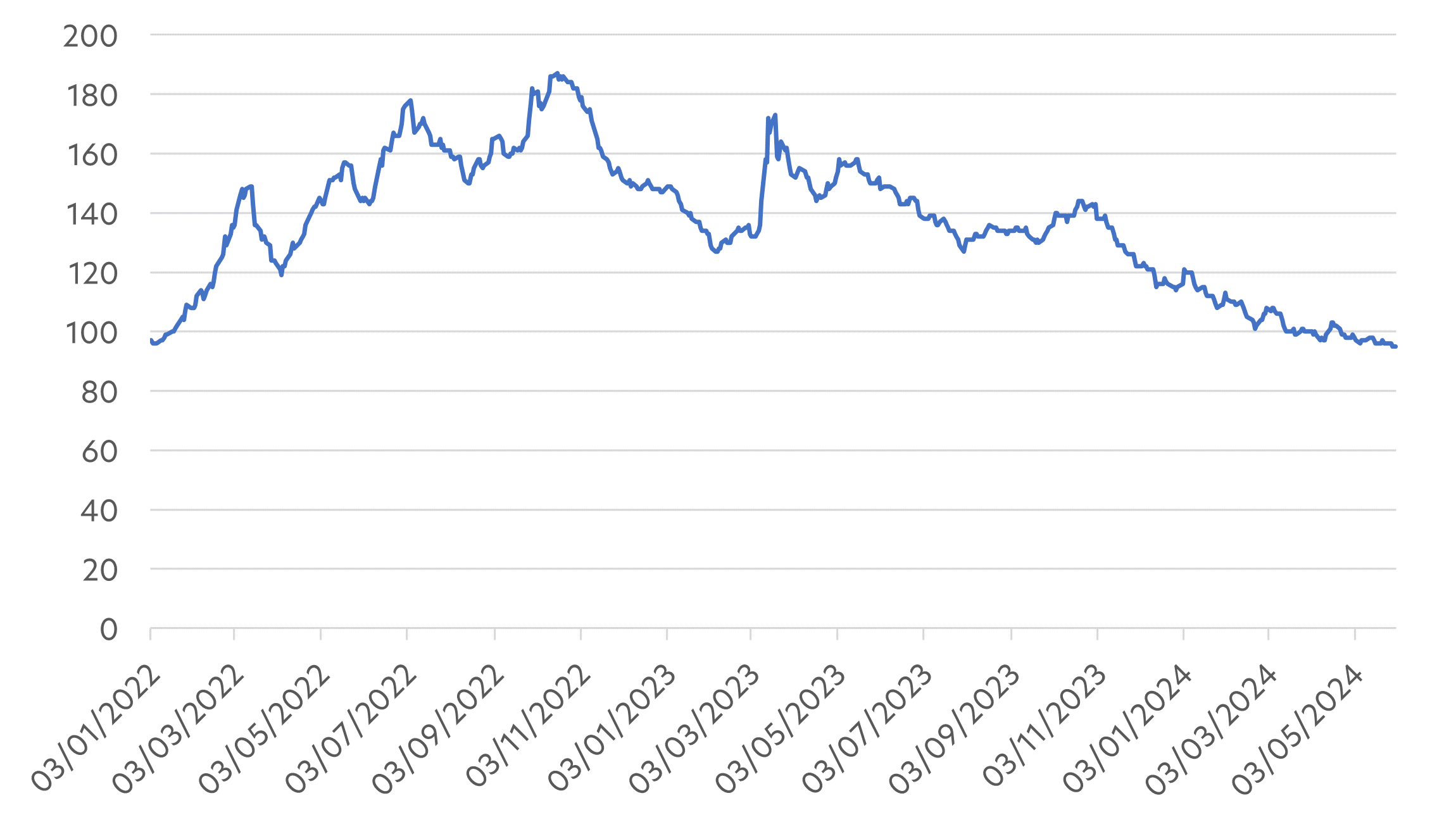

Fig 2: Developed market IG corporate bond spreads, Jan 2022 – May 2024

Source: Bloomberg/UOBAM

Interest shifting towards high yields

Some investors in search of higher returns are now more willing to move down the quality scale from IG to HY bonds. It is estimated that US HY bond funds saw inflows of about US$8 billion3 in April. This is still a small percentage of the total, but represents a big jump from preceding months.

It appears that as more signs emerge of easing inflationary pressures, and an interest rate cut becomes more imminent, the desire to lock in yields is becoming more urgent. Over in Asia, the trend is similar but less marked. Inflation rates have been more contained, allowing Asian economies to cut rates sooner, although many are still looking to the US as a catalyst.

The plight of China’s developers and defaults in the sector over the past year also soured the Asian high yield market, but even here, there is greater optimism that the worst is over. As a result, Asian high yields are attracting considerable attention as a way for global investors to diversify their US bond holdings and potentially earn equity-like returns with bond-like risk.

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

1,2 Source: Broadridge, May 2024

3 Source: Morningstar, May, 2024

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z