- The Asian bond market is growing strongly this year

- Global investors are looking to lock in yields as US rate cuts get more imminent

- Asia is becoming the new investment destination amid US and Europe growth fears

For the third straight month, July saw good overseas demand for Asian bonds. According to Reuters, a net US$7.91 billion worth of Asian bonds were snapped up during the month. This followed the US$3.03 billion net demand in June, and US$9.50 billion in May. Of particular interest were bonds from Indonesia, India, Malaysia, South Korea and Thailand. The demand for Asian bonds is spurred by a combination of both push and pull factors.

Three key considerations are causing investors to diversify away from US bonds:

- US rate cuts

It has become increasingly probable that the US Fed will start to cut its rates in September. The only thing that seems unclear at this point is whether the cut will be 25 basis points or a deeper 50 basis points. The latest US CPI report released last week indicate that headline inflation, at 2.9 percent YoY, is running slightly below expectations while the 3.2 percent core CPI is in line with expectations. The stickiness of shelter costs point to a more conservative approach.

- US growth prospects

On the other hand, the US Fed is also closely monitoring growth indicators such as employment rates and manufacturing growth. Both these numbers have weakened in recent weeks, prompting calls for a bolder rate cut. Whatever the case, a lower policy rate also means a lower bond yield and a weaker US dollar, prompting investors around the world to look for alternative places to park their money.

- US election uncertainties

As if the US elections were not exciting enough, polls now suggest almost even chances of a Harris or Trump win. Economists generally expect a Trump presidency to result in higher Treasury yields given the potential widening of the US budget deficit and release of more US long term bonds. However, in the immediate term, investors are concerned that election uncertainties will be enough to destabilise the market.

There are also good reasons for foreign investors to gravitate towards Asian bonds:

- Asia is powering global growth

Asia is expected to grow strongly over the next few years, driven by the region’s export recovery. Despite its problems, China’s GDP growth is still expected to be double that of the US, but China is no longer Asia’s primary powerhouse. China’s GDP growth is expected to be overtaken by ASEAN countries over the next few years.

Fig 1: Real GDP growth consensus estimates (%)

| 2024F | 2025F | |

| US | 2.4 | 1.7 |

| Eurozone | 0.6 | 1.4 |

| Japan | 0.7 | 1.1 |

| Asia ex Japan | 4.9 | 4.6 |

| China | 4.8 | 4.5 |

Source: Bloomberg/UOBAM

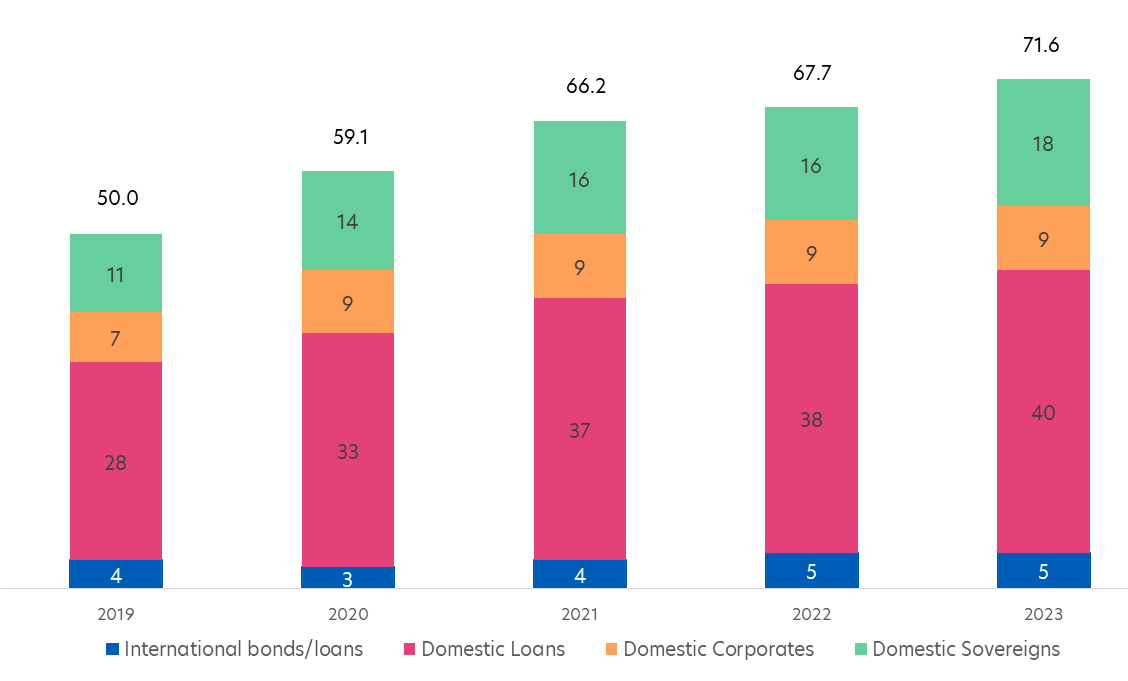

- A deeper Asian bond market

Cheap onshore funding rates and Covid recovery initiatives have enabled the Asian domestic (i.e. local currency) bond market to flourish. As a result, the domestic market has grown substantially over the past five years. In absolute terms, China continues to dominate the market. However, if we assess bond markets as a percentage of GDP, other countries including Korea, Singapore, Malaysia and Hong Kong stand out.

Fig 2: Asia ex Japan credit market size credit market size, US$ trillions

Source: BofA Global Research, Aug 2024

It is also noteworthy that in the first half of 2024, G3 (i.e. USD, EUR and JPY-denominated) bond issuances came back into fashion. Worth US$122.9 billion, this was an 18 percent gain over the previous year, of which about a quarter were from Chinese corporates, and another quarter from Korean corporates, according to data provider LSEG. Meanwhile Indian corporates dominated in the G3 high yield space.

- Specific market support

There are also recent developments favouring specific Asian markets and sectors. For example, having rallied by more than 10 percent so far this year, Asian corporate high yield bond returns are well in excess of the global high yields sector. Investors have been taking advantage of the region’s fall in default rates and good company fundamentals, and are likely to continue to do for the rest of the year.

China’s CNY-denominated bond market is also seeing interest return, aside from its property sector bonds. The CNY appears to have bottomed against the USD, but more importantly, China’s domestic bond market is deemed too big to ignore and offers solid diversification benefits given the low correlation to US and other global bond markets.

Gains could slow down but yields remain a draw

So far this year, the interest in Asian bonds has caused sovereign bond prices to rally and Asian credit spreads to tighten. This run up means Asian bonds are not as cheap as they were and gains could start to slow down, especially within the Asian investment grade sector. That said, Asian sovereign bonds are still expected to appeal to foreign investors looking to lock in higher yields. The negative net supply expected for this year should also help support Asia credit markets.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z