In the second instalment of our Singapore Series, we zoom in on the SREITs sector, which looks set to be boosted by new policy initiatives and the latest inflation figures

Low Soo Fang

Portfolio Manager, Asia equities

- The Singapore budget and Equity Market Development Programme is supportive of SREITs

- CPI data released this week points to easing inflation. This increases the scope for lower interest rates, which is favourable for the REITs sector

- Our preference is for retail, data centre and industrial REITs

A few weeks ago, the iEdge S-REIT index was at a 10-year low, excluding its temporary plunge during Covid. However, recent announcements have put in place tailwinds that, if the current Singapore stock market rally is anything to go by, could lead to a meaningful SREITs recovery this year.

Policy impetus

The good news started with the Singapore budget. As mentioned in our Research Note last week, this year’s market-friendly budget included direct SREITs incentives such as the extension of tax concessions for SREIT providers. The government hopes that this will encourage more SREIT listings while also improving the bottom lines of existing providers. In addition, the focus on retail consumption and key industries could also indirectly support such real estate sub-sectors as shopping malls and data centres.

And even before developers could take a breath, this week saw the release of yet more stimulus measures for the sector. As promised, the MAS Review Group laid out a few bold plans to revive stock market trading volumes, liquidity and valuations. In particular, S$5 billion will be injected into the market. SREITs comprises about 12 percent of the Singapore stock market, but given a lower average capitalisation, they could benefit disproportionately.

Macro-economic impetus

While these measures alone are enough to reinvigorate investor sentiment, SREITs also stand to benefit from recent economic data releases. Singapore inflation figures for January 2025 came in lower than expected, with core inflation registering 0.8 percent year-on-year, a level not seen in three years. This was also significantly below December’s 1.7 percent, the consensus forecast of 1.5 percent.

The easing inflation trend leaves room for further monetary easing and suggests that Singapore government bond yields may potentially continue their downward trajectory. The Singapore 6-month Treasury Bill yield has already fallen from a high of 4.5 percent in December 2022 to 2.9 percent today. This suggests that the average SREITs dividend yield, currently running at around 6.5 percent, will become increasingly attractive to investors.

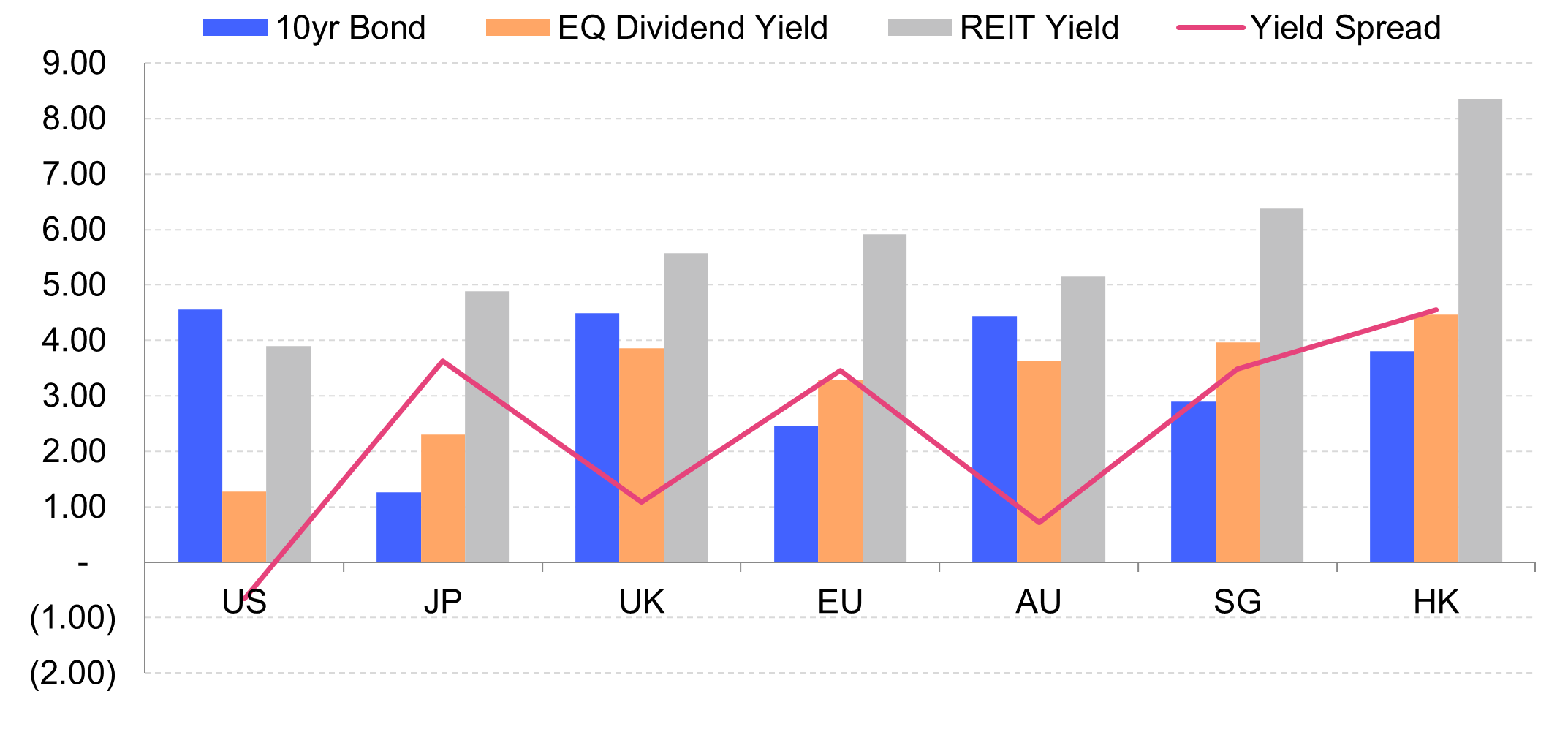

SREIT dividend yields also compare favorably to the average for equity and other bond investments, and is among the highest in the world. They are also at levels comfortably above their historical averages and there is therefore scope for the sector to be re-rated.

Fig 1: Yield spread compression for SREITs vs other countries/regions

Source: Bloomberg/ UOBAM, 31 Jan 2025

Which subsectors have the highest potential?

Given the drivers described above, we recommend that investors focus on the higher growth subsectors, and those that are interest rate sensitive but undervalued. In our view, these include:

- Retail REITS - We have a preference for suburban malls over prime properties

- Data centre REITs - Despite some re-thinking about the amount of hardware and space required to support AI initiatives in the wake of China’s DeepSeek launch, we continue to expect secular demand growth and a revaluation for this subsector

- Industrial REITs – We have a preference for logistics REITS, and are more cautious in relation to business parks.

|

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management fund to consider:

|

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z