Cash yields are decent, but why stop there? In the second of our Yield and Income series, we look at ways to go beyond cash returns, without taking on much higher risk

Although interest rates around the world are expected to fall over the next two years, UOBAM believes that rates will stay relatively high, even over the longer term. In the US, we believe interest rates will ease gradually from its current 5.25 – 5.50 percent range, and will bottom at around 3.0 – 3.5 percent over the long term.

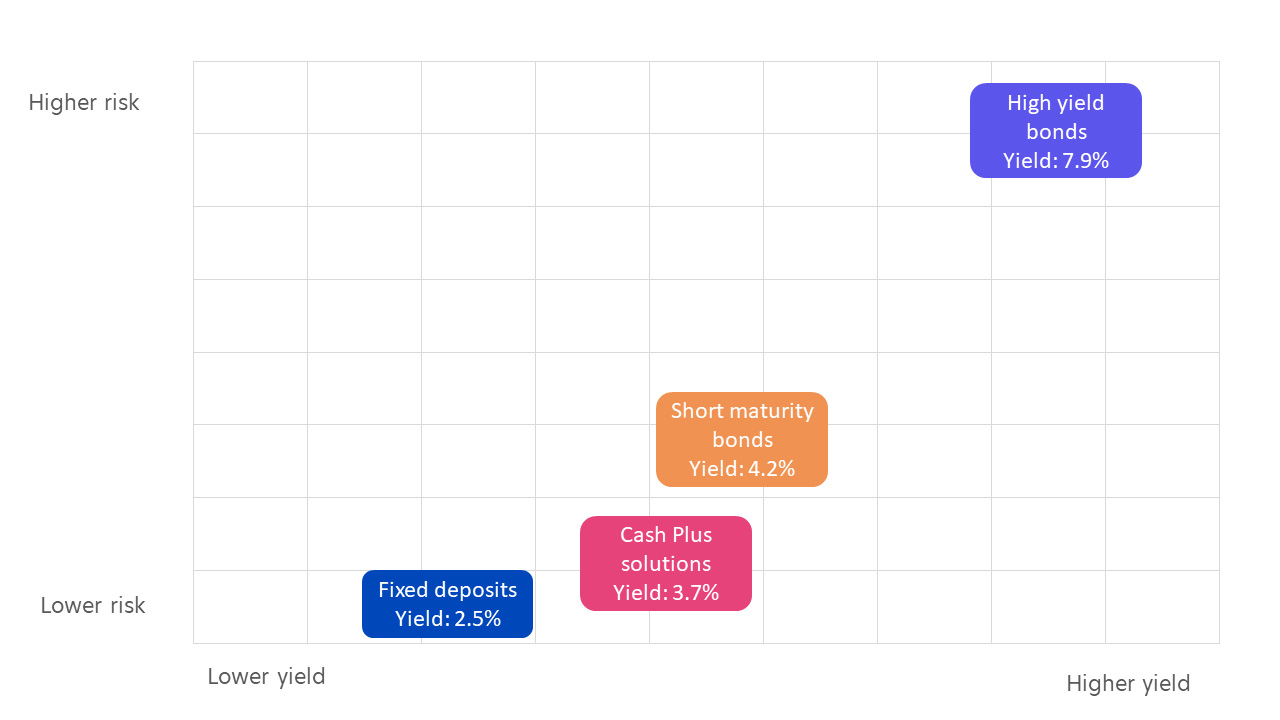

This is still far above the 0.25 – 0.50 percent rates seen in the 2010s and early 2020s. Understandably, those who remember this period will find even a 2.5 percent interest rate to be very attractive. However, in today’s environment, other interest-paying instruments are paying up to three times higher in yields, as shown below. And when policy rates start to fall, likely in the second half of 2024, we can expect these instruments to also deliver good capital appreciation.

Figure 1: Solutions that provide higher income than fixed deposits

Source: UOBAM/Bloomberg, as of 13 June 2024. Cash Plus solution: Projected rate net of fees based on a portfolio holding a Money Market Fund and Enhanced Liquidity Fund. Short maturity bonds: ICE BofA 1 -3 year Global Broad Market Index. High yield bonds: ICE BofA All Maturity Global High Yield Index.

Fixed deposit yield based on the average rate offered by Singapore’s local banks for a 12-month placement of S$100,000 (DBS: 3.2%, OCBC: 2.8%, UOB: 1.5%), as of 20 June 2024.

How to step up your returns?

Given the attractive fixed deposit (FD) rates relative to past years, there are many individuals who have foregone investments and opted for a cash-only portfolio. However, going forward, with banks already lowering their FD rates, the disparity between cash and low-risk investment returns is set to increase. Many savers are already on the hunt for higher yields and ready to diversify away from cash, but in a gradual and controlled way. To enjoy a step up in returns without a big step up in risk, here are three options to consider:

Step Up 1: Enhance cash savings with cash plus solutions

Cash plus solutions currently offer higher yields than FDs. They are deemed to be very low risk given that they hold very short-term (less than 1 year), high-quality assets such as Treasury bills (T-bills), very short duration bonds and fixed deposits. Many also offer the added benefit of daily liquidity.

Step Up 2: Lock in higher yields with short maturity bond solutions

Once rates start to fall (the first US rate cut is widely expected to take place in September this year), solutions that are based on slightly longer duration bonds (1 – 3 years) will benefit, both in terms of capital appreciation and higher yields. These remain low risk solutions because they tend to hold high quality government and corporate bonds that are less volatile and have a low chance of defaulting.

Step Up 3: Beat inflation with high yield bond solutions

High yield bond solutions invest in corporate and government bonds with credit ratings of below BBB-. Due to their lower quality, such solutions are able to offer about 8 percent yield, and have capital appreciation potential. With inflation in Asia expected to average 3.21 percent this year, these solutions offer substantial real income, that is, income net of inflation. They are a step up in risk, but less risky than equity solutions.

How much to invest?

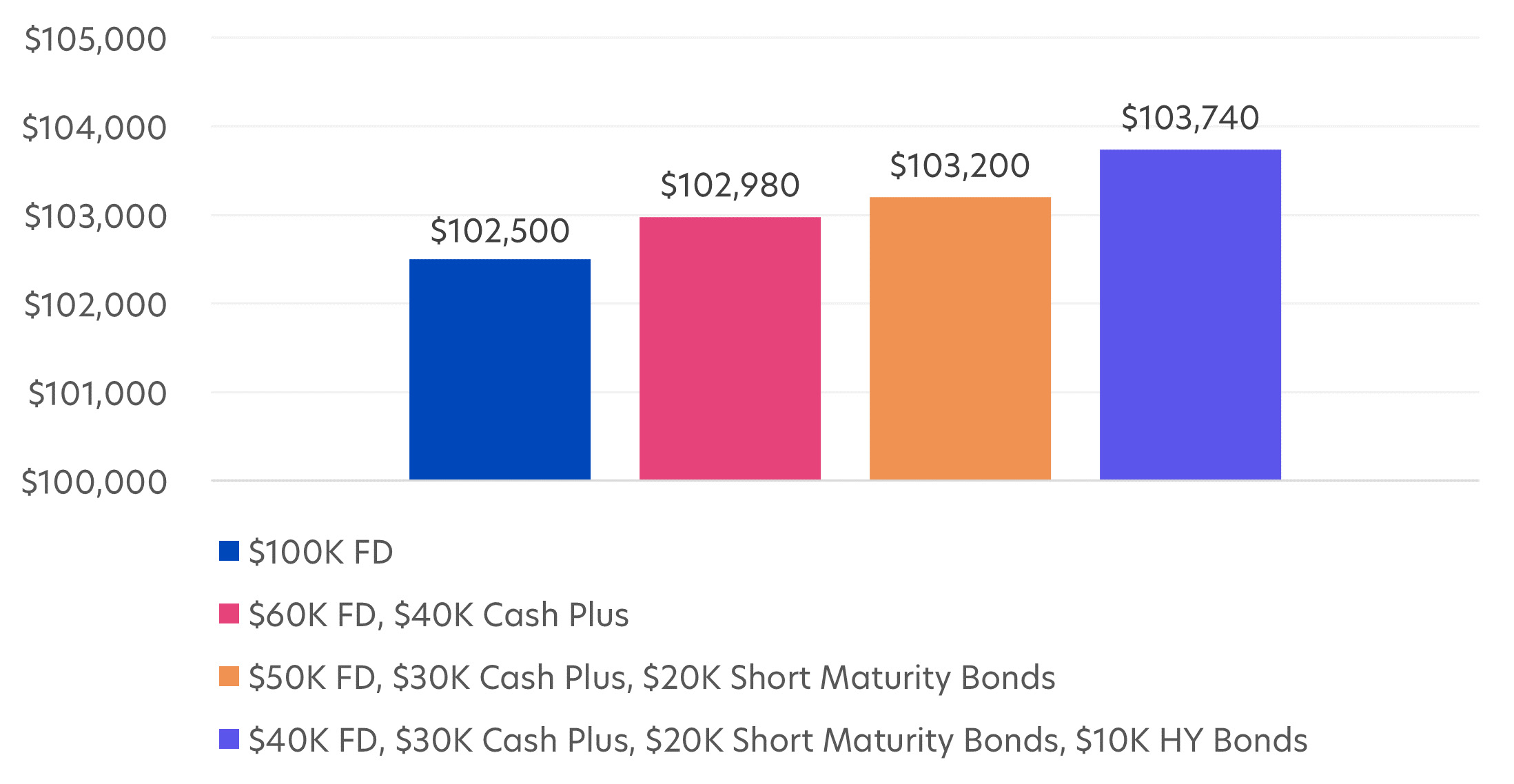

Many people are cautious about the percentage they should hold in cash versus investments. An adequate amount of cash is necessary to deal with regular expenses as well as unforeseen events. At the same time, the larger the amount invested, the greater the potential for higher gains. Based on the average 2.5 percent per annum fixed deposit rate currently available for new 12-month SGD placements2, you can expect to earn S$2,500 per annum for a S$100,000 deposit. So how much more can you achieve by investing? Here are three simulated portfolios.

Figure 2: 1-year growth of $100,000 allocated to different instruments

Source: UOBAM/Bloomberg, as of 13 June 2024. Cash Plus solution: Projected rate net of fees based on a portfolio holding a Money Market Fund and Enhanced Liquidity Fund. Short maturity bonds: ICE BofA 1 -3 year Global Broad Market Index. High yield bonds: ICE BofA All Maturity Global High Yield Index.

Fixed deposit yield based on the average rate offered by Singapore’s local banks for a 12-month placement of S$100,000 (DBS: 3.2%, OCBC: 2.8%, UOB: 1.5%), as of 20 June 2024.

Portfolio A: 60% cash, 40% cash plus solution

Cash plus solutions that are typically very low risk and have no lock-in restrictions allow investors to invest more of their savings without worrying about quick access when needed. This portfolio assumes that you invest 40 percent of your S$100,000 savings in a cash plus solution, while leaving the rest in fixed deposits. In this case, your absolute returns over the same period is potentially S$2,980, an excess of S$480.

Portfolio B: 50% cash, 30% cash plus solution, 20% short maturity bond solution

While providing higher yields and good liquidity, cash plus solutions offer very little capital upside potential. To secure capital gains, this portfolio assumes that 20 percent of your savings is invested in a short maturity bond solution, 30 percent in a cash plus solution, and the rest remains in fixed deposits. The result of this is an annual gain of S$3,200, an excess of S$700.

Portfolio C: 40% cash, 30% cash plus solution, 20% short maturity bond solution, 10% high yield solution

High yield solutions come with more risk but provide a significant boost to your yields plus capital appreciation potential. This portfolio includes a small 10 percent exposure to a high yield solution, 50 percent in cash plus and short maturity bond solutions, and the rest in fixed deposits. The combination has the ability to yield S$3,740, an extra S$1,240 over cash i.e. about 40 percent higher than cash yields.

Despite the only small allocation to the high yield solution, diversifying a cash-only portfolio across several low-risk and medium-risk solutions offers investors the ability to substantially increase their annual income.

| If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider: You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

1Asian Development Outlook, April 2024, Asian Development Bank

2 Based on the average FD rate offered by Singapore’s local banks (DBS: 3.2%, OCBC: 2.8%, UOB: 1.5%), as of 20 June 2024

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z