What is the FTSE China A50 Index?

The FTSE China A50 Index (the “Index”) is one of the most recognised China A-share indices. Launched over 20 years ago, it comprises China’s 50 largest A-share companies listed on the Shanghai or Shenzhen stock exchanges. These 50 stocks represent about one third of the entire A-share market by weight.

Why China A-shares?

The A-share market is popular among investors seeking exposure to China’s domestic growth potential. A-share companies typically serve the domestic market and as such, generate the bulk of their revenue from Chinese consumers. This makes them relatively better positioned to weather ongoing US-China trade tensions, and are better placed to benefit from China’s stimulus plans.

Eight benefits of the UOBAM FTSE China A50 Index ETF (“the Fund”)

#1. Exposure to big name stocks

The ETF offers investors access to some of the most well-established stocks in the China A-share market. These include well-known names such as liquor giant Kweichow Moutai, battery maker Contemporary Amperex Technology (CATL), and the Industrial & Commercial Bank of China (ICBC).

These companies reflect some of most important themes within China’s modern economy, including decarbonization, financial services and domestic consumption.

Fig 1: Index top 10 holdings, as of 28 February 2025

| Company name | Weight (%) | Description |

| Kweichow Moutai | 11.63 | Producer of Moutai, known as China's national liquor |

| Contemporary Amperex Technology | 7.17 | World's largest producer of electric vehicle (EV) batteries |

| China Merchants Bank | 5.35 | Chinese commercial bank |

| China Yangtze Power | 4.13 | Chinese utilities company |

| BYD Co Ltd | 4.04 | Leading EV manufacturer |

| Ping An Insurance Group | 3.34 | Chinese financial services company |

| Industrial & Commercial Bank of China | 3.26 | Partially state-owned multinational banking and financial services company |

| Wuliangye Yibin | 3.15 | One of the largest baijiu manufacturers in China |

| Agricultural Bank of China | 2.72 | Chinese commercial bank |

| Industrial Bank | 2.66 | Chinese commercial bank |

Source: Bloomberg, as of 28 February 2025

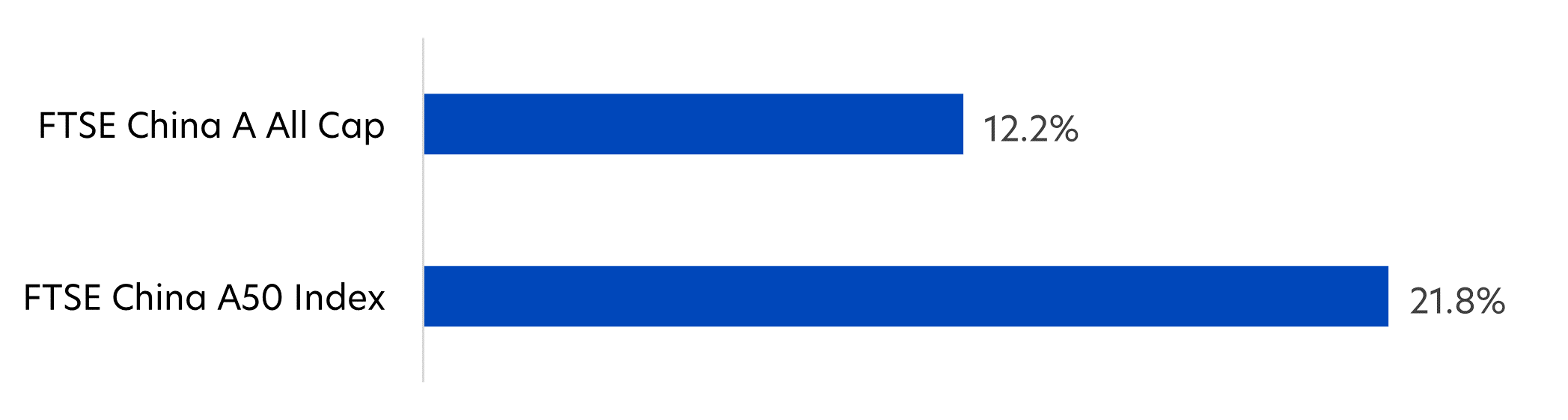

#2. Potential to outperform in market rallies

China’s large cap stocks have outperformed their smaller cap peers during recent market rallies. This is because popular indices and ETFs that benefit the most from foreign investor flows, tend to feature large cap stocks.

As a result, in 2024, when the China market rallied on the back of stimulus measures, large cap indices like the FTSE China A50 Index outperformed all cap indices such as the FTSE China A All Cap.

Fig 2: Index performance, 2024 (in CNY)

Source: FTSE, Index performance relative to the FTSE China A All Cap Index (in CNY). Data as of 29 November 2024, based on three years of historical data

#3. Potential resilience in down markets

Large cap stocks also tend to be more stable given the companies’ strong brand presence, significant market share, and especially during times of economic uncertainty. This is because investors are more inclined to hold on to such stocks for their dividend payments and good fundamentals, despite downward market pressures.

Fig 3: Index performance, 2018 (in CNY)

Source: FTSE, Index performance relative to the FTSE China A All Cap Index (in CNY). Data as of 29 November 2024, based on three years of historical data

#4. Denominated in SGD

The ETF is listed on the Singapore Exchange (SGX) and offers trading in SGD. This is particularly appealing for Singapore investors who do not want to bother with currency exchange issues. The majority of China-focused ETFs are listed in Hong Kong or the US, and offered in HKD or USD, which is inconvenient for investors whose wealth and portfolios are SGD-based.

Singaporeans can also buy into the ETF using their SRS funds. There are no Customer Account Review (CAR) requirements as the Fund is an Excluded Investment Product (EIP).

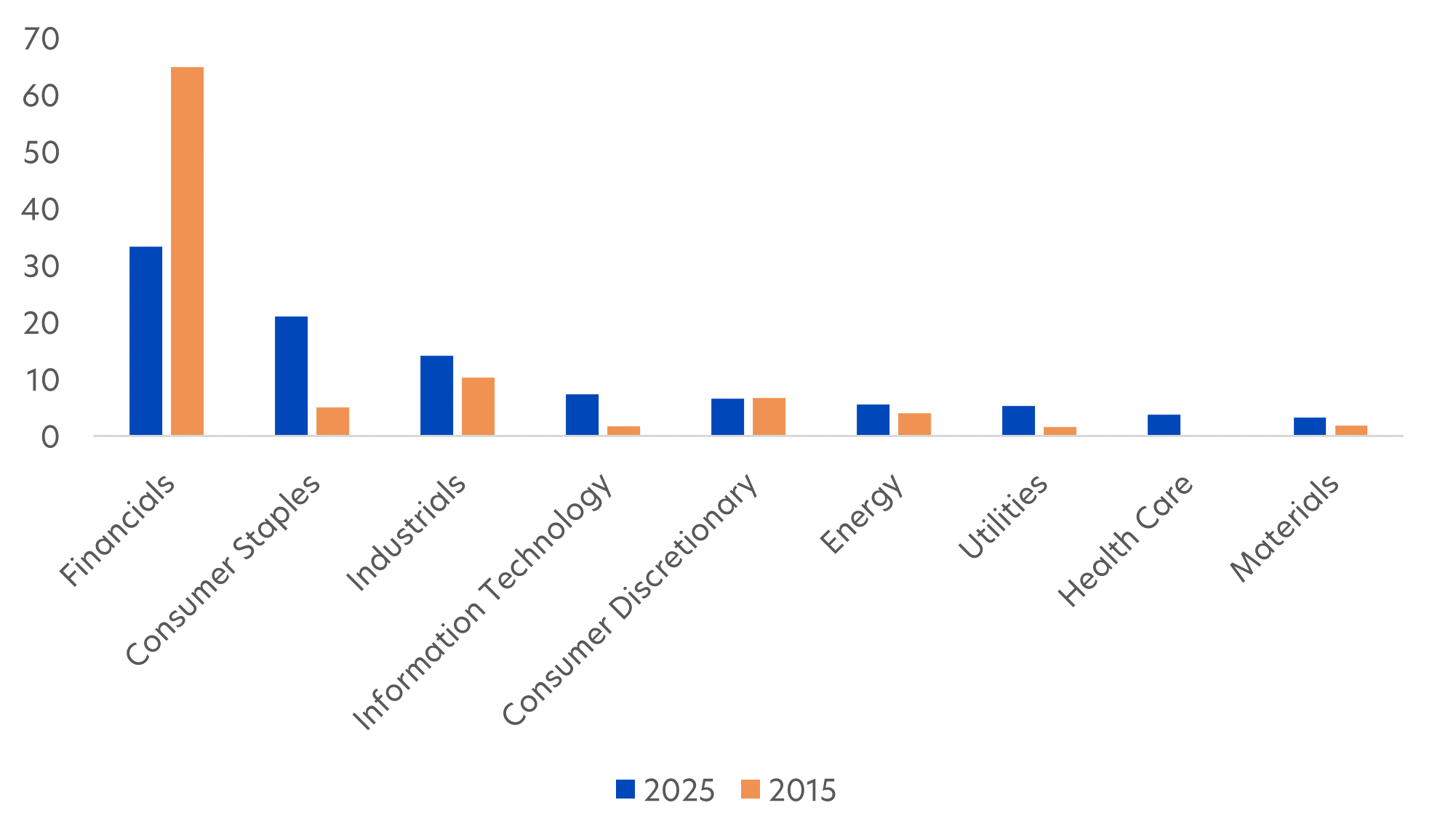

#5. Diversification across key industries

China’s economy has transformed significantly over the past 20 years and the FTSE China A50 Index has evolved alongside. The country’s focus on innovation and consumption-led growth have increased the weighting of consumer, technology and healthcare companies within the Index.

Such companies now make up 39 percent of the Index, three times more than in 2015. In contrast, financials, which made up more than 60 percent of the Index a decade ago, now occupies just a third of the index.

By investing in the ETF rather than individual stocks, investors ensure that they are in lockstep with the changing face of China’s economy.

Fig 4: Index sector weightings in 2025 vs 2015

Source: Bloomberg, as of 28 February 2025

#6. Regular dividend payments

Another benefit of the Index’s large cap exposure is the potential for attractive income. Large cap companies tend to have more room to pay dividends compared to growth-focused smaller caps. This average dividend payment for the FTSE A50 index is 3.61 percent compared the all-caps average dividend of 2.44 percent. The ETF aims to provide annual distributions1, making it an appealing choice for income-seeking investors.

#7. Low cost and transparent

The ETF offers ongoing exposure to China’s biggest stocks via a single vehicle, based on a quarterly rebalancing cycle. This means that if a stock shrinks in size and is no longer a Top 50 stock, it will be automatically replaced without investors needing to keep track. Additionally, to prevent excessive turnover, there is a buffer zone in place around the 50th ranked stock.

#8. No minimum board lot size

This Singapore-listed ETF can be bought from just one unit, in contrast to most Hong Kong listed ETFs, which usually require a minimum lot size of 100 units. This makes it easy for investors to tactically allocate to the ETF as part of a well-diversified portfolio.

Fund Details

| Fund Name | UOBAM FTSE China A50 Index ETF |

| Investment Objective | The investment objective of the ETF is to replicate as closely as possible, before expenses, the performance of the FTSE China A50 Index. |

| Trustee | State Street Trust (SG) Limited |

| Stock Exchange | Singapore Exchange Securities Trading Limited |

| Listing Date | Listed as the United SSE 50 China ETF on 26 November 2009. Effective switch to UOBAM FTSE China A50 Index ETF on 25 March 2025 |

| Management Fee | Currently 0.45% p.a. |

| Number of Index Constituents | 50 |

| Distribution Policy | Distributions are at the sole discretion of the Managers. Currently, we intend to make annual distributions around December each year as at such date as we may from time to time determine. Distributions may be made out of income, capital gains and/or capital. |

| Currency Classes | Class SGD United (Primary Currency: SGD | Secondary Currency: USD) |

| SGX Stock Code | Units traded in SGD: JK8 | Units traded in USD: VK8 |

| Designated Market Maker | Philip Securities Pte Ltd |

1Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: UOBAM FTSE China A50 Index ETF You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

This document is for general information only. It does not constitute an offer or solicitation to deal in units (“Units”) in the UOBAM FTSE China A50 Index ETF (“Fund”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it.

The information contained in this document, including any data, projections and underlying assumptions, are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and UOB Asset Management Ltd’s (“UOBAM”) views as of the date of the document, all of which are subject to change at any time without notice. In preparing this document, UOBAM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by UOBAM. While the information provided herein is believed to be reliable, UOBAM makes no representation or warranty whether express or implied, and accepts no responsibility or liability for its completeness or accuracy. Nothing in this document shall, under any circumstances constitute a continuing representation or give rise to any implication that there has not been or there will not be any change affecting the Fund. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOBAM and any past performance or prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund.

Investors should note that the Fund is not like a conventional unit trust in that an investor cannot redeem his Units directly with UOBAM and can only do so through the participating dealers, either directly or through a stockbroker, if his redemption amount satisfies a prescribed minimum that will be comparatively larger than that required for redemptions of units in a conventional unit trust. The list of participating dealers can be found at www.uobam.com.sg. An investor may therefore only be able to realise the value of his Units by selling the Units on the Singapore Exchange Limited (“SGX”). Investors should also note that any listing and quotation of Units on the SGX does not guarantee a liquid market for the Units.

An investment in unit trusts is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before deciding whether to subscribe for or purchase any Units. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you.

The UOBAM FTSE China A50 Index ETF has been developed solely by UOBAM. The UOBAM FTSE China A50 Index ETF is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE China A50 Index vest in the relevant LSE Group company which owns the FTSE China A50 Index. “FTSE®” is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license.

The FTSE China A50 Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the FTSE China A50 Index or (b) investment in or operation of the UOBAM FTSE China A50 Index ETF. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the UOBAM FTSE China A50 Index ETF or the suitability of the FTSE China A50 Index for the purpose to which it is being put by UOBAM.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z