By Colin Ng, Head of Asia Equities, UOB Asset Management

- Fears of a highly damaging US-China Trade War 2.0 are likely overblown

- We can expect China market volatility to increase in the next few months

- However, there is room for positive surprises in 2025

The Trump factor

With a Trump win in the bag, all analyst eyes on Friday were on last week’s Chinese Communist Party Politburo meeting. There was fervent speculation that this group of 24 top Chinese officials would announce a substantial stimulus package to counter trade tariffs promised by president-elect Trump.

Late on Friday, journalists were told that more than US$1.4 trillion (10 trillion yuan) would be made available over the next five years to help local governments meet their “hidden” ie off-balance sheet debt. Local government finances have faltered since the fall in local tax revenues and land sales, and this will help address a growing area of concern.

Nevertheless, markets were disappointed that there was no direct stimulus in the wake of Trump’s re-election. Officials signalled that China wanted better sight of what lies ahead before unleashing more firepower, but this was not enough to reassure investors.

Potential for US pragmatism

Indeed, over the next few weeks, as president-elect Trump finetunes his rhetoric on Chinese trade tariffs and restrictions, we can expect Chinese market volatility to increase further. After all, his threat to impose 60 percent tariffs on US imports of Chinese goods is much higher than the 7.5-30 percent levied during his first term. Also, given broad public and bipartisan political support, plus the ability to apply his executive powers, China tariffs would allow Trump to quickly make good on one of his key election promises.

That said, Trump's background as a businessman and his track record suggest that there is room for negotiation beyond the initial headlines. One key consideration is the ‘boomerang’ effect of higher tariffs on US inflation, at a time when interest rate cuts are highly anticipated. Faced with the need to keep inflation in check, tariffs could be adjusted lower. Also, China has seen this before, and is said to have a playbook ready to help neutralise the Trump factor as and when required.

Not a death blow to China exports

While US tariffs and restrictions will doubtlessly reduce China trade flows in the near term, some of this could be eventually offset by re-shoring over the longer term. Also, thanks to its growing manufacturing capability in renewable sectors such as electric vehicles, EV batteries and solar panels, China could see an organic increase in exports.

The globalisation of Chinese e-commerce companies such as PDD (Temu), Shein and Alibaba has also helped the country to move away from its dependence on the US as the primary importer of Chinese goods and services.

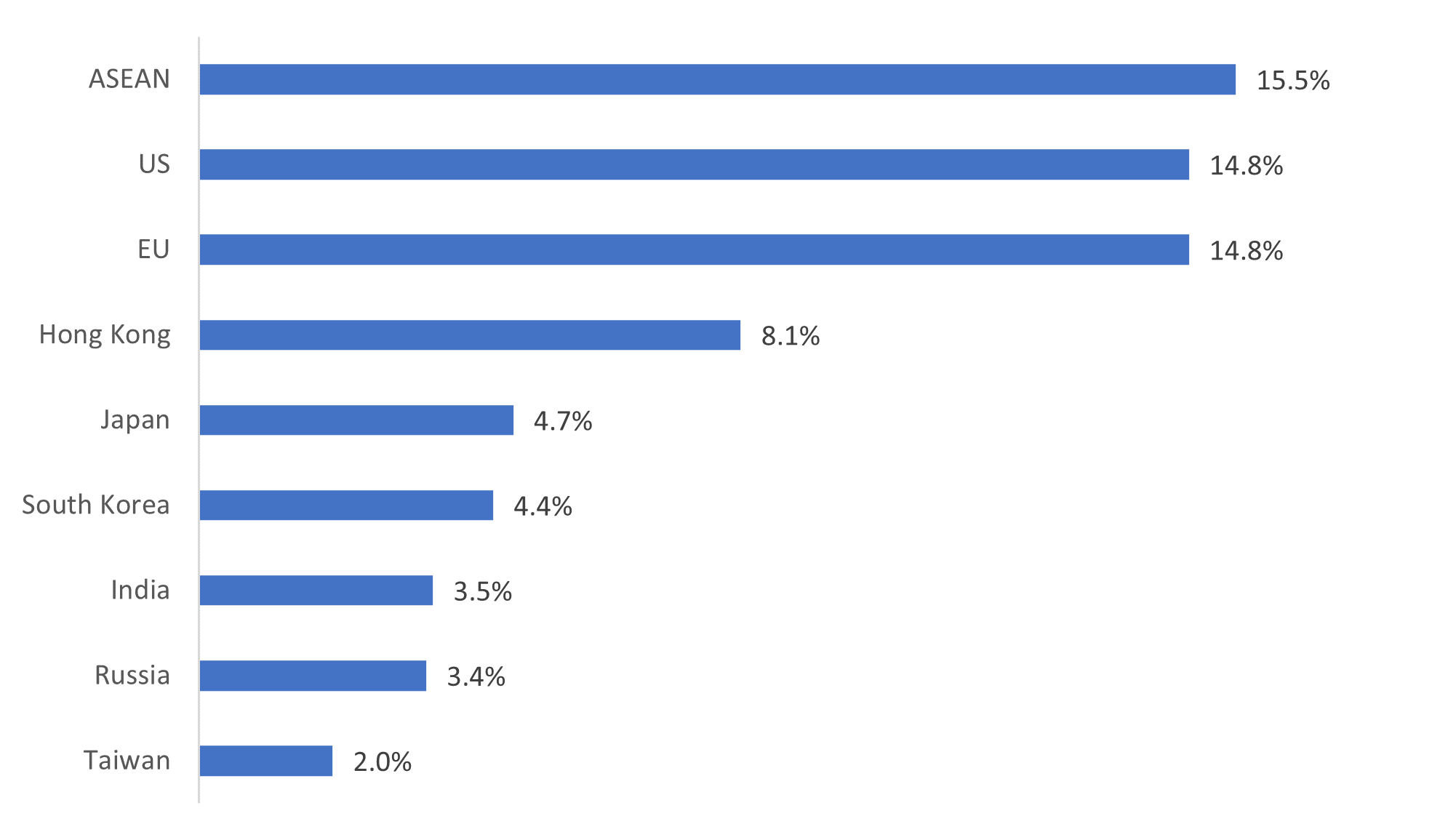

In fact, in recent years, the US has gradually been replaced by ASEAN and European Union as China’s top trading partners.

Fig 1: China exports by trade partner, 2023

Source: statista, https://www.statista.com/statistics/270326/main-export-partners-for-china/

More domestic consumption needed

Lower exports in the short term will likely impact China’s GDP growth, but how much depends on whether the country’s domestic policies can provide the economic strength needed to offset this growth decline. We note that since the start of the year, retail sales value growth has been trending down suggesting that overall consumer demand has not yet improved, despite the recent stimulus measures.

However, we do not expect China to follow in Japan’s footsteps. There are distinct differences in their economic journeys, with China wielding far more manufacturing power, cost competitiveness and currency control than Japan a decade ago.

A shift in China’s political mindset

In addition, we think there is a step-change in China’s political stance. Political leaders seem no longer willing to tolerate the consequences of a weakening economy and property sector downturn. As a result, they are showing an increased determination to shore up the economy, especially given the potential for Trump to raise the stakes.

So over the medium term, we think China’s economy can withstand a trade war with the US, and that market sentiment will eventually recover. We would note that despite the recent rally, China market valuations remain attractive by most financial measures, and are trading below its mean in terms of forward PER and PBR. Markets currently appear to be under-estimating the monetary levers and structural opportunities available to China, and overestimating the US’s commitment to protectionism at all costs, and could therefore could be positively surprised.

In particular, we would anticipate favourable policies towards China consumer and real estate sectors in 2025, while continuing to push for innovation and high-tech manufacturing industries.

Having previously been a member of the analyst team, Colin re-joined UOB Asset Management (UOBAM) in October 2012 as Head of Asia (ex Japan) Equities. He is responsible for overseeing the ongoing development of the Asian equity research and investment capabilities. He has supervisory responsibilities for the specialist equity teams of Greater China and ASEAN

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z