- Trump policies have the potential to add to inflationary pressures

- This is unlikely to cause a new inflation wave, but could be stickier than previously expected

- Investors may want to tilt towards Asian bonds in 1H 2025, buy Asian equities on dips

The January effect

In the post Covid era, inflation skyrocketed around the world before being tamed by high interest rates. Take the US inflation rate, which peaked at 9.1 percent in June 2022, then fell to a low of 2.4 percent in September 2024. Similarly, over in Asia, Singapore’s inflation rate has fallen from its 7.5 percent peak to a 1.4 percent low in October 2024.

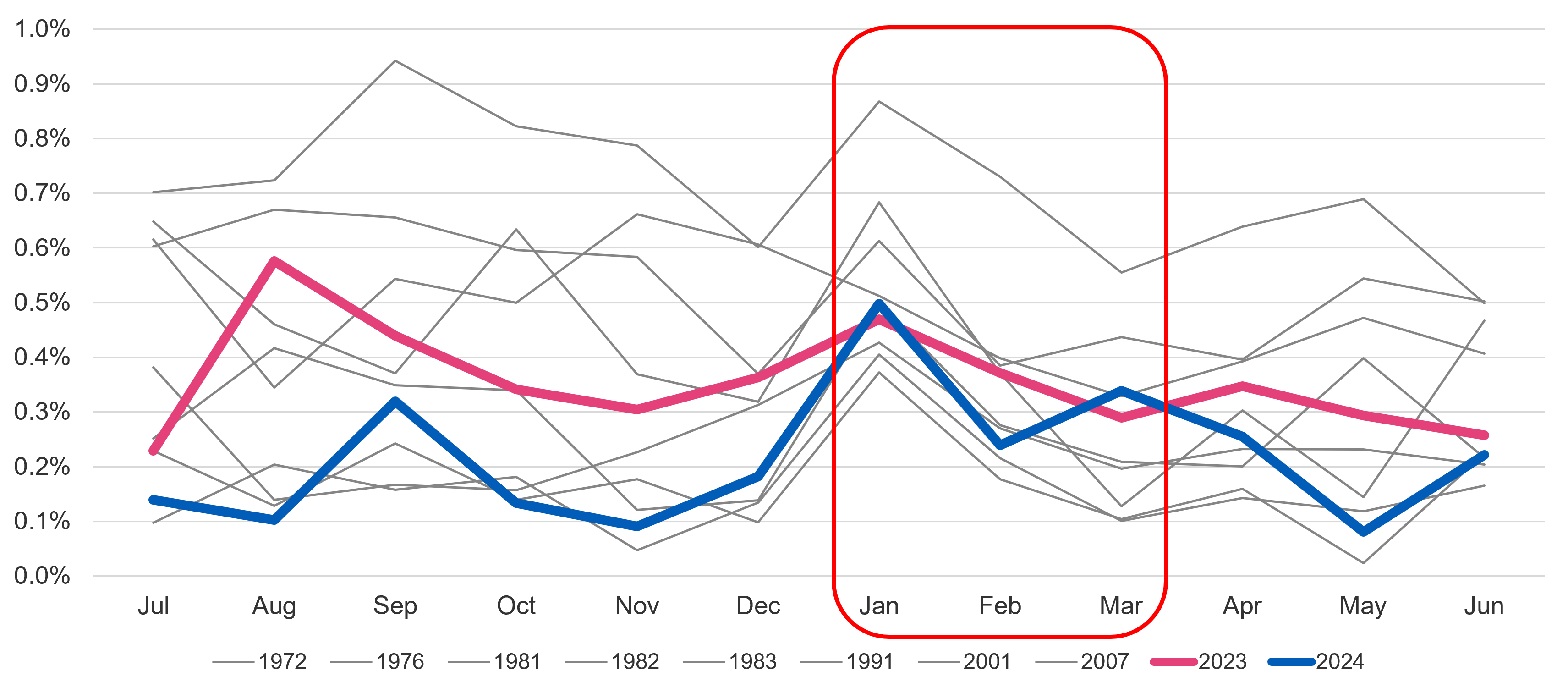

However, in both cases, inflation ticked up marginally in November 2024 and this will likely be the case again in 1Q 2025. As shown in the chart below, there is a tendency for inflation to spike in January. This is largely due to companies resetting their annual prices and in most years, the effect is temporary.

Fig 1: Month-on-month US Core PCE, selected calendar years

Source: Bloomberg/UOBAM

The Trump effect

We would expect this to be the case for 2025, but this year, there is another less predictable effect at play. With President-elect Trump soon to be inaugurated, his threats of reduced immigration and higher trade tariffs threaten to derail the world’s current disinflation trend.

These fears were voiced by the US Fed in its December meeting minutes published last week. The minutes noted that there was now “elevated uncertainty” about the effects of potential policies, which meant that “it could take longer than previously anticipated” to reach the Fed’s inflation target of 2.0 percent. As a result, the Fed concluded that the pace of interest rate cuts could slow to just two cuts in 2025.

Impact on Asia

Over in Asia, these warnings have caused Asian currencies to weaken further against the USD. The USDCNY reached 7.33 following the Fed minutes, a new 17-year high. There are now concerns that if this USD strength continues, Asian economies face the potential for imported inflation. While a lower currency makes exports cheaper, which could help to partially offset US tariffs, it can also make imports more expensive, and therefore add to inflationary pressures. Higher inflation in turn makes it more difficult for Asian central banks to spur growth by further cutting rates.

Reasons not to over-react

A growing number of economists are now raising the possibility of a “second wave of inflation” similar to that seen in the 1910s, 1940s and 1970s. For example, US inflation spiked to 11 percent in 1974, and eased for two years before rising to a new peak at the end of the decade.

However, we think such fears are excessive. These were periods dominated by global wars and energy supply disruption, resulting in significant cost-push inflation. In contrast, prior to Trump’s election, even traditionally sticky components of US inflation such as services, rentals, auto insurance, etc, looked to be easing. As such, even an aggressive implementation of Trump’s immigration and tariff threats is unlikely to cause US inflation to cross 3.5 percent.

In our view, President-elect Trump’s bark is worse than his bite, given that in the past he has used such threats more as negotiating tactics. Also, inflation was a central tenet of his election campaign and he is unlikely to want to risk significant inflation.

Reasons not to under-react

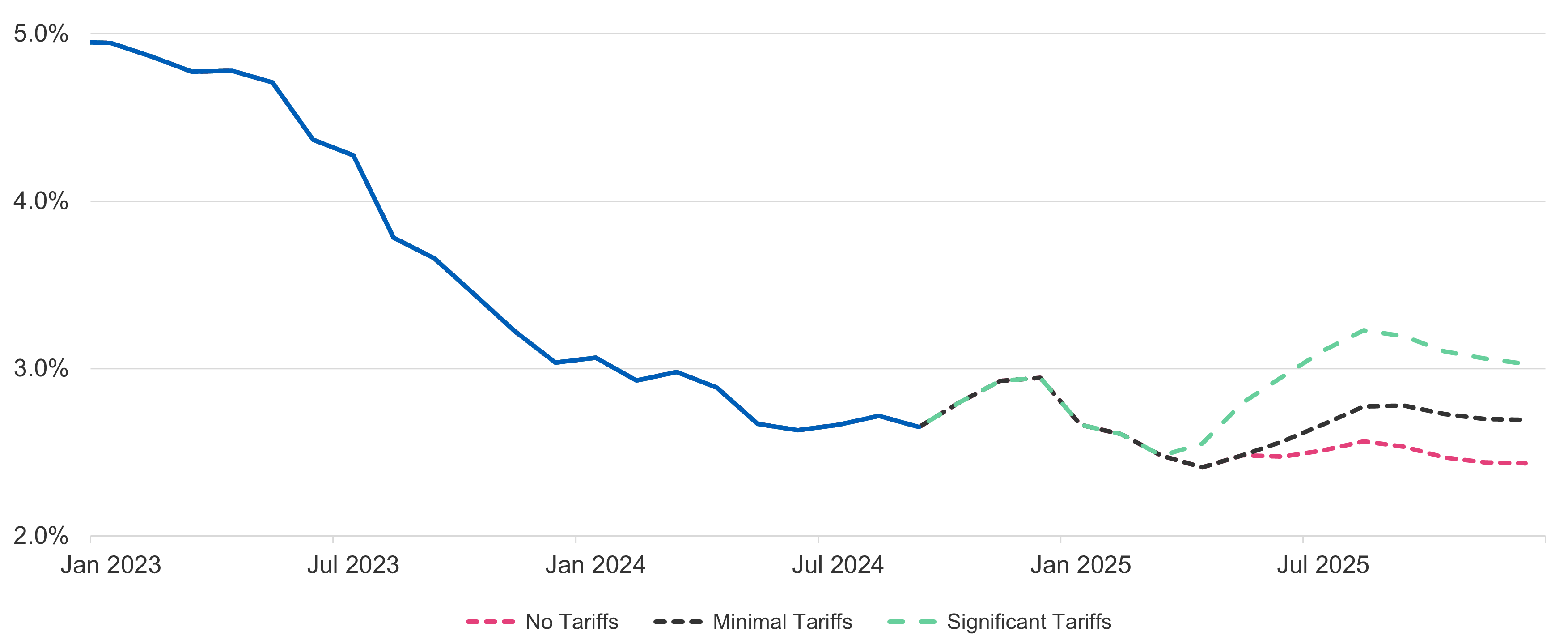

That said, investors should not be complacent about inflationary pressures going forward. We retain our long-held view that global inflation will be higher-for-longer, and our base case is for core US inflation to range between 2.5 to 3.0 percent for an extended period. This reflects our expectation that Trump policies will put upward pressure on goods prices, but that disinflation could continue in other areas of the economy such as services.

Fig 2: Year-on-year Core PCE Trend and Expectations

Source: Bloomberg/UOBAM

In terms of timeframes, we expect core Personal Consumption Expenditures (PCE) to end 2024 around 2.8 percent, before falling closer to 2.5 percent in the first half of 2025, and rising thereafter towards 3.0 percent.

This calls for individuals and institutions to consider not just the potential return on their investments, but also, the potential real returns ie net of inflation. Assuming that in 2025 inflation persists at above central banks’ 2.0 percent target, bank deposits and certain ultra-low risk investment returns may not be enough to hedge against price rises or ensure steady earnings growth.

Additionally, dollar strength and US tariff uncertainties could cause Asian equities to underperform in the short term. Given this, investors may want to tilt towards Asian fixed income in the first half of the year. Investors can consider buying Asian equities on any significant dips, especially as the tariff overhangs fade.

|

If you are interested in investment opportunities related to the themes covered in this article, here are some UOB Asset Management funds to consider: United SGD FundUnited Asia Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z