Published on The Straits Times on 6 April 2024

Chor Khieng Yuit, Senior Business, Correspondent

Both funds beat benchmarks over 3 years; UOBAM to tap AI for all Asia equity funds

The use of artificial intelligence in investment is constantly being put to the test, with two Singapore-managed funds reporting positive results with an AI-augmented (AI-plus-human) approach to making stock-buying decisions.

The United Asia Fund started incorporating AI into its investment processes in the fourth quarter of 2020, while the United Greater China Fund did so in 2021.

The two funds have consistently outperformed their benchmarks since then.

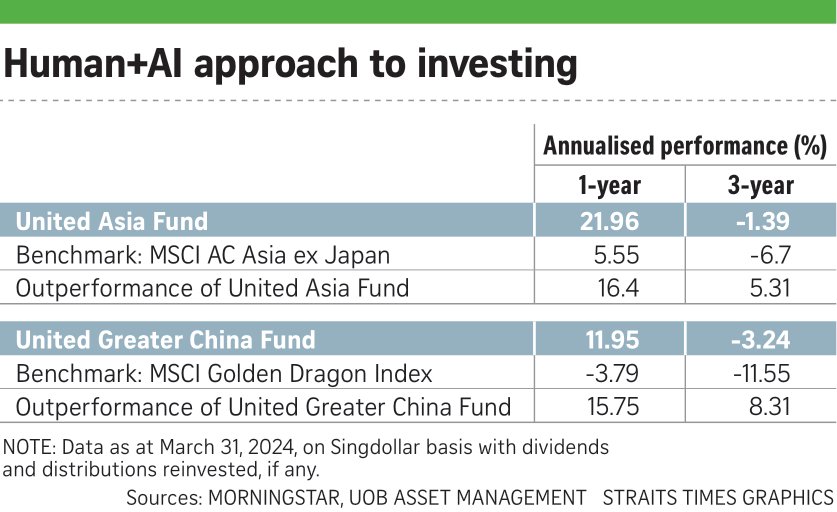

The United Asia Fund has done better than the MSCI AC Asia ex-Japan Index on average by 5.3 per cent a year in the last three years, as at March 31.

The United Greater China Fund beat the MSCI Golden Dragon Index on average by 8.3 per cent a year in the last three years, also as at March 31.

Mr Paul Ho, head of investment technology at UOBAM, said all the other Asia equity funds managed by UOBAM will eventually adopt this AI-augmented approach.

Currently, the client base is predominantly retail investors, but Mr Ho said institutional investors and family offices are beginning to show interest.

He was speaking at a learning session on AI in investing for the media on April 3.

Mr Daryl Liew, head of portfolio management at SingAlliance, is one of the portfolio managers who have been looking at the two UOBAM funds for the past year.

Mr Liew, who has not invested in them yet, said: “They have been beating the benchmark.”

He added that UOBAM seems to have achieved a good balance between harnessing AI and human insights.

The debate over AI and its use cases in investment is not new.

Mr Ho said it is a well-known challenge in the financial industry that there are many stocks to cover but not enough analysts to do research on every single counter.

UOBAM has come up with a model that uses AI to separate good from bad based on criteria like a company’s financials, macro data like gross domestic product and money supply, and technical analysis data.

Every single stock is then ranked by its expected return in the next month, and the 100 best stocks are shortlisted for analysts to do further research on.

A portfolio rebalance is done every month and the best performers are brought into the fund, while laggards are thrown out, Mr Ho added.

Mr Liew said this method of screening the entire stock universe has been used by portfolio managers for years.

He added that the process is probably more complex for UOBAM as it looks at hundreds of indicators at one time and uses AI to analyse how these indicators interact with one another in different situations.

Mr Ho said of the extent of the complexity: “We process more than 30,000 variables at the same time. We explore the combinations and permutations of those 30,000 variables.”

“It is way more than the human mind can process.”

The same pattern recognition algorithm used by Walmart, Amazon and Netflix is deployed here.

This algorithm looks for patterns in the data.

The entire process is flexible and there is no preset way in which the algorithm should work, Mr Ho said. “We keep an open mind and let the data tell us what is driving the markets.”

Mr Ho said the two UOBAM funds incorporating the AI-augmented approach have been tested over different market cycles, including during and after the pandemic.

Markets always keep changing, said Mr Kyith Ng, a senior solutions specialist at financial adviser Havend. The market has a “certain kind of dynamism to it”, so AI will need to be able to adapt and pivot the strategy if it is not working, he added.

Mr Ho said that “the model can learn from how the stock prices have reacted in the past when events happen”.

Every time there is an unexpected event, other variables like company financials and macro data indicators are also impacted.

The model learns from the process so it will be able to give better predictions of which stocks are likely to do well or which stocks will do poorly, Mr Ho added.

Source: The Straits Times © SPH Media Limited. Permission required for reproduction.